Promote sustainable energy in Colombia with your investment by realising 11 solar projects with combined annual CO₂ savings of 3,872 tons.

Mit dem Laden des Videos akzeptieren Sie die Datenschutzerklärung von YouTube.

Mehr erfahren

Part 2 of the series “5 Questions for Ongresso Energy”:

In this format, the project owner Ongresso Energy answers the bettervest crowd’s questions directly in a video interview. You can find the continuation of Part 2 under the “Video Interview” tab.

The acquisition of this packaged investment product entails considerable risks and may result in the complete loss of the assets invested. Please read the Key Information Document carefully before making any investment decision.

UN Sustainable Development Goals

Overview of The Packaged Investment Product

The overall project has a total funding target of €1,310,900 (including bettervest fees). The financing will be carried out in several tranches, with this tranche having a funding target of €760,650. All figures in the text refer to the overall project.

Project intent

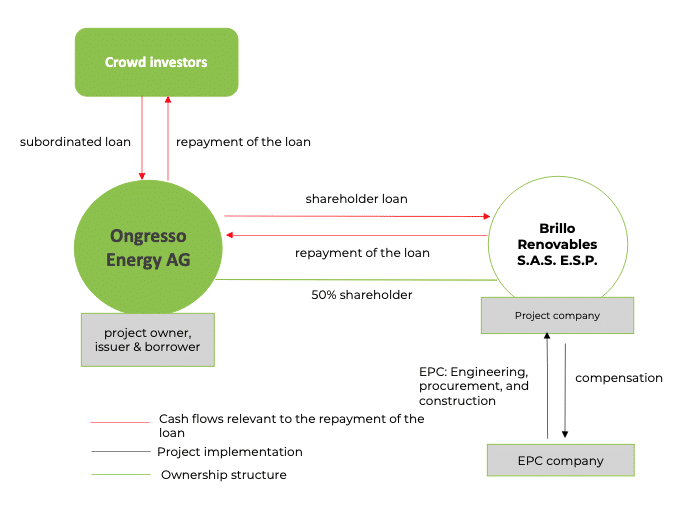

With the bettervest loan, the Swiss company Ongresso Energy finances the project company “Brillo Renovables SAS ESP” – a 50/50 joint venture between Ongresso Energy and a mayor European Utility – in the form of a shareholder loan. The project company is responsible for the development, construction, ownership, and operation of solar photovoltaic energy plants in Colombia.

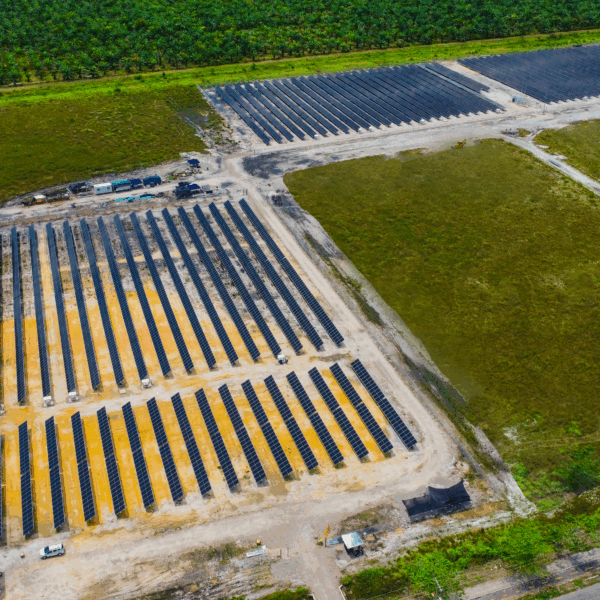

A total of 11 photovoltaic plants are planned, including five small-scale, ground-mounted solar parks with a combined capacity of 6.6 MWp. The electricity generated by these plants will be sold to a major local utility under a 15-year power purchase agreement (PPA) and fed into the national grid. Additionally, six C&I rooftop systems with a total capacity of 2.8 MWp will supply electricity directly to the one of the main supermarket chains in the Americas under a 10-year off-take agreement.

The first two projects to be implemented are in Aguachica (Departamento Cesar), two small-scale, ground-mounted solar parks with a capacity of 1.365 MWp each.

The overall project contributes both to the diversification of Colombia’s energy mix and to the sustainable power supply of the retail sector.

Social & Economic Impact

The project creates approximately 175 jobs locally during the construction phase. In addition, local companies are engaged through the supply of materials and services, which sustainably strengthens the regional economy. The neighbouring community is actively involved, including through information events that promote transparency and acceptance. Furthermore, the local School is supported with targeted initiatives such as the construction of a school kitchen, the installation of a solar system for self-consumption, or the provision of school supplies.

Climate protection

The solar plants together save approximately 3,872 tons of CO₂ annually and a total of 116,160 tons of CO₂ over the 30-year lifetime of the projects.

Bonus interest

In addition to the regular interest rate of the subordinated loan, the issuer grants a bonus interest rate of 0.50% p.a. The payment of this bonus interest is subject to an exchange rate condition: the decisive factor is the exchange rate of the Colombian peso (COP) to the euro (EUR) at the time of loan disbursement, which is set once as the reference value and serves as the basis of comparison for the entire term of the loan.

For further details, please refer to the section “Financing and Repayment.”

Established, sustainable company

The Swiss company Ongresso Energy was established in 2020 based on the long-standing entrepreneurial activities of Daniel Breitenmoser and Ulrich Hinterberger, who had already founded the consulting firm Ongresso Consulting GmbH in 2010 to support international companies entering Latin America.

Risk reduction measures

Partnership with a mayor European Utility:

In 2024, Ongresso Energy entered a partnership with a mayor European Utility: in the 50/50 joint venture “Brillo Renovables”, both partners jointly develop, implement, and operate distributed energy and self-generation C&I solar energy assets in Colombia. Both companies take on operational roles in all processes and contribute 50% of the investments each. This ensures the highest standards, financial stability, and effective risk diversification.

Power Purchase Agreements (PPA):

The project company’s repayment is secured through the revenues of a 15-year power purchase agreement with one of Colombia’s largest energy distributors as well as the 10-year PPA take-or-pay agreement with one of the main supermarket chains in the Americas.

Financing Facility (Loan Structure) with a Swiss Impact Fund:

In cooperation with an established Swiss asset manager, Ongresso Energy is currently establishing a green bond facility that will provide additional local-currency capital for the implementation of the projects.

For further details, please refer to the section “Risk Mitigation Measures.”

Project description

Around 65% of electricity in Colombia is generated from hydropower. While this renewable energy source is climate-friendly, it makes the country highly dependent on rainfall. Recent droughts caused by the El Niño phenomenon have clearly shown how fragile this system is: in some regions, reservoir levels dropped to only 20% of capacity. Fossil power plants had to temporarily cover up to 50% of electricity demand, leading to rising energy prices and an increase in CO₂ emissions.

Therefore, the integration of additional renewable energy sources into the energy mix is of central importance. Photovoltaics are particularly promising in Colombia, as the country enjoys 1,500 to 2,000 hours of sunshine per year, providing excellent natural conditions. Moreover, global levelized costs of electricity for solar energy now average 0.04–0.05 USD/kWh, significantly below the costs of generating electricity from imported fossil fuels. Solar energy thus not only contributes to the resilience of the energy mix but also supports stable and affordable energy prices for end consumers in the long term.

This is where Ongresso Energy’s project comes in: with the bettervest loan, the Swiss company finances the project company “Brillo Renovables” – a 50/50 joint venture between Ongresso Energy and a major European Utility – in the form of a shareholder loan. The project company is responsible for the development, construction, ownership, and operation of solar photovoltaic energy plants in Colombia.

A total of 11 photovoltaic plants are planned. Five of these are small–scale ground-mounted solar parks with a combined capacity of 6.6 MWp. The electricity generated will be sold to a major local utility under a 15-year power purchase agreement (PPA) and fed into the Colombian national grid. The remaining six projects are commercial and industrial (C&I) rooftop solar systems with a total capacity of 2.8 MWp. These systems will be installed on the rooftops of the one of the main supermarket chains in the Americas, which will purchase the electricity under a 10-year off-take agreement and use it directly for on-site consumption.

The first projects to be implemented are in Aguachica (Departamento Cesar), two ground-mounted solar parks with a capacity of 1.365 MWp each.

Overall, the project delivers a dual impact: it contributes to the diversification of the national energy mix by feeding renewable electricity into the grid, and it supports the decarbonization of the retail sector through the direct supply of clean solar power to the supermarket chain.

The Ongresso Energy project actively contributes to 8 of the United Nations Sustainable Development Goals (SDGs):

SDG 1 (No Poverty): The project creates jobs during both the construction and operation phases, providing the local population with additional income opportunities.

SDG 4 (Quality Education): The project offers training for students of the Bateas School on topics such as traffic safety and sustainability. As part of these activities, learning materials are provided to support educational outcomes.

SDG 5 (Gender Equality): The project ensures that all contractors provide equal employment opportunities for men and women and do not discriminate against minorities. Additionally, the Ongresso Energy Code of Conduct and Ethics must be adhered to and communicated to all employees.

SDG 7 (Affordable and Clean Energy): The solar plants generate clean, renewable solar energy. The energy is either fed into the national medium-voltage grid and distributed to end consumers or in the case of C&I rooftop solar plants directly used for on-site consumption. In this way, the project contributes to a cleaner energy supply and reduces the use of more environmentally harmful energy sources.

SDG 8 (Decent Work and Economic Growth): By creating jobs, a safe and professional working environment is ensured, as all contractors are required to comply with the highest health and safety standards. At the same time, the projects contribute to the economic development of the local community by creating additional employment opportunities and collaborating with other local companies to procure local services and goods such as security personnel, concrete, fencing, etc. This helps to support small and medium-sized enterprises in the region.

SDG 9 (Industry, Innovation, and Infrastructure): The project contributes to the modernization of electricity generation infrastructure, with solar modules that are robust, durable, and resource efficient. At the same time, the use of clean technologies in rural areas is promoted.

SDG 10 (Reduced Inequalities): The project helps reduce inequalities by deliberately hiring workers of different genders and with various educational backgrounds from the region.

SDG 13 (Climate Action): The project reduces greenhouse gas emissions and actively supports the transition to a more sustainable, diversified energy supply in Colombia.

Every year, UPME, the Colombian Mining and Energy Planning Unit, and XM, the operators of the national electricity grid, publish the previous year’s grid emission factor. Ongresso Energy uses this indicator to calculate the CO₂ savings achieved by its projects. In 2024, Colombia’s electricity generation mix consisted of approximately 62% hydropower, 29% thermal power plants, and 9% solar energy, resulting in a relatively low grid emission factor of 0.21742 tons of CO₂ per MWh.

The 11 plants together generate approximately 17.8 GWh of electricity per year. Multiplying this amount of electricity by the Colombian grid emission factor of 0.21742 t CO₂/MWh results in an annual CO₂ savings of about 3,872 t CO₂, and a total of approximately 116,160 t CO₂ over the 30-year lifetime of the plants.

The project owner points out the following special features in the design of the project:

Partnership with a mayor European Utility:

In 2024, Ongresso Energy entered a partnership with a mayor European Utility: in the 50/50 joint venture “Brillo Renovables”, both partners jointly develop, implement, and operate distributed energy and self-generation C&I solar energy assets in Colombia. Both companies take on operational roles in all processes and contribute 50% of the investments each. This ensures the highest standards, financial stability, and effective risk diversification.

Power Purchase Agreement (PPA):

The project company intends to service the issuer’s loan claim with revenues from its power purchase agreements. The agreement with one of Colombia’s largest energy distributors governs the use of the electricity generated by the solar plants and guarantees its offtake for 15 years at a predefined price indexed to Colombian inflation.

The C&I rooftop projects have a 10-year PPA take-or-pay agreement, with one of the main supermarket chains in the Americas. The prices are indexed to the Colombian inflation.

Financing Facility (Loan Structure) with a Swiss Impact Fund:

To finance its project pipeline, Ongresso Energy is partnering with an established Swiss asset manager. Together, they are currently setting up a green bond facility that will provide additional local-currency capital for project implementation. This collaboration is designed to open up an additional financing channel and support the realization of Ongresso’s projects.

Investment Requirement

With a loan of €1,310,900, the Swiss company Ongresso Energy finances the project company “Brillo Renovables” – a 50/50 joint venture between Ongresso Energy and a mayor European Utility – in the form of a shareholder loan. The project company is responsible for the development, construction, ownership, and operation of solar photovoltaic energy plants in Colombia.

The loan will be financed in several tranches. This represents the first tranche, with a funding target of €760,650.

The term of the loan is 3 years and has an annual interest rate of up to 8.5% p.a. for the crowd investors.

The funding threshold for this project is €50,000. If the funding target is not reached, but at least the funding threshold is met, the project owner will still use the investor funds to finance the project company, albeit to a reduced extent.

Bonus interest

In addition to the regular interest rate on the subordinated loan, the issuer grants a bonus interest of 0.50% p.a. The payment of this bonus interest is linked to an exchange rate condition: the relevant rate is the Colombian peso (COP) to euro (EUR) exchange rate at the time of the loan disbursement, which is set once as the reference rate and serves as the basis for comparison throughout the entire term of the loan.

Two weeks before each interest payment date, the current exchange rate is reviewed again. If this rate is at least ten percent below the reference rate established at the time of disbursement, the bonus interest for the respective interest period is granted. If the condition is not met, the bonus interest for that period is forfeited. The assessment is made independently for each interest period, meaning the bonus interest may be paid in some periods but not in others. If payable, the bonus interest is disbursed together with the regular interest payment.

Interest payment

The investor receives an annual interest payment of up to 8.5% p.a. on the outstanding subordinated loan amount, starting from the beginning of the regular interest period. Interest payments are due annually in arrears, with the first payment due 12 months after the start of the regular interest period and the final payment due at the end of the loan term. The amount of the yearly interest payments is detailed in the subordinated loan terms as part of the interest and repayment schedule.

Repayment

Repayment of the subordinated loan is subject to qualified subordination and the pre-insolvency enforcement block and takes place in the amount of the invested loan capital. Repayment is due at maturity, i.e., in a single payment at the end of the term. The detailed repayment schedule is attached to the terms and conditions of the subordinated loan as an interest and repayment schedule.

The repayment of the loan is made from liquid funds that Ongresso Energy receives from the repayment of the shareholder loan by Brillo Renovables. Brillo Renovables in turn generates revenues through the sale of the electricity produced to one of the main Colombian distributors, who sells the electricity to their clients, and to one of the main supermarket chains in the Americas.

"As a co-founder of Ongresso Energy, it is very satisfying to be able to develop and implement projects that have an impact on several levels, including clean energy generation and economic/educational growth in rural areas via a business model that also creates financial sustainability. With the help of the bettervest crowd, we will be able to ensure further scaling of our company and extending the impact we create to more communities. "

The Borrower and Country Profile

Ongresso Energy AG

Kreuzhofstraße 29

9050 Appenzell

Switzerland

Brillo Renovables S.A.S. E.S.P.

Carrera 11 #77a-49, floor 11

Bogotá, Colombia

Contact

https://www.ongresso-energy.com/

contact@ongresso-energy.com

Ongresso Energy AG: Project Owner, Issuer & Borrower

The Swiss company Ongresso Energy was founded in 2020 based on the long-standing entrepreneurial activities of Daniel Breitenmoser and Ulrich Hinterberger, who had already established the consulting firm Ongresso Consulting GmbH in 2010 to support international companies entering Latin America.

Building on his experience in consulting and investment projects in the Global South, as well as a strong regional network, Ulrich Hinterberger founded Ongresso Energy together with Thomas Stetter, Niels van der Wijk and Daniel Breitenmoser. With the vision of becoming the “market leader for scalable decarbonization projects in the Global South,” the company develops renewable energy plants, implements CO₂ compensation programs, and promotes carbon financing in emerging markets.

The headquarters of Ongresso Energy is located in Switzerland. Together with its subsidiary in Colombia, the company currently employs 12 dedicated staff members from four nations.

Achievements of Ongresso Energy:

Funding grant from the REPIC platform for the development of a floating solar power plant in Colombia: REPIC-Projectlink

Credit line from the SECO Start-up Fund for the implementation of photovoltaic projects in Colombia: SECO-Projectlink

Co-owner of a compensation program in Senegal focusing on large-scale battery energy storage systems (BESS): KliK-Projectlink

To finance its project pipeline, Ongresso Energy is working with an established Swiss impact asset manager. Together, they are currently setting up a green bond construction facility that will provide additional capital in local currency for the implementation of projects. This cooperation is intended to open up an additional financing channel and can support the implementation of Ongresso’s projects.

Brillo Renovables S.A.S. E.S.P.:

In 2024, Ongresso Energy entered into a partnership with a major European Utility: In the 50/50 joint venture “Brillo Renovables”, both partners jointly develop, implement, and operate distributed energy and self-generation C&I solar energy assets in Colombia. Both companies take on operational roles in all processes and each bears 50 % of the investments, ensuring highest standards, financial stability, and effective risk diversification.

When making investment decisions, it is advisable to find out about the project location in advance, especially the country in which the project is to be implemented. To get an overview, the following indicators offer a helpful starting point for your own research. The information was taken from the relevant data sources in August 2025 and is published without guarantee.

| INDICATOR | REVIEW COLOMBIA |

| Euler Hermes Ranking | Euler Hermes has rated the risk of non-payment by Colombian companies as “medium risk” and rated Baa2 on a scale from AA to D (source: Euler Hermes Country Risk Map). |

| OECD Classification | The OECD classifies Colombia’s general country risk as 4 on a scale from 0 (low risk) to 7 (high risk) (source: OECD Ranking 2025). |

| Corruption index (Transparency International) | The corruption index, which is published by Transparency International and is measured on a scale from 0 (high levels of corruption) to 100 (no perceived corruption), is 39 in Colombia (source: Transparency International 2024). |

| Commercial Bank Prime Lending Rate | The Commercial Bank Prime Lending Rate shows the average of annualized interest rates that local commercial banks charge their most creditworthy customers for new loans in the local currency. For Colombia, the Commercial Bank Prime Lending Rate was 16.4% in 2024 (source: World Bank Data). |

| Credit score (Moody’s) | Moody’s has rated the creditworthiness of Colombian government bonds at Baa3 on a scale from AAA to D and classified the outlook as stable (source: Trading Economics). |

| Foreign exchange market (Bundesbank) | In the last five years, the foreign exchange price for the euro in Colombia has risen slightly: five years ago the price was 4,216.588 Colombian pesos, a year ago it was 4,406.761, and today (August 2025) the price is 4,699.67 Colombian pesos (source: Bundesbank 2025). |

The second episode of our interview format “5 Questions for Ongresso Energy” with Niels van der Wijk, Managing Director of Ongresso Energy, is now available here.

While Episode 1 is embedded as the main video at the top of the page, you can find Episode 2 in this tab.

The video is in English and comes with German subtitles.

Watch the video interview: Watch now

Additionally, the full interview is also available in written form — both in German and English:

Interview (German): Jetzt lesen

Interview (English): Read now

In this episode, Ongresso Energy answers key questions from the bettervest crowd, including topics such as joint-venture structures, financing, project progress, and the long-term strategy in Colombia.

Key figures

| Borrower | Ongresso Energy AG |

| Investment type | Subordinated loan |

| Loan volume | EUR 760,650 |

| Term | 3 Years |

| Return | up to 8.50% p.a. (bonus interest of up to 0,5% p.a. may apply) |

| Repayment and interest payment | Repayment due at maturity, interest payment in annuity |