Support the construction of three wind turbines in Brandenburg with your investment, which will enable end customers to benefit from clean electricity and save over 20,000 tons of CO2 annually.

Mit dem Laden des Videos akzeptieren Sie die Datenschutzerklärung von YouTube.

Mehr erfahren

Video from June 2023.

The acquisition of these securities is associated with considerable risks and can lead to the complete loss of the assets invested.

UN Sustainable Development Goals

The investment at a glance

This project is a co-funding with the crowdfunding platform GLS Crowd. This means that the project is offered on the platform of bettervest and GLS Crowd in parallel. In total, EUR 5.5 million are to be collected – via bettervest, EUR 1 million will be financed by the crowd.

Project intent

With your investment in NEAG Norddeutsche Energie Invest 2 GmbH, you are indirectly financing the construction of three wind turbines of the German manufacturer eno energy GmbH with a total capacity of 15.5 megawatts in the wind farm "Trebitz 1" in Brandenburg with the aim of generating and marketing renewable electricity from wind power. Directly enable the issuer with capital for the construction of further wind farms. In the coming years, the NEAG Group plans the strategic expansion and diversification of its existing plants.

Sustainable & Economic Effects

Through the generation of renewable energy from wind power and its further expansion, the company contributes significantly to ensuring that people have access to reliable and green electricity. In addition, NEAG Norddeutsche Energie Invest 2 GmbH creates secure jobs and shows annual economic growth through a targeted and long-term investment strategy. Along the entire value chain, the company pays attention to social conventions. In addition, full employment, equal pay and the promotion of further training characterize the Group.

Climate protection

Per year, the three plants achieve a total output of approximately 30,000,000 kilowatt hours. They thus enable an annual saving of over 20,000 tons of CO2. bettervest finances approx. 18.2% of this, which corresponds to 3,636.4 tons of CO2.

Risk reduction measures

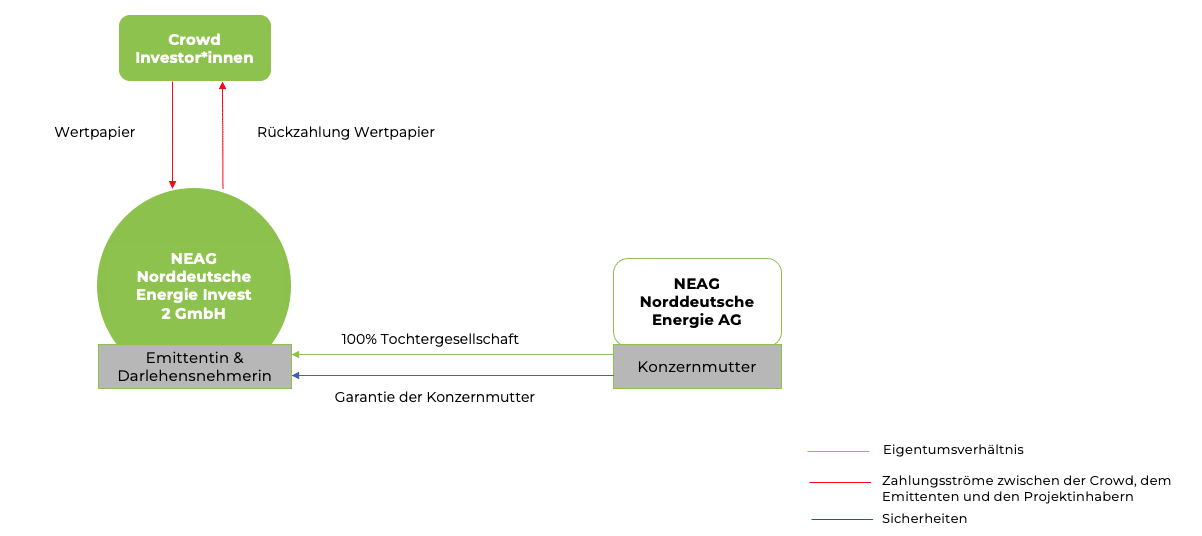

The payments are secured by a guarantee of the parent company NEAG Norddeutsche Energie AG. If the issuer does not meet its obligations to the investors, NEAG Norddeutsche Energie AG will take over the payments for the issuer.

In addition, there is a hedge in the form of a cross default clause. According to the bond conditions, this grants the investors the right to terminate the bond as soon as a company from the NEAG Group does not service an initial claim of 100,000 euros. Details about the arrangement are specified in the bond conditions.

Established, sustainable company

As an owner-managed medium-sized company, the NEAG Group has been building wind turbines in Germany for more than 20 years and, in addition to maintenance and repair, offers supplementary services in the areas of project planning and operational management as well as asset management. Since 2017, NEAG has successfully placed investments in the double-digit million range annually and successfully implemented its energy projects with the help of its capital companies. The NEAG Group operates a total of 106 wind turbines with an output of 314.5 megawatts. Another 35 wind turbines with 182.2 megawatt output are in the concrete planning and construction phase.

Project description

NEAG Group’s goal is to nearly double its portfolio of owned wind farms to more than 1 gigawatt of capacity by 2025. In 2022, the total electricity production amounted to more than 500 gigawatt hours of green electricity, which could supply approximately 125,000 four-person households.

In the Issuer’s “Trebitz 1” project, the construction of three wind turbines of the German manufacturer eno energy GmbH with a total capacity of 15.5 megawatts is planned. The turbines will be built on the territory of the city of Lieberose in the district of Dahme-Spreewald, north of Cottbus in Brandenburg. Approximately 50 wind turbines are already in operation there and another 20 are currently under construction or in planning. The area has average wind speeds of 6.5 m/s, making it a windy location.

With your investment in NEAG Norddeutsche Energie Invest 2 GmbH, you are indirectly financing the construction of three wind turbines in the “Trebitz 1” wind farm in Brandenburg with the aim of generating and marketing renewable electricity from wind power. Directly, you make it possible to provide the issuer with capital for the construction of further wind farms.

In the coming years, the NEAG Group plans the strategic expansion and diversification of its existing plants. The partnership with the wind turbine manufacturer eno energy GmbH, which secures NEAG Norddeutsche Energie AG exclusive access for projects ready for construction and turnkey projects, is of central importance for this.

With its business model, NEAG Norddeutsche Energie Invest 2 GmbH actively contributes to three of the UN’s sustainable development goals („SDGs“):

NEAG Norddeutsche Energie Invest 2 GmbH focuses exclusively on the generation of renewable energy from wind power and its further expansion. The company thus makes a significant contribution to ensuring that people have access to reliable and green electricity (Goal 7).

Through a targeted and long-term investment strategy, the company creates secure jobs and shows annual economic growth. NEAG Norddeutsche Energie Invest 2 GmbH, together with the parent company, benefits from the close relationship with renowned plant manufacturers and service providers throughout Europe and respects social conventions along the entire value chain. In addition, full employment, equal pay, and the promotion of further training characterize the Group (Goal 8).

Clean energy and climate protection are the company’s overriding goals. The reduction of global greenhouse gas emissions can be realized through the expansion of renewable energies. An investment finances the development and construction of wind turbines and thus supports people who are particularly affected by climate change (Goal 13).

Per year, the three plants achieve a total output of approximately 30,000,000 kilowatt hours. They thus enable an annual saving of over 20,000 tons of CO2. The performance data are based on two reliable and independent yield reports. bettervest finances approx. 18.2% of this, which corresponds to 3,636.4 tons of CO2.

Comprehensive environmental and conservation measures:

Avoidance and minimization:

• Shutdown periods for bats

• Reptile and wildlife fence during construction phase

• Reduction of land consumption through use of existing roads

• Installation of sealing systems and catch basins to prevent contamination of groundwater by oils, lubricants, coolants.

Compensation:

• Initial reforestation with forest edge design with species-rich deciduous and mixed forest as well as plants and shrubs

The investment risks associated with this financial product are described in detail in the WIB under point 4 and in the risk notes. With a view to assessing and limiting the risks for investors, the Issuer draws attention to the following special features in the design of the project:

1) Guarantee of the parent company

The payments are secured by a guarantee of the parent company NEAG Norddeutsche Energie AG. If the issuer does not meet its obligations to the investors, NEAG Norddeutsche Energie AG will assume the payments for the issuer.

2) Cross default clause

In addition, there is a hedge in the form of a cross-default clause. According to the bond conditions, this grants the investors the right to terminate the bond as soon as a company from the NEAG Group does not service an initial claim of 100,000 euros. Details about the structure are specified in the bond conditions.

The figures are not from the individual financial statements of the issuer, but from the consolidated financial statements including the currently seven project companies with 26 wind turbines (WTG). Of the funds from the security, approx. EUR 3 million will be used for the “Trebitz 1” project. These seven project companies are thus fully financed. Proceeds of less than EUR 3 million would be compensated by funds from NEAG Norddeutsche Energie AG and proceeds of more than EUR 3 million would be used for the construction of additional WTGs. The repayment in 2027 will be made from the increase in sales, annual result, and operating income or from the pro rata borrowing.

NEAG Norddeutsche Energie Invest 2 GmbH (hereinafter referred to as Invest 2) as the issuer is a wholly owned subsidiary of NEAG Norddeutsche Energie AG. In the form of a holding company, Invest 2 serves as an investment vehicle for the financing of new wind power plants and is also responsible for operational management.

Investment requirement

The crowdfunding campaign aims to finance EUR 5,500,000 (including fees). This sum will be co-financed by the two platforms bettervest and GLS Crowd. Via bettervest, EUR 1 million is to be collected. The minimum investment amount for this project is 1,000 EUR.

Of the funds raised from the security, approximately EUR 3 million will be used for the “Trebitz 1” project, which involves the installation of three wind turbines from the German manufacturer eno energy GmbH with a total capacity of 15.5 megawatts. Proceeds of less than EUR 3 million would be compensated by funds from NEAG Norddeutsche Energie AG and proceeds of more than EUR 3 million would be used for the construction of additional WTGs.

Repayment

The term of the loan is 3.75 years and has an annual interest rate of 5.5% p.a. for the crowd-investors. The interest is due annually one banking day after 31.03. (for the first time in 2024). The first interest payment is due on 01.04.2024.

This is a bullet redemption on 31.03.2027 or in a redemption window of 3 months before or after this date (see § 3.2 Bond Conditions).

The repayment is made once a year and includes only interest in the first three years (2024, 2025, and 2026) (bullet repayment). In year 4 (2027), the repayment of principal and interest takes place.

At the end of the term, the refinancing or sale of the wind farm “Trebitz 1” or other plants of the issuer is intended. The repayment in 2027 will therefore be made from the increase in sales revenues, net income, and operating cash inflows or from the pro rata raising of debt capital. In addition to the repayment to the financing partners and the investors of this bond, the proceeds are to be used for the construction of further wind farms.

Example repayment plan

Assuming you issue a loan of EUR 10,000.00 at 5.50% interest p.a. for the term of 3.75 years at the start of the project on June 22, 2023, your payment schedule for this loan is as follows:

Please note that before interest is paid out, taxes are usually still deducted by your custodian bank.

In the Issuer’s project “Trebitz 1”, the construction of three wind turbines of the German manufacturer eno energy GmbH with a total capacity of 15.5 megawatts is planned. The turbines will be built on the territory of the town of Lieberose in the district of Dahme-Spreewald, north of Cottbus in Brandenburg. Approximately 50 wind turbines are already in operation on the site and another 20 are currently under construction or in planning. The area has average wind speeds of 6.5 m/s, making it a windy location.

Copyright: Paul Langrock. Windkraftanlage ENO126.

Copyright: Paul Langrock. Windkraftanlage ENO126.

The three wind turbines of “Trebitz 1” will be equipped twice with the highly efficient eno160 turbines and once with the eno126 turbine. On average, one eno160 turbine can supply 6,100 households with green electricity per year at average wind speeds.

The cooperation partner eno energy GmbH has more than 20 years of experience as a general contractor in the field of project planning and construction of wind turbines and wind farms.

The eno 160 wind turbine is the flagship of the German manufacturer eno energy GmbH from Rostock. It convinces with 20,106 m² of swept rotor area, as well as hub heights of 100 m, 120 m, 150 m and 165 m to cover the respective site specifics. The turbine is based on professional engineering work over many years as well as many years of experience in order to achieve an optimal yield with reduced mechanical loads at the same time. The combination of innovative solutions with excellent technical availability makes the eno160 the first choice for highest economic efficiency.

1. How does an investment in the bond work?

As with previous projects, you start the investment via the button

“Invest now” button. The minimum investment amount for securities is higher than for subordinated loans because the costs for the issuer are higher. For NEAG’s current project, the amount is 1,000 euros.

In the investment process, you will be asked to deposit your securities account data. Please make sure that the spelling is correct and remember to enter the BLZ and not the BIC. Unfortunately, the following banks cannot be used as a securities account for a subscription in a security on bettervest.com: Augsburger Aktienbank, Umweltbank, Frankfurter Fondsbank (FIL Fondsbank), Fondsdepotbank, Dekabank, Union Investment, trade republic.

By clicking on the button “Submit subscription declaration subject to payment”, your subscription will be final and subject to payment.

Shortly after submitting your subscription, you will receive a separate e-mail with the further steps necessary to complete the submission of your subscription – this is, firstly, the transfer of the investment amount to the paying agent, Bankhaus Gebrüder Martin, and the identification.

Transfer the indicated amount with the indicated purpose to the indicated current account.

Identification of your person is a requirement by law. You will receive a link for this purpose in the above-mentioned e-mail after submitting your subscription. The identification takes place at our partner of Deutsche Post and takes about 10min. There are no costs for you with this.

Info: For future subscriptions a new identification is only necessary if your address or name changes.

The security is automatically booked into your securities account via bettervest.com and you do not need to contact your depository bank for this.

The distribution of interest or redemption is made via the paying agent to the reference account of your securities account.

2. Why can’t I see the bond in my securities account yet?

The security will be booked by the paying agent “Bankhaus Gebrüder Martin”. You do not need to contact your depository bank for this. The security will not be booked into your securities account until the investment is revocation-free. To do this, you must have transferred the investment amount and identified yourself via the PostIDENT procedure. We will then send the data to Bankhaus Gebrüder Martin, who will then make the entry into your securities account.

The duration of the complete process may take several weeks and also depends on how quickly you perform the required steps mentioned above, such as online identification and transfer of the amount.

3. Why has the guarantee only been concluded between NEAG Norddeutsche Energie AG (guarantor) and GLS Crowdfunding GmbH (platform operator & co-financier of the project)?

The guarantee cannot be issued directly to the crowd. Therefore, the guarantee is a genuine contract in favor of third parties (§ 328 BGB) in favor of each bondholder (“beneficiary”). The guarantee applies irrespective of whether the beneficiary (investor) has subscribed to the bond via the GLS Crowd platform or has become the holder of the bond by other means (see §1 of the guarantee).

This means that it also applies to bondholders who subscribed via the bettervest platform. This has been confirmed to us by a lawyer:

We are pleased to confirm that the bondholders of the bond “Unternehmensanleihe_NEAG_Invest2_2023_2027” can assert claims under the guarantee against the guarantor without the involvement of GLS Crowdfunding GmbH according to the provided guarantee conditions if the requirements under the guarantee are met. This claim of the bondholders under the guarantee also exists if GLS Crowdfunding GmbH is liquidated or becomes insolvent.

Dear investors,

Wind and sun are the most important energy sources of the future and, together with storage technologies, are gradually replacing fossil energy generation. As NEAG Norddeutsche Energie AG, we are part of the energy turnaround and are bringing more speed to the construction of new wind power plants.

In this way, we are making a significant contribution to more independence for our energy supply. We invest in sustainable energy projects that generate continuous and plannable income. One of our new wind farms is the "Trebitz 1" project with three wind turbines in Brandenburg, which is to be financed by NEAG Norddeutsche Energie Invest 2 GmbH as issuer of the security. At the same time, the issuer owns other wind farms that are already in operation and generating income.

Through an innovative design - with a guarantee of the NEAG Group and an integrated cross default clause - the investment risk is to be significantly reduced. The commissioning of the new wind power plants is planned for mid-2024. We would like to realize an effective expansion of renewable energies together and rely on our experience and your investment.

The Borrower and Country Profile

NEAG Norddeutsche Energie Invest 2 GmbH

Am Kaiserkai 69

20457 Hamburg

NEAG Norddeutsche Energie AG

Am Kaiserkai 69

20457 Hamburg

Contact:

+49 40 8000 845 48

info@ne-ag.com

https://ne-ag.com/

NEAG Group

The history of the NEAG Group includes the history of today’s exclusive cooperation partner, eno energy GmbH. As an owner-managed medium-sized company, it has been building wind turbines in Germany for more than 20 years and, in addition to maintenance and repair, offers supplementary services in the areas of project planning and operational management as well as asset management. In order to increase earnings and thus to be able to accelerate the energy turnaround, Karsten Porm as managing director decided not only to realize and sell wind turbines for third parties, but to hold them in the portfolio in NEAG Norddeutsche Energie AG, which was founded in 2016 as the holding company of a group of companies as well as the parent company of the issuer.

Since 2017, NEAG has successfully placed investments in the double-digit million range every year and successfully implemented its energy projects with the help of its capital companies.

Nik Piening and Dr. Steffen Hundt jointly form the Executive Board of NEAG Norddeutsche Energie AG. The sole shareholder of NEAG AG as a holding company is Ann Kruth, the partner of Karsten Porm. The latter acts as Chairman of the Supervisory Board there. The NEAG Group operates a total of 106 wind turbines with an output of 314.5 megawatts. A further 35 wind turbines with an output of 182.2 megawatts are in the concrete planning and construction phase.

NEAG Norddeutsche Energie AG and its subsidiaries are based in the Port of Hamburg with additional offices in Rostock.

NEAG Norddeutsche Energie AG – Group Parent & Guarantor

NEAG Norddeutsche Energie AG acts as the holding company and parent company within the NEAG Group. In this project, it also acts as guarantor for the issuer NEAG Norddeutsche Energie Invest 2 GmbH.

The activities of the AG are divided into the following business areas:

• Asset and portfolio management

• Transaction management

• Project financing

• Accounting

NEAG Norddeutsche Energie AG’s teams cover key competencies in asset management, the initiation and structuring of project financing and the establishment of alternative investment vehicles for institutional investors.

Further strengths lie in the lean internal structures and concentration on core competencies through close cooperation with eno energy GmbH and other renowned partners and service providers (e.g. for technical and commercial management).

NEAG Norddeutsche Energie Invest 2 GmbH – Issuer & Provider of the Bond

NEAG Norddeutsche Energie Invest 2 GmbH was founded in 2016 as a wholly owned subsidiary of NEAG. It is the issuer of the bond and bundles wind power plants with a partial volume of currently more than 48 megawatts of capacity in the group – with the realization of “Trebitz 1”, the issuer then has a total capacity of more than 63 megawatts.

As a holding company, NEAG Norddeutsche Energie Invest 2 GmbH has no employees of its own. This means that business operations are carried out by employees of the parent company.

Management

Nik M. Piening has been a member of the Management Board of NEAG Norddeutsche Energie AG since October 1, 2022. Nik M. Piening looks back on more than 10 years of experience in the field of renewable energies.

He is responsible for the operative business, project development, finance, and accounting as well as risk management of the NEAG Group.

An experienced team with extensive know-how in the field of renewable energies as well as the long-term partnerships contribute significantly to the success of the company. This lean corporate structure is possible due to the established partnership with the eno Group, which, as a plant manufacturer, also provides services for NEAG Norddeutsche Energie AG in the areas of project development, maintenance as well as technical and commercial management.

NEAG Norddeutsche Energie AG holds further holding companies in addition to the issuer, in which project companies with wind power plants also exist.

The following diagram shows the structure of NEAG Norddeutsche Energie AG in simplified form with a focus on the issuer. It also explains the relationship with its respective subsidiaries. A complete organization chart with all wholly-owned subsidiaries of the NEAG Group is available in the download area.

When making investment decisions, it is advisable to find out in advance about the project location, in particular the country in which the project will be implemented. To get an overview, the following indicators are a helpful starting point for independent research. The information was retrieved from the relevant data sources in June 2023 and is published without guarantee.

| INDICATOR | RATING GERMANY |

|---|---|

| Euler Hermes Ranking | Euler Hermes has rated the risk of non-payment by German companies as “low risk” and rated it AA1 on a scale from AA to D (Sources: Euler Hermes Country Risk Map) |

| Corruption Index (Transparency International) | The Corruption Index, published by Transparency International and measured on a basis of 0 (high level of corruption) – 100 (no perceived corruption), is 79 in Germany (Source: Transparency International 2022). |

| Commercial Bank Prime Lending Rate | The Commercial Bank Prime Lending Rate shows the average annualized interest rates charged by local commercial banks to their most creditworthy customers for new loans in the local currency. In Germany, the Commercial Bank Prime Lending Rate was 5.24% in April 2023 (Source: Trading Economics 2023). |

| Credit Rating (Moody’s) | Moody’s has rated the creditworthiness of German government bonds as Aaa on a scale from AAA to D, thus classifying them as “prime” (Source: Finanzagentur 2023) |

Key figures

| Issuer |

NEAG Norddeutsche Energie Invest 2 GmbH

|

| Type of Investment | Bearer Bond (non-subordinated) |

| Volume | EUR 5.500.000 |

| Term | 3.75 years |

| Interest Rate | 5.5% p.a. |

| Available from | 22.06.2023 |

| Interest Date | Interest is due annually one banking day after March 31 (first time in 2024). The first interest payment is due on 01.04.2024. |

| Repayment | final maturity on March 31, 2027 or in a repayment window of 3 months before or after this date (see § 3.2 Bond Conditions) |

| Minimum Investment Amount | 1,000.00 EUR |

| Denomination | 1,000.00 EUR |

| Tradability | A stock exchange listing is not planned. |