Help the leader of energy efficient cookstoves in Kenya expand to 7 African countries, make clean cooking accessible to millions & enable the saving of 934,400 tons of CO2 per year!

Mit dem Laden des Videos akzeptieren Sie die Datenschutzerklärung von YouTube.

Mehr erfahren

For subtitles, please press the CC button at the bottom right of the screen.

The acquisition of this investment is associated with considerable risks and may lead to the complete loss of the invested assets.

UN Entwicklungsziele (SDGs)

The investment at a glance

UKaid supported bettervest in designing legal contracts related to this project through Energy4Impact’s Crowd Power programme.

Project intent

Award-winning company BURN Manufacturing manufactures high-quality, resource-efficient cookstoves ("cookstoves") that provide a cost-effective, health-saving alternative for cooking for people in developing countries, vastly improving their quality of life. The market leader in Kenya now wants to make its sustainable cooking solutions available to people across Africa and plans to enter the market in seven more countries by 2024. BURN Manufacturing will use the loan to finance these expansion plans as well as to expand its production capacities and further develop its energy-efficient electrical product line.

Sustainable & social impact

By 2027 BURN Manufacturing plans to sell over 20 mio. resource-efficient cookstoves through its expansion on the African continent, reducing the consumption of other fuels such as charcoal by 39%. This results in an immense increase in energy efficiency, leading to an average of 9.2 mio. tons of wood being saved from deforestation each year. Additionally, the use of these cookstoves greatly improves air quality, reducing health hazards such as indoor air pollution that can cause high-grade respiratory illnesses. As part of its expansion, BURN Manufacturing aims to create more than 10,000 jobs by 2027, helping women in particular to take traditional "men's jobs."

Climate protection

Sales of over 20 mio. energy-efficient cookstoves by 2027 will generate high fuel savings, preventing the emission of an average of 3.2 tons of CO2 per stove per year. By 2027, this amounts to an average of 12.8 million tons of CO2 per year. The crowdfunding campaign will finance 7.3% of this and thus save an average of 934,400 tons of CO2 per year.

Established, sustainable company

BURN Manufacturing Company (BURN Manufacturing) was founded in 2011 by Peter Scott and Boston Nyer and has been active in Kenya through its local branch since 2013. At its own factory in Ruiru, Kenya, BURN Manufacturing produces resource-efficient cookstoves and has established itself as the market leader in Kenya with more than 1.6 mio. cookstoves sold. The company employs more than 1000 team members and emphasizes innovative research, design, efficient production, and excellent customer service. BURN Manufacturing has generated a total of €40.98 mio. ($41 mio.) in revenue since selling its first cookstove in 2014, of which €11.7 mio. ($11.7 mio.) was generated in 2021 alone. In addition, since 2018, BURN Manufacturing's net income and equity have been positive. By 2027, BURN Manufacturing aims to increase net profit from €3 mio. ($3.0 mio.) in 2020 to over €99.96 mio. ($100 mio.). Since initial sales in Kenya and Somalia & Somaliland in 2016, BURN is now looking to put its further expansion plans into action by serving over 14 East, Central and Western countries. BURN Manufacturing has received several awards for its business model, such as the Bloomberg New Energy Pioneers Award 2018, the Swiss Energy and Climate Summit Award 2018, and the Ashden Green Energy International Award 2015 - the Oscar among awards in the energy sector.

Early bird bonus

All investors who invest until 03.02.2023 will receive an early bird bonus of 1%. The interest rate thus increases to 7% in total.

Risk reduction measures

This project will be the first to have a guarantee from a guarantee fund. This will take effect in the event of a default on repayment of the loan by the project owner after all recovery measures have been met. The guarantee is partially covering the oustanding capital of loan and is provided strictly on the basis of True Risk Sharing by the Lender (SPV/bettervest). Political risks are not covered by the guarantee.

For the crowdfunding campaign on bettervest, a special purpose entity called Burn Cook Stove Emissions UG (haftungsbeschränkt), based in Germany, was established to act as the borrower in this project. It forwards the collected capital as a secured loan to the project owner in Kenya, BURN Manufacturing USA LLC Kenya Branch (BMUKB) and does not engage in any other business activities during the entire term of the loan. Shareholders and managing directors of Burn Cook Stove Emissions UG (haftungsbeschränkt) are independent of BMUKB.

In addition, Burn Cook Stove Emissions UG (haftungsbeschränkt) has a liquidity buffer of 25,000 euros of the money collected in the crowdfunding, which serves as a financial cushion for any necessary measures if BMUKB does not meet its payment obligations.

The on-lending loan from Burn Cook Stove Emissions UG (haftungsbeschränkt) to BMUKB is secured by the following assets:

(i) Inventories of finished products: The collateral relates to 40% of the outstanding loan amount.

(ii) CO2 Certificates (VERs): In addition, the parent company in USA BURN Manufacturing Company, Washington State pledges CO2 allowances, known as Voluntary Emission Reductions (VERs), credited to the U.S. parent company in the course of BMUKB's manufacturing and marketing of cookstoves in Africa. This security relates to 100% of the outstanding loan amount.

The on-lending loan also includes ancillary loan agreements ("financial covenants") between the creditor Burn Cook Stove Emissions UG (haftungsbeschränkt) and debtor BMUKB in order to maintain the financial stability of the company on a high level.

To supplement its equity, BURN will receive a total of USD 7.6 million in quasi-capital and subordinated loan funding from Spark+ Africa Fund and the East Africa Relief Fund over the course of 2022.

Raffle of 5 cook cookers

Want to try the BURN cookstove for yourself? BURN Manufacturing has made 5 of their energy-efficient cookstoves available for a raffle among bettervest investors. The cookstoves will be raffled off among the supporters with the highest investment amount and sent to the winners if they are interested.

Report on BURN

BURN Manufacturing as well as bettervest were featured in a report by ZDF in March 2022. The plan b format presented, among other things, BURN's need for capital for its expansion plans and the closing of this financing gap through crowdfunding via bettervest. You can watch the report entitled „Geld ist nicht alles – Investieren in gute Zwecke – Film von Alexandra Hostert und Norman Laryea“ ("Money isn't everything - Investing in good causes - film by Alexandra Hostert and Norman Laryea") here.

Project description

A large proportion of people in sub-Saharan Africa rely on charcoal or firewood as an energy source for cooking, the combustion of which releases emissions that are harmful to health. According to the World Health Organization, smoke inhalation from cooking on open fires causes 3.8 mio. premature deaths each year. For lack of alternatives, households spend heavily to purchase these harmful fuels, for which they must pay $300 to $500 per year, depending on the region, type of wood, and price volatility. Entire forests are being cut down to meet demand.

Award-winning company BURN Manufacturing Company (BURN Manufacturing) is countering these problems by manufacturing energy-efficient cookstoves. At the company’s factory, which is located in Ruiru, Kenya, BURN Manufacturing produces resource-efficient cooking appliances that use less fuel than conventional cookstoves and produce up to 80% less smoke. This significantly minimizes health risks and provides high cost savings for customers who tend to be from poorer backgrounds.

Since its founding in 2011, BURN Manufacturing has established itself as the market leader in Kenya with over 1.6 mio. cooking appliances sold and now wants to make its climate-friendly products available to the African continent. As a result, BURN Manufacturing plans to enter the market in several additional countries by 2024 like Rwanda, Ghana, Uganda, Tanzania, Democratic Republic of Congo, Nigeria and Mozambique. As part of this, BURN Manufacturing aims to expand its production capacity in Kenya, as well as invest in the further development of its energy-efficient electric cooking solutions. Currently, the company has the capacity to produce over 200,000 cookstoves per month. This is expected to increase to 500,000 units per month by mid-2024. This funding will therefore finance BURN Manufacturing’s business expansion and the expansion of production to improve the quality of life of one mio. people.

BURN Manufacturing has already successfully completed two fundings on bettervest.com. The first campaign raised €336,700 and the second one 666,700 EUR to fund raw materials for the cookstoves.

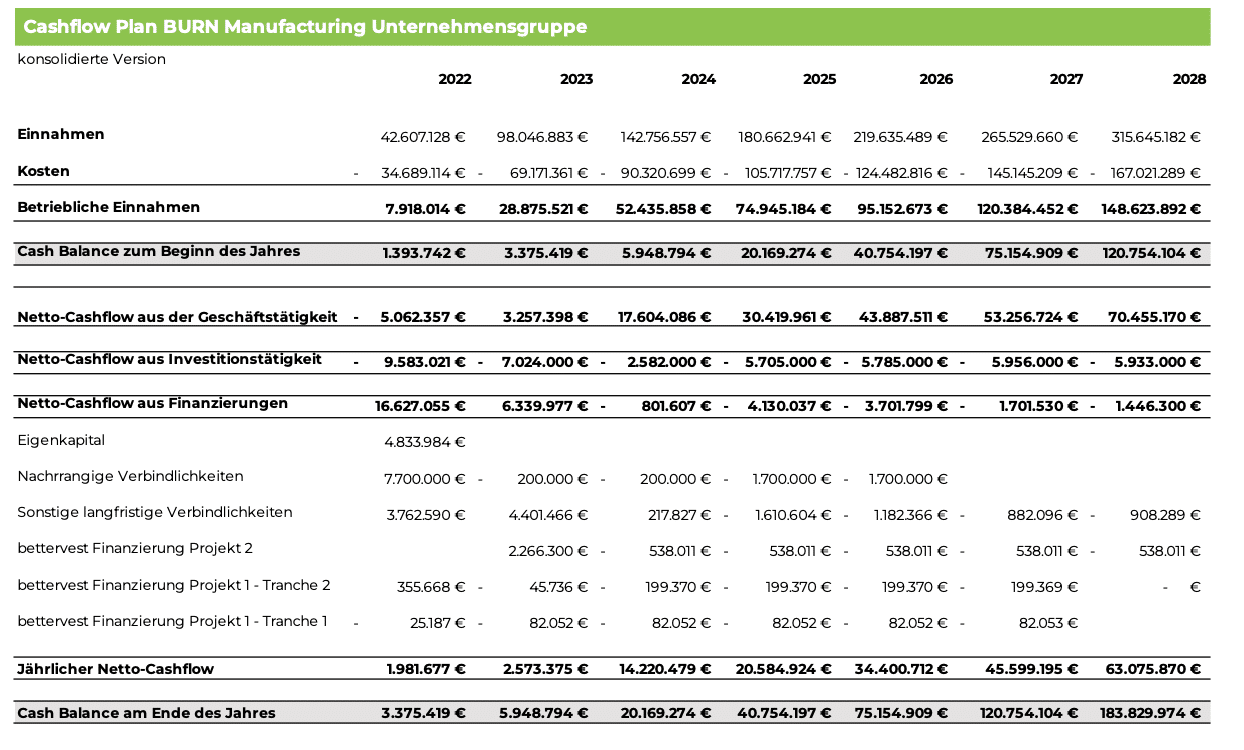

BURN Manufacturing’s business model actively contributes to 6 of the UN’s sustainable development goals („SDGs“):

The resource-efficient cookstoves reduce fuel consumption by 39%, increasing energy efficiency (Goal 7.3) and cutting down fewer trees (Goal 15.2). Since the first so-called jikokoas (Swahili for “cook stove” and “save”) were sold in 2013, 6.1 mio. tons of wood have already been saved from deforestation. At the same time, customers are able to save on fuel costs (Objective 8.4). BURN Manufacturing customers’ cost savings have accumulated to $468.8 mio. since 2013.

The use of the efficient cookstoves also reduces health hazards such as indoor air pollution that can cause respiratory illnesses (Goal 3.9). Reduced fossil fuel use also results in lower CO2 emissions (Goal 13), helping to combat climate change. BURN Manufacturing has been able to avoid 10.9 mio. tons of CO2 emissions to date due to its energy-efficient cookstoves.

BURN Manufacturing currently employs more than 1,000 people, approximately 50% of whom are women, and supports women in taking positions that are traditionally “for men only” (Goal 5.1).

The use of the efficient cookstoves saves fuel, which at the same time creates a great potential for CO2 savings. On average, a BURN cookstove saves 3.2 tons of CO2 and 2.3 tons of wood per year. Thus, indoor air pollution is reduced by 60% when using a cookstove. The expansion is expected to sell 20 mio. more cookstoves in the next five years until 2027, saving 12.8 mio. tons of CO2 per year on average. The crowdfunding campaign will finance 7.3% of this and thus save an average of 934,400 tons of CO2 per year.

The investment risks associated with the subordinated loan are described in detail in the VIB under item 5 and in the risk notes. With a view to assessing and limiting the risks for investors*, the issuer draws attention to the following special features in the design of the project:

a) External default guarantee

This project will be the first to have an external default guarantee from a guarantee fund. The guarantee exists in favour of the issuing SPV, a special purpose vehicle independent of the project owner, and relates to the loan that the SPV uses to on-lend the funds provided by the Crowd to the project owner.

The guarantee takes effect in the event of default on repayment of the loan by the project owner after all reasonable recovery measures have been put in place by the Lender (SPV/bettervest). Payments under the guarantee are subject to the terms and conditions of the relevant guarantee agreement. The guarantee covers partially the outstanding loan capital. The Guarantee is not a first loss guarantee and is provided strictly on the basis of True Risk Sharing by the Lender (SPV/Bettervest). Political risks are not covered by the guarantee. The costs and fees associated with the guarantee in favor of the Guarantor will be borne by bettervest.

You can find our blog post on the general topic of “default guarantees” here.

b) Use of a special purpose vehicle:

For the crowdfunding campaign on bettervest, a special purpose entity called Burn Cook Stove Emissions UG (haftungsbeschränkt) was established. Burn Cook Stove Emissions UG (haftungsbeschränkt) acts as the borrower and is based in Germany. It forwards the collected capital as a secured loan to the company in Kenya, BURN Manufacturing USA LLC Kenya Branch (BMUKB) and does not engage in any other business activities during the entire term of the loan. The shareholders and directors of Burn Cook Stove Emissions UG (haftungsbeschränkt) are independent of BMUKB. In addition, Burn Cook Stove Emissions UG (haftungsbeschränkt) has a liquidity buffer of 25,000 euros of the money raised in the crowdfunding. The liquidity buffer serves as a financial cushion for any necessary measures in the event that BMUKB does not meet its payment obligations.

c) Collateralization of the on-lending loan:

The on-lending loan from Burn Cook Stove Emissions UG (haftungsbeschränkt) to BMUKB is secured by the following assets:

(i) Inventory of completed products.

The collateral relates to 40% of the outstanding loan amount. These are higher quality electric powered cooking stoves, which are spun off for the purpose of pledging into a trust company based in Mauritius.

(ii) CO2 certificates (VERs):

In addition, the parent company in USA BURN Manufacturing Company, Washington State pledges CO2 allowances, known as Voluntary Emission Reductions (VERs), credited to the U.S. parent company in the course of BMUKB’s manufacturing and marketing of cookstoves in Africa. This security relates to 100% of the outstanding loan amount.

d) Special Credit Agreement Ancillary Covenants (“Financial Covenants”):

The following ancillary credit agreement covenants between creditor Burn Cook Stove Emissions UG (haftungsbeschränkt) and debtor BMUKB were included in the on-lending loan:

(i) BMUKB’s debt service coverage ratio shall not exceed 2.5:1 for the first 12 months of the contractual term, and shall not exceed 2.0:1 from the 13th month until the end of the contractual term. The debt service coverage ratio is defined in the agreement as follows: (non-subordinated debt) / (equity + subordinated loan).

(ii) BMUKB’s debt service coverage ratio shall not fall below a factor of 1.2x during the entire term of the loan. That is, in the 4 quarters prior to the maturity of each annuity payment, the cash flow available for servicing the company’s debt must be at least 20% greater than the debt service BMUKB is required to pay on its total debt in those 4 quarters.

e) Equity:

BURN shall provide the Trust Company in Mauritius with equity equal to 10% of the issue amount. Disbursement of the on-lending loan will only be made upon presentation of proof of receipt of payment of the corresponding equity amount.

In May of this year, BURN’s parent company in the USA received fresh equity in the amount of USD 2.2 mio. Another capital increase of USD 5 mio. is planned for December this year with the Option for further 5 mio. USD in the first quarter of 2023. The funds will be invested in BMUKB. Thus, they strengthen the financial power of the borrower vis-à-vis the issuer of the crowdfunded loan.

f) Subordinated loan:

To supplement its equity, BURN received a total of US$4 mio. in funding from Spark+ Africa Fund in the form of equity-like loans at the end of May 2022.

Spark+ Africa Fund is a $70 mio. investment fund that finances companies providing next-generation distributed energy solutions to the mass market in sub-Saharan Africa.

The fund invests debt and mezzanine capital in leading companies along the value chain of various cooking fuels such as liquefied petroleum gas (LPG), biofuels such as ethanol and pellets, electrical appliances, and efficient biomass stoves.

Spark+ is the first fund of Luxembourg-based Spark+ General Partner Sàrl, a joint venture between the fund’s exclusive advisor, Swiss impact investment consultancy Enabling Qapital, and the Dutch foundation Stichting Modern Cooking.

Investment needs

In order to realize the expansion as well as the development of the production and the product range, BURN Manufacturing needs 7.6 Mio. Euros. On the one hand, this will finance the market expansion into seven African countries and the associated measures such as sales, marketing, logistics and administration. On the other hand, BURN Manufacturing uses the money to invest in the development and design of (new) products as well as in the expansion of production capacities.

Through crowdfunding, 2,266,300.00 euros (including fees) are to be collected, the remaining needs will be covered by equity, grants and debt. The project is co-financed by the crowdfunding platforms bettervest and GREEN ROCKET. This means that the project will be offered for financing on two platforms in parallel.

The term of the loan is 5 years and has an annual interest rate of 6% for the crowd-investors. Investors who invest in the project within the first four weeks also receive an early bird bonus of 1% (i.e. a total of 7%). The funding threshold for this project is 50,000 euros. If only this amount is reached, the project owner will fund the rest from other sources and carry out the project.

Repayment

The loan will be repaid from cash generated by BURN Manufacturing through the sale of the cookstoves and CO2 certificates (Voluntary Emission Reductions (VERs)).

Want to try the BURN cookstove for yourself? BURN Manufacturing has made 5 of their energy-efficient cookstoves available for a raffle among bettervest investors. The cookstoves will be raffled off among the supporters with the highest investment amount and sent to the winners if they are interested.

1. What is a partial guarantee?

We have created a detailed blog post on the topic of default guarantees, which you can access here.

2. Do I, as an investor, have additional costs due to the guarantee?

No. The costs of the guarantee are paid in full by the special purpose vehicle, which in turn invoices the project owner.

The BURN business model: clean cooking stoves and green CO2 certificates

A) Production and sale of resource-efficient cook stoves

Product Overview:

– Jikokoa Classic – BURN Manufacturing’s flagship product, sold over 1 million units since 2014.

– Mass Market Jikokoa – The new, improved, and more affordable version of the Classic. Improved efficiency and durability as the ‘Classic’, but with a 25% lower MSRP (23.7 Euros, $24).

– Payback time: 2-4 months

– CO2 reduction: 4-5 tons of CO2 per stove per year.

Strategy and rationale:

– The Jikokoa Classic version will be discontinued and replaced with the improved mass market version in Q4 2022.

Economic specifications:

– Classic: retail price $37

– 2021: retail price: $10-$27 (prices subsidized using carbon financing)

Product Overview:

• Jikokoa Xtra – The largest, longest lasting and most powerful household biomass stove in Africa.

• Jikokoa Pro – The most efficient commercial charcoal cookstove in Africa

Strategy and rationale:

• Xtra enables BURN Manufacturing to capture the premium consumer market at a higher price point and margin.

• Pro is designed for restaurants and institutions. Studies have shown that these institutions are responsible for ~50% of charcoal consumption in Kenya.

• Economic Specifications:

• Xtra: retail price: $47

• Pro: retail price: $80

Product Overview:

– Ecoa Wood – The world’s most economical stove for home use.

– Uses 71% less wood than a 3-stone fire.

– 43% thermal efficiency (51% with pot skirt)

– ISO/IWA level 3

– Lifetime: 5 years+

– CO2 reduction: 2.3 – 3 tons per stove per year

Highlights

• 90,000 units sold in 2021

• Currently negotiating supply contracts for 1 over million units in Africa for 2022

Strategy and rationale:

• More than 600 mio. rural residents in SSA rely on wood because they cannot afford LPG or electricity.

Economic specifications:

• Wholesale price: $23

Product Overview:

• EPC – The safest, most affordable and modern cooking solution that can prepare any meal.

• Designed for the East African market with one-touch cooking for traditional East African cooking.

• Induction Cooker –

• An Induction Cooker heats an Induction vessel through electrical induction, thereby ensuring minimum loss of energy.

• The Induction Cooker is targeted towards African households.

• Switching to the Induction cooker, is 3-8x cheaper than other fuels, with customers reducing their weekly average fuel expenditure by 65%, from $8.40 to $2.70 – an average savings of $5.70 per week. This benefit will become increasingly apparent as ethanol, LPG and biomass cooking fuel costs continue to rise.

• Customers using our electric induction cooker reduce their charcoal usage by 85% and LPG usage by 59%

Highlights

• A 10-member research and development team developed a grid-connected platform, with pilot projects now underway in Kenya, Tanzania, and Ghana. Approved $1.5m in grants/ received $358k to date.

Strategy and rationale:

• Target households that have access to electricity, with a focus on those that rely on charcoal, wood and kerosene. Electrification on the continent is progressing rapidly; for example, 56% of all Kenyan households are now connected to the grid

Economic specifications:

• Retail price: $60-110

Product Overview:

– ecoa LPG (Liquified Petroleum Gas) – locally manufactured cookstove that offers better quality at a lower price than comparable imported cookstoves.

– Value and Premium models retail for ~20% less than imported units

– Modular design to accommodate PAYG and OEM customer specifications

Highlights

• VAT exemption for raw materials

• Duty-free shipping to EAC (East African Community)

Strategy and rationale:

• LPG consumption in SSA will double in the next 10 years.

• Direct sales to retail, OEM (for LPG companies like ProGas) and wholesale to PAYG LPG companies.

Economic specifications:

• Retail price: $21 – $37

All cookstoves have been tested by several independent bodies including the Kenya Industrial Research and Development Institute (KIRDI) and the University of Washington. Fuel efficiency, durability and reduced emissions have been confirmed. UC Berkley and the University of Chicago also authored an independent study on customer efficiency and cost savings. The study can be found here. In general, the cookstove can be registered by customers by means of a serial number, which gives them access to customer service, which assists them in maintaining the cookstoves and provides spare parts. For this purpose, they have access to over 50 service points in Kenya and East Africa.

Manufacturing Process:

The modern production hall is located in Ruiru and is powered by solar electricity, which covers two-thirds of the production’s energy needs. A large part of the raw material such as Galvalume sheets or stainless steel sheets is sourced by BURN Manufacturing in Kenya. Other materials such as stainless steel tubes or wires are imported from China. In the press, the material is cut, pressed and formed into different parts, with each machine producing about 4,000 – 7,000 parts per day. The individual parts are powder coated in an oven at 1,000 degrees, giving them a glossy finish and making them durable and odorless. The individual parts are then assembled into various sub-assemblies, which are ultimately joined together to form the finished product. This is done by welding or with riveted joints. Quality control is carried out directly on the assembly lines. Within one month, over 200,000 climate-friendly cook stoves can thus be produced.

Distribution:

The cookstoves are sold and marketed worldwide through many channels. These include retailers, financial institutions that allow installment payments, cooperatives, and through an online store.

BURN Manufacturing already sells its products in Kenya, Somalia and Somaliland, and sporadically in other parts of East Africa and the world. An expansion is now planned to several other African countries.

With regard to the packaging of the cookstoves, BURN Manufacturing operates a zero-plastic policy. This includes packaging the stoves with sustainable materials that do not cause environmental pollution.

B) Trading of CO2 certificates (Voluntary Emission Reductions (VERs))

The second source of revenue for BURN Manufacturing is the trading of CO2 certificates. Since 2016, BURN Manufacturing has generated tradable CO2 certificates, so-called Voluntary Emission Reductions (VERs), through the sale of cookstoves and the associated CO2 savings. One VER represents one metric ton of CO2 equivalent from a verified project that is audited by an independent third party and certified to Gold Standard. The Gold Standard sets requirements for designing projects for maximum positive impact on climate and development and certifies CO2-saving projects such as BURN Manufacturing.

VERs are sold to companies and brokers. Sales are often made through Emission Reduction Payment Agreements (ERPAs). ERPAs are a commitment to buy/sell carbon credits at predetermined prices over a period of time. BURN Manufacturing has already signed EPRAs worth approximately EUR 30 mio. with various buyers. The end of the contract period is between 2021 and 2028 and the average price per VER is 5,21 euros (6,21 USD).

In the last four years, BURN Manufacturing has also already been able to sell more than 1 mio. VERs at a price between $1 and $6 per certificate, with the expectation that this figure will continue to rise.

The decline in global inventories has driven up VER prices, and carbon credit prices are estimated to continue to increase tenfold to ~$50/tCO2e by 2030. BURN credits have followed market trends, rising from ~$3-4/VER in 2020 to $8-10/VER in 2022. The increasing net zero obligations of many companies and countries have led to an explosion in carbon credit demand, with prices expected to continue to rise.

For more in-depth information on carbon credits, read our blog post on the topic.

We are excited to partner with Bettervest as we embark the most ambitious growth plans in our company history: expanding to new markets across Africa, increasing our production capacity and launching new product lines.

This year alone BURN will manufacture and sell over 1.2 million stoves, employ over 1000 team members, and deliver life-changing impact to over 5 million customers. These all more than we have delivered in all previous years combined and just the beginning of our major scale-up across the African continent.

Through our partnership with Bettervest and their unique crowd funding platform, we are grateful for the opportunity to utilize a key, timely source of capital for funding of our aggressive growth and to share our journey with an investor base committed to delivering environmental & life changing solutions like BURN.

The Borrower and Country Profile

Burn Cook Stove Emissions UG (haftungsbeschränkt)

Falkstraße 5

60487 Frankfurt, Germany

BURN Manufacturing USA LLC,

Kenya Branch

New Horizons Industrial Park

Ruiru, Kenya

Contact:

+254 700 667 788 kenya@burnmfg.com

https://burnstoves.com/

Burn Cook Stove Emissions UG (haftungsbeschränkt): Issuer and borrower

The special purpose entity Burn Cook Stove Emissions UG (haftungsbeschränkt) KG is based in Germany and acts as the borrower in this project. The task of this special purpose entity is to forward the collected money of the crowdinvestors as a project loan to the project owner on site, BURN Manufacturing USA LLC Kenya Branch (BMUKB). Burn Cook Stove Emissions UG (haftungsbeschränkt) will not engage in any other business activities during the entire term of the loan. Shareholder and managing director of Burn Cook Stove Emissions UG (haftungsbeschränkt) are independent from the project owner BMUKB.

BURN:

BURN Manufacturing Company (BURN Manufacturing): parent company

BURN Manufacturing Company was founded in 2011 by Peter Scott in the United States. The company comprises several local entities through which it is active in several African countries. In Kenya, BURN Manufacturing operates through its branch BURN Manufacturing USA LLC Kenya Branch (BMUKB), a 100% subsidiary which started operations in 2013.

In addition to Kenya, BURN Manufacturing has been operating in Somalia and Somaliland since 2016, where it has seen steadily growing sales. As part of its expansion plans, BURN Manufacturing aims to offer its cookstoves in several other African countries by 2024, including Tanzania, Ethiopia, Ghana, Democratic Republic of Congo, Rwanda, Mozambique and in Nigeria. As part of this, BURN Manufacturing plans to restructure and expand its product line.

The company employs more than 1000 team members worldwide and has sold over 1.6 mio. energy-efficient cookstoves until today. BURN Manufacturing has generated a total of €40.98 mio. ($41 mio.) in revenue since selling its first cookstove in 2014, of which €11.7 mio. ($11.7 mio.) was generated in 2021 alone. In addition, since 2018, BURN Manufacturing’s net income and equity have been positive. By 2027, BURN Manufacturing aims to increase net profit from €3 mio. ($3.0 mio.) in 2020 to over €99.96 mio. ($100 mio.).

BURN Manufacturing has already received several awards for its business model. Among them, the company received the 2018 Bloomberg New Energy Pioneers Award for global leadership in developing clean energy solutions, the 2018 Swiss Energy and Climate Summit Award for a pitch on the impact of clean stoves, and the 2015 Ashden Green Energy International Award – the Oscars of energy sector awards – for empowering women through new economic opportunities. In 2020, BURN Manufacturing received the LEAP Affordability Award for its electric pressure cooker (model BURN MY-8001) for offering the best overall value to the end user based on unit price, estimated cost of ownership, overall performance and cooking capacity.

BURN Manufacturing USA LLC Kenya Branch (BMUKB): Project Owner

BURN Manufacturing USA LLC Kenya Branch (BMUKB) is a 100% subsidiary of BURN Manufacturing Company (based in the USA) and started operations in 2013. At its facility in the town of Ruiru, Kenya, BMUKB designs, manufactures and distributes Africa’s best-selling, longest-lasting and most economical cookstoves and has established itself as the market leader in Kenya. The company focuses on innovative research and design, efficient production and excellent customer support.

When making investment decisions, it is advisable to find out in advance about the project location, especially the country in which the project will be implemented.

To get an overview, the following indicators are a helpful starting point for independent research. The information was retrieved from the relevant data sources in January 2023 and is published without guarantee.

| INDICATOR | RATING KENYA |

|---|---|

| Euler Hermes Ranking | Euler Hermes hat das Risiko der Nicht-Zahlung von kenianischen Unternehmen mit “sensitive risk” bewertet und auf einer Skala von AA bis D mit C3 gerated (Quellen: Euler Hermes Country Risk Map) |

| OECD Klassifizierung | Die OECD klassifiziert das allgemeine Länderrisiko Kenias auf einer Skala von 0 (geringes Risiko) bis 7 (hohes Risiko) mit 7 (Quellen: OECD Country Risk Classification und OECD Ranking 2022). |

| Korruptionsindex (Transparency International) | Der Korruptionsindex, der von Transparency International veröffentlicht wird und auf einer Basis von 0 (hohes Maß an Korruption) – 100 (keine wahrgenommene Korruption) bemessen wird, liegt in Kenia bei 30 (Quelle: Transparency International 2021). |

| Commercial Bank Prime Lending Rate | Die Commercial Bank Prime Lending Rate zeigt auf, welchen Durchschnitt an annualisierten Zinsraten lokale Geschäftsbanken ihren kreditwürdigsten Kunden für neue Kredite in der Landeswährung berechnen. Bei Kenia lag die Commercial Bank Prime Lending Rate im September 2022 bei 12,41% (Quelle: Trading Economics 2022). |

| Kreditwürdigkeit (Moody’s) | Moody’s hat die Kreditwürdigkeit von kenianischen Staatsanleihen auf einer Skala von AAA bis D mit B2 bewertet und somit als spekulativ eingestuft (Quelle: Trading Economics 2022) |

| Devisenmarkt (Bundesbank) | In den letzten fünf Jahren ist der Devisenpreis für den Euro in Kenia leicht gesunken, vor fünf Jahren lag der Preis bei 122,42 Kenia-Shilling, vor einem Jahr bei 126,96 und heute liegt der Preis bei 121,09 Kenia-Shilling (Quelle: Bundesbank 2022). |

Key figures

| Borrower | Burn Cook Stove Emissions UG (haftungsbeschränkt) |

| Type of investment | Subordinated Loan |

| Funding volume | EUR 2,266,300.00 |

| Term | 5 years |

| Interest | 6.0% p.a. (7.0% p.a. for an investment in the first four weeks) |

| Repayment of principal and interest | annuity |