Support cleaner and healthier cooking in Zambia, save 278,000 tons of CO2 and save 50,000 trees by funding sustainable cookstoves!

Video from June 2020. For subtitles, please press the CC button in the lower right-hand corner of the screen.

The acquisition of this investment is associated with considerable risks and may lead to the complete loss of the invested assets.

UN Sustainable Development Goals

The investment at a glance

This is the second tranche of the crowdfunding campaign for “Sustainable Cook Stoves for Zambia – Part 2”

Project intent

With this project, the award-winning Indian company Greenway Grameen Infra Private Limited (Greenway) succeeds in combining innovative financing with poverty reduction, environmental protection and health promotion. The efficient and innovative use of carbon credits as a source of revenue, reduces the price of Greenway’s cookstoves to levels affordable to poorer sections of the population in Zambia. Access to clean cookstoves reduces time collecting fuel (usually women) and cooking, lowers fuel costs, and improves health and quality of life. The project is therefore a best-practice example of development aid from which all those involved derive sustainable benefit!

Sustainable & social impact

The use of a cookstove significantly reduces health hazards of indoor smoke. In addition, a user saves about 304 working hours per year, which can be used for leisure and educational activities thereby improving living standards. The innovative project aims to solve the interconnected problems of poverty, natural resource depletion, poor health, and global carbon emissions by providing clean cooking to thousands of households in the country.

Climate protection

Using a cookstove reduces the clearing and collection of firewood by about two-thirds. On average, a cookstove saves around 2.8 tons of CO2 per year. The project will finance a total of 100,000 cookstoves (including the first funding via bettervest), resulting in annual CO2 savings of 278,000 tons and saving 50,000 trees from deforestation annually.

Risk reduction measures

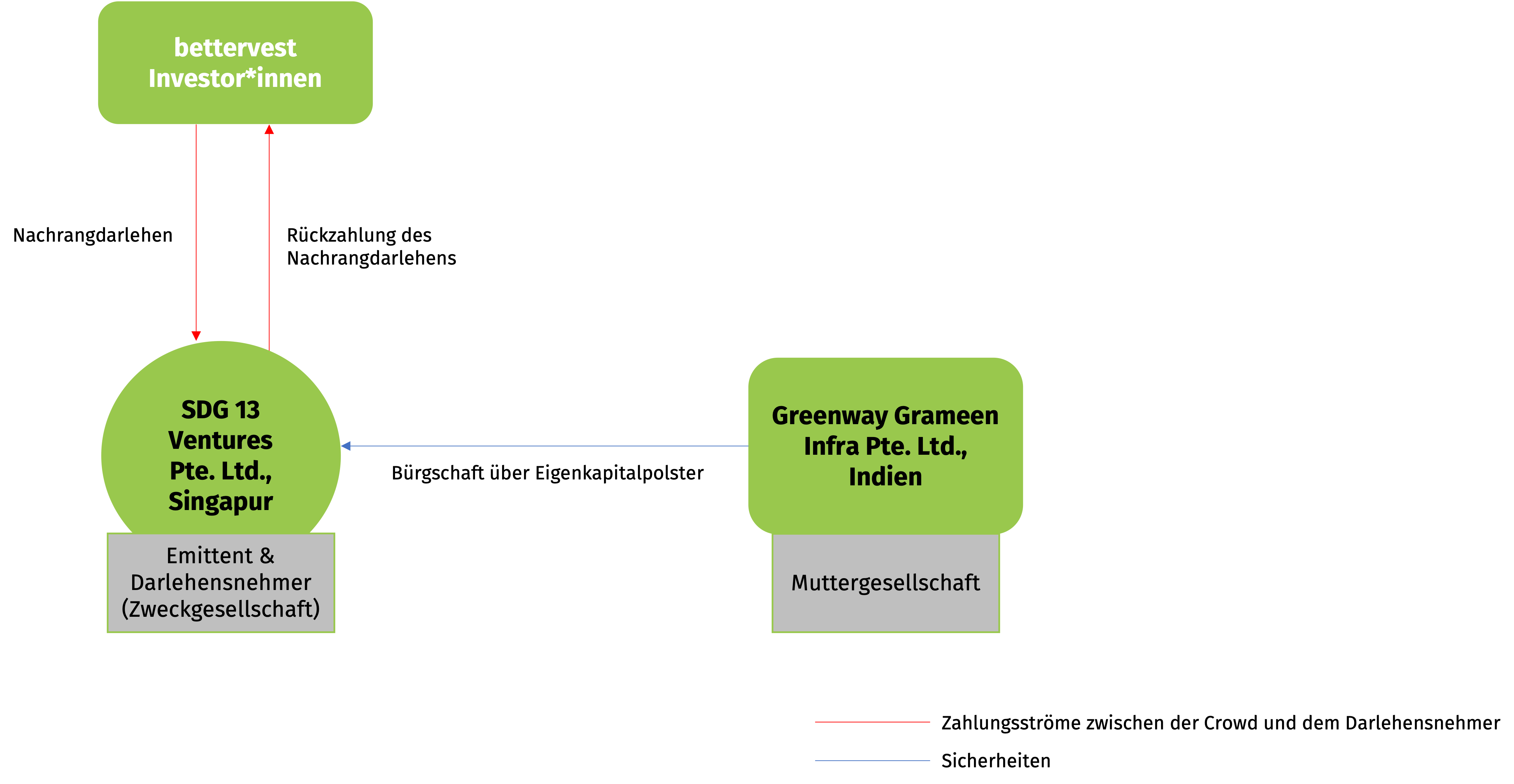

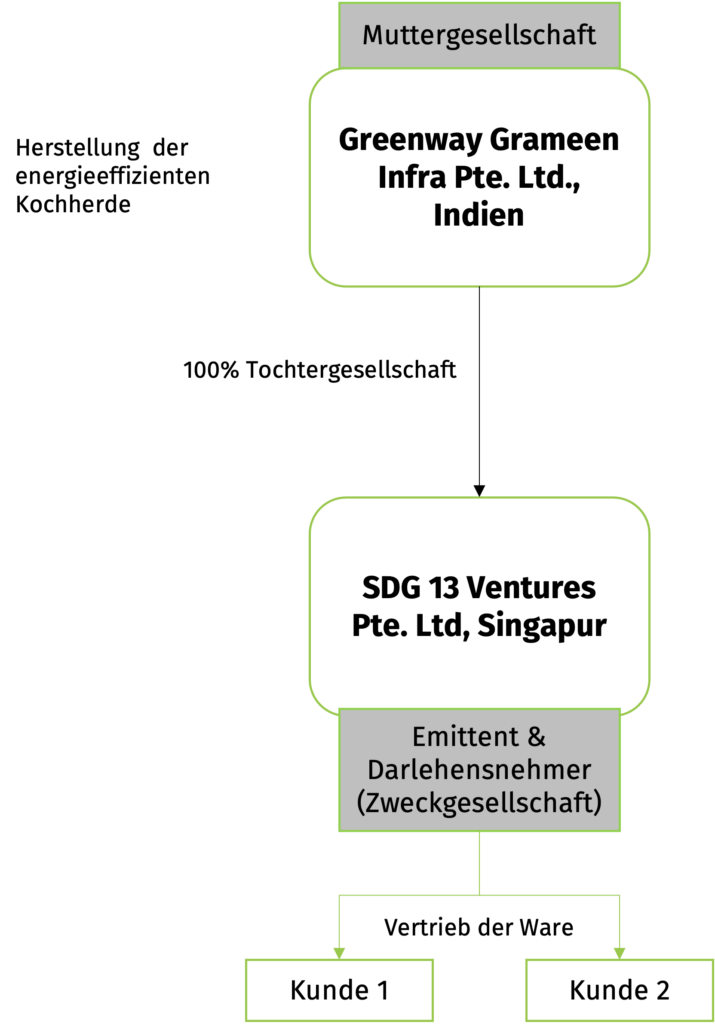

Greenway has established a special purpose vehicle (SPV) called SDG 13 Ventures Pte. Ltd (SDG 13) for the crowdfunding campaign. This will act as the borrower and will be responsible for sales and marketing of the cookstoves in Zambia. The SPV cannot take on any other debt other than that from bettervest investors. The parent company in India, Greenway Grameen Infra Private Limited (Greenway), has a solid equity cushion and the parent company guarantee to SDG 13 explicitly indicates Greenway’s ongoing balance sheet support to SDG 13 . Furthermore, the costs of the overall project are financed by different parties: the bettervest loan covers 26% of the costs and the rest is financed by the parent company Greenway and the partner.

Established, sustainable company

Since its founding in 2011, Greenway, with now more than 160 employees, has manufactured and sold over 1.3 million cookstoves to customers in India. Greenway is a professionally managed and financially stable company that has generated a solid equity cushion in recent years. Greenway has developed a creative business model that takes advantage of favorable conditions in the carbon credit market to enable the poorer population in Zambia to purchase its sustainable cookstoves.

Early bird bonus

All investors who invest up to and including 26.07.2022 will receive an early bird bonus of 0.5%. The interest rate thus increases to 7% in total over the loan duration.

Project description

In Zambia, wood is inefficiently used for cooking on traditional open fires. According to the World Health Organization, smoke inhalation from cooking on open fires causes 3.8 million premature deaths worldwide each year. In Zambia, women predominantly cook on traditional three-stone fireplaces using solid biomass as fuel. The smoke from such fires is both a health hazard and significant source of carbon emissions. Furthermore, over 80% of the biomass used for cooking is harvested unsustainably, resulting in the depletion of local forest resources. This leads to income losses associated with agroforestry (~45% labor dependency) and tourism (~7% of GDP), as Zambia’s national parks are key tourist attractions. A lack of alternatives forces households to spend a lot of money purchasing these fossil fuels, such as charcoal.

This project aims to achieve long-term and far-reaching change in clean cooking in Zambia. Greenway has chosen Zambia as the country of distribution because of the high use of biomass in cooking. The project aims to replace the unhealthy fireplaces, especially in rural areas, with the efficient cooking stove, the “Greenway Jumbo Stove”. The overall project is expected to sell 100,000 sustainable cookstoves in Zambia. Greenway’s first cookstove project on bettervest.com collected EUR 161,700 by November 2020. This second project funding will refinance the cookstoves initially funded up-front through equity from Greenway. Greenway financed EUR 561,200 in 2022 for the first tranche of the second part of the project. In total, Greenway has already sold 91,000 cookstoves in Zambia and built a network of over 40 organisations and community awareness agents.

India-based Greenway aims to make cookstoves affordable for Zambian end users, subsidised in part through the sale of CO2 certificates generated by the sale of the cookstoves. The final price of a cook stove should thus be between 20 and 50 Kwacha (€0.95 and €2.40 ), depending on the area and payment method (end customers can pay in installments ). The CO2 certificates are sold to buyers, usually large companies, who purchase them for regulatory or voluntary reasons.

The introduction of the efficient cookstoves will lead to measurable positive changes in terms of health, environment and reduction of physical workload in the communities, improving local standard of living for rural populations. In addition, Greenway’s innovative business model actively contributes to three of the UN’s Sustainable Development Goals (“SDGs“).

The “Jumbo Cookstove” consumes less fuel, reducing time spent collecting firewood, largely carried out by women, and in turn provides alternative opportunities for economic and personal gender equality (Goal 5). Cooking and heating with solid fuels on open fireplaces or with traditional stoves results in high levels of air pollution, particularly when cooking indoors. The fuel-efficient stove emits fewer toxic particles due to a decrease in the total biomass burned, an increase in the efficiency of biomass combustion, and an increased fire temperature. The stove thus provides a much safer and more modern method of burning biomass for cooking (Goal 7). Furthermore, the stove reduces burn injuries as well as smoke inhalation, especially among children. The project, which is being tendered for funding, will contribute to safe and long-term sustainable development in Zambia.

Greenway’s project will actively contribute to climate change mitigation by avoiding CO2 emissions and reducing deforestation, thereby conserving existing natural forest ecosystems and wildlife habitats. The protection of existing forests ensures the preservation of watersheds that regulate water levels and prevent flash floods (Goal 13).

Due to the high efficiency of the “Jumbo Stove”, the project will help to significantly reduce Zambia’s greenhouse gas emissions: one cookstove can prevent the generation of roughly 2.78 tons of CO2 per year. Based on the total project size and the distribution of 100,000 cookstoves in Zambia, 278,000 tons of CO2 will be avoided annually.

The investment risks associated with the subordinated loan are described in detail in the Capital Investment Information Sheet (VIB) under item 5 and in the risk disclosures. With a view to assessing and limiting the risks for investors, the issuer incorporates the following special features in the project structure:

a) Use of a special purpose vehicle:

Greenway has established an SPV called SDG 13 Ventures Pte. Ltd. (SDG 13) in Singapore for the bettervest crowdfunding campaign. SDG 13 acts as the borrower in this project and is responsible for the distribution and marketing of the cookstoves to end users in Zambia. The SPV cannot take on any other debt than that of the bettervest investors.

b) Parent company guarantee:

Greenway, the parent company in India, has a very solid equity cushion (gearing ratio: 38.4%). Through the guarantee, the parent company is explicitly providing on-going balance sheet support to its subsidiary SGD 13.

c) Breakdown of costs:

The total cost of the project is split between three parties: the bettervest loan covers 26% of the costs; Greenway contributes 60.8%; and the partner the remaining 13.2%.

d) Carbon trading:

Selling the cookstoves to the population in Zambia generates CO2 certificates, which are sold as Verified Carbon Units (VCUs) on the voluntary market. The buyers are usually large corporations companies that purchase the VCUs for regulatory or voluntary reasons.

The loan repayment in this project is serviced entirely through revenue earned on sales of CO2 certificates.

SDG 13 previously issued its CO2 allowances under the Clean Development Mechanism (CDM). This mechanism, defined in the Kyoto Protocol , allows projects to create saleable certified emission reduction (CER) credits available for purchase by countries and companies wishing to meet their CO2 targets. One (1) CER is equivalent to 1 metric ton of CO2 and can be counted toward meeting Kyoto targets.

The CDM expires at the end of 2022 and the CDM Executive Board has only processed applications to issue CERs until December 31, 2020. Through Greenway’s Zambia project, just over 55,000 CERs have been issued through December 31, 2020.

Due to the end of the CDM, SDG 13 will no longer be able to issue CERs. The project will therefore be converted into a project with certificate sales on the voluntary market, where the price per CO2 allowance (Verified Carbon Unit, VCU) is significantly lower.

Further assumptions on Greenway’s revenues: in 2022, Greenway will receive the proceeds of 55,000 CERs at a price of €13 per CER, or EUR 715,000 in total. In 2023-2025, 2.7 VCUs per cookstove (270,000 VCUs) will be issued at a price of €3 euros/VCU, or EUR 810,000 in total. Greenway conservatively assumes they can sell 80% of these VCUs directly, for a total value of EUR 648,000.

Investment need

The total project cost amounts to EUR 2.79 million and is intended to finance the production and distribution of 100,000 cookstoves in Zambia. It will be financed over time in several tranches through bettervest.

In this project, EUR 561,300 (including bettervest listing and trustee fees) will be financed (tranche 2b). The loan will refinance the purchase, distribution and marketing of the Greenway Appliances Jumbo Stove. The borrower, SDG 13, is an SPV established specifically for the funding in Singapore.

The term of the loan is 3 years and has an annual interest rate of 6.5% for the crowd-investors. Investors who invest in the project within the first 28 days will also receive an early bird bonus of 0.5% (i.e. 7% in total for the loan duration). Repayment takes place once a year and includes repayment and interest (annuity repayment). The funding threshold for this project is EUR 50,000. If only this amount is reached, the issuer will cover the difference with existing equity and carry out the project.

Repayment

The crowdfunded loan is repaid by income from the sale of CO2 certificates generated by the sale and operation of the cookstoves.

SDG 13 previously issued its CO2 certificates as Certified Emission Reductions (CERs) under the Clean Development Mechanism (CDM). Through Greenway’s Zambia project, just over 55,000 CERs were issued by 31 December 2020.

However, this CDM mechanism will end at the end of 2022 and the CDM Executive Board will only process applications for the issuance of CERs submitted by 31 December 2020.

This means that due to the end of the CDM mechanism SDG 13 will no longer be able to issue CERs. The project will therefore be converted into a project with certificate sales on the voluntary market. The 45,000 CO2 certificates that can still be generated will then be sold on the voluntary market as so-called Verified Carbon Units (VCUs). The buyers are usually companies that purchase the VCUs to comply with CO2 savings regulations or for voluntary reasons.

Very handy for a mobile cooking stove, the “Greenway Jumbo Stove” is constructed of a lightweight blend of steel and aluminium. This holds up to 40 kilograms of load capacity and can be fired with almost any biomass fuel, primarily wood, but also dry manure, crop waste, coconut waste and bamboo. The geometric structure of the product is composed of an inner and outer wall. Optimally-placed holes and air gaps, as well as a substructure in the fuel chamber, ensure that the air supply during use is as efficient as possible. As a result, the heat in the stove remains constant and easy to regulate, allowing for ideal cooking. The Jumbo Stove requires two-thirds less fuel (than conventional stoves) and results in 70% less toxic smoke production compared to an open fire.

The second webinar on Greenway’s project with co-founder and CEO Ankit Mathur took place on 7/25/2022 at 6pm. You can watch the recording here.

The first webinar on the second part of Greenway’s project took place on 3/23/2022 at 5pm. Co-founder and CEO Ankit Mathur presented the project and answered all questions. You can watch the recording here.

Our project in Zambia is a multi-year intervention that provides families with access to clean cookstoves and also delivers measurable progress for improved family health, time and money savings for users and a reduction in greenhouse gas emissions for us all. We are delighted to be working with bettervest, who have helped us raise the funds needed to make this project a reality and provided us with an alternative channel to raise capital.

The Borrower and Country Profile

SDG 13 Ventures Pte. Ltd.

100 Peck Seah Street #10-18

PS100 Singapore

079333 Singapore

Greenway Grameen Infra Private Limited

#501-502, Plot No, 522, CTS No.F/355, Makani Centre, 35th Road, T.P.S. III Bandra, Mumbai, India

Contact:

+9744413640

contact@greenwayappliances.com

www.greenwayappliances.com

SDG 13 Ventures Pte. Ltd (SDG 13): Issuer and Borrower

SDG 13 Ventures Pte. Ltd. (SDG 13), a special purpose vehicle (SPV) based in Singapore, is the issuer and borrower for this project. SDG 13 does not engage in any other business activities throughout the life of the loan.

Greenway Grameen Infra Private Limited (Greenway): Project owner

Founded in 2011 by Neha Juneja and Ankit Mathur, Greenway aims to provide immediate impact product solutions to consumers in developing countries. Headquartered in Mumbai, India, the company designs, manufactures and distributes highly efficient cookstoves that function with a patented air induction mechanism. This ensures clean combustion of solid biomass fuel, which is predominantly wood.

To date, Greenway has sold more than 1.3 million cookstoves to individual customers, mainly in India, with various partners and microfinance institutions, and has grown into a company with more than 160 employees thanks to its clear strategy. Through targeted reinvestment of the revenues gained and subsidies received in infrastructure, distribution network and production line, Greenway manages to produce up to 40,000 cookers per month. With this project, the company aims to expand on the African continent and in particular in the Southern African Development Community region, where the penetration of clean cooking is among the lowest in the world.

Awards:

Greenway has won several awards for its business model. Among others, the company received the TIME Magazine Award (India) in 2017: Startup Sustainability Pioneer for Best Startup and in 2014, the International Ashden Award for sales of their innovative cookstoves. In addition, Neha Juneja was named Most Powerful Women in Business by Business Today in 2017.

When making investment decisions, it is advisable to find out in advance about the project location, especially the country in which the project will be implemented. To get an overview, the following indicators are a helpful starting point for independent research. The information was retrieved from the relevant data sources in June 2022 and is published without guarantee.

| INDICATOR | RATING ZAMBIA |

|---|---|

| Euler Hermes Ranking | Euler Hermes has rated the risk of non-payment by Zambian companies as “high risk”, with a rating of D on a scale from AA to D (sources: Euler Hermes Country Risk Map) |

| OECD Classification | The OECD classifies Zambia’s overall country risk as 7 on a scale of 0 (low risk) to 7 (high risk) (Sources: Country Risk Classification and OECD Ranking 2022). |

| Corruption Index (Transparency International) | The Corruption Index, published by Transparency International and measured on a basis of 0 (high level of corruption) – 100 (no perceived corruption), puts Zambia at 33 (Source: Transparency International 2021). |

| Commercial Bank Prime Lending Rate | The Commercial Bank Prime Lending Rate shows the average annualised interest rate charged by local commercial banks to their most creditworthy customers for new loans in local currency. For Zambia, the Commercial Bank Prime Lending Rate was 9.5% in 2020 (source: World Bank Data). |

| Creditworthiness (Moody’s) | Moody’s has rated the creditworthiness of Zambian government bonds as Ca on a scale of AAA to D, classifying them as speculative (Source: Trading Economics) |

| Foreign exchange market (Bundesbank) | Over the past five years, the foreign exchange price for the euro in Zambia has increased slightly, five years ago the price was 10.39 kwacha, a year ago it was 27.47 and today the price is 18.46 kwacha (Source: Bundesbank 2022). |

Key figures

| Borrower | SDG 13 Ventures Pte. Ltd. |

| Type of Investment | Subordinated Loan |

| Funding volume | EUR 561,300.00 |

| Term | 3 years |

| Interest | 6.5 % p.a. (7,0 % p.a. for an investment in the first 28 days) |

| Repayment of principal and interest | annuity |