Bring clean electricity from environmentally friendly river hydropower to Kenya for businesses and homes, avoiding 1,000 tons of CO2 per year!

Mit dem Laden des Videos akzeptieren Sie die Datenschutzerklärung von YouTube.

Mehr erfahren

Video from March 2023. You can select German subtitles in the lower right-hand corner of the video.

The acquisition of this investment is associated with considerable risks and may lead to the complete loss of the invested assets.

UN Sustainable Development Goals (SDGs)

The investment at a glance

Project intent

The Belgian company Hydrobox NV (Hydrobox) will use the loan to finance the construction of two environmentally friendly small hydropower stations: - Kiamahindu, a 110 kW small hydropower station - Gitwamba, a 140 kW hybrid hydro and solar power station The on-site works will be carried out by Hydrobox Kenya and the power stations will be owned by two Kenyan subsidiaries, Kiamahindu Power Station Ltd and Gitwamba Power Station Ltd. The hydropower stations make use of the run-of-river principle which is an efficient and environmentally friendly way to produce reliable power 24/7. Standardization and the use of existing infrastructure allows Hydrobox to reduce costs and production time, and the "smart" features allow remote operation and monitoring, which is especially beneficial in rural areas. Hydrobox is the developer of the hydro power stations. The Hydrobox business model follows the anchor-business-household customer model (ABC model). In this model, a tea/coffee factory, farm or mobile telco customer with a 24/7 power need (Anchor) consumes over 40-60% of the power that Hydrobox produces at a given site. This ensures a stable revenue for their hydro power stations to pay back the loans. This allows Hydrobox to sell the rest of the power to households, schools, hospitals, and smaller businesses against an affordable tariff to ensure that the surrounding community also benefits from green and stable electricity. Finally, it is important to note that the company also has off-takers with a flexible energy need (cold stores, battery charging for e-bikes, data mining). They can absorb excess power whenever available and function as a buyer of last resort, which ensures that up to 90% of the power produced is consumed.

Sustainable & social impact

By switching to sustainable hydropower, Hydrobox's customers receive cheaper and cleaner electricity, as well as a reliable and stable supply of electricity. This is critical for rural businesses, hospitals and schools operating in areas where there is no stable power supply from the national grid. This can greatly strengthen the economic performance of local businesses, as they will no longer be affected by power outages and will not have to rely on expensive diesel generators. The project will enable 300 households (1500 end-users) to enjoy a more affordable and reliable electricity supply, thereby raising their standard of living. In addition, the project is expected to create 10 new jobs and another 40 indirect jobs from local businesses.

Climate protection

The implementation of the project will mitigate climate change and has a low impact on the environment. The two hydropower stations will save approximately 1,000 tons of CO2 annually. In addition, the stations use the run-of-river principle to generate electricity, which has a limited environmental footprint compared to large traditional hydropower plants. The run-of-river power stations uses only a portion of the river water and does not require a dam or reservoir. This is important because large reservoirs can have negative impacts on forests, wildlife habitats, and agricultural land. A detailed environmental and social impact assessment is conducted at the start of each project, and the company has a system in place to monitor environmental and social impacts and subjects the project to annual environmental audits.

Early bird bonus

All investors* investing up to and including 02.05.2023 will receive an early bird bonus of 1% p.a.. The interest rate thus increases to 7.5% p.a. in total.

Podcast by Hydrobox

Hydrobox has launched its own podcast series to share its passion for Africa, social entrepreneurship and renewable energy as levers for a better world. Together we are stronger - Tuko Pamoja.

Risk reduction measures

In order to be able to incorporate risk-mitigating measures despite subordinated loans, three special purpose vehicles are used: The German Afrika Emissions 1 UG (haftungsbeschränkt) (which is independent of the local project owners) takes the collected capital from the crowd and forwards it as a secured loan to the two Kenyan companies Gitwamba Power Station Limited and Kiamahindu Power Station Limited. In return, the German Afrika Emissions 1 UG (haftungsbeschränkt) is pledged all assets (85% of the funding amount), such as the turbines to be financed, until the loan is repaid in full. In addition, the German special purpose vehicle Afrika Emissions 1 UG (haftungsbeschränkt) will be provided with a liquidity reserve of 5% of the net proceeds (collected through crowdfunding). EUR 25,000 of this serves as a liquidity buffer in order to be able to intervene or even take legal action in the event of any repayment problems on the part of the two project companies. The remaining liquidity reserve is reserved for short-term declines in performance. The parent company Hydrobox NV in Belgium (HBNV) has confirmed its firm intention to support both Gitwamba Power Station Limited and Kiamahindu Power Station Limited (the project companies) up to the total amount of the crowdfunded loan. This is done by means of a guarantee for 100% of the loan amount in favour of the special purpose vehicle Afrika Emissions 1 UG (haftungsbeschränkt). The project companies Gitwamba Power Station Limited and Kiamahindu Power Station Limited will receive equity from the Belgian parent company Hydrobox NV amounting to EUR 500,000 or 29% of the funding sum. Thanks to proceeds from subsidies amounting to approximately EUR 255,000, the debt financing share of the entire project amounts to a sustainable sum of EUR 983,675 or 54% of the funding sum. The two Kenyan project companies, Gitwamba Power Station Limited and Kiamahindu Power Station Limited, take out comprehensive insurance cover for the hydropower plants, which in addition to the usual risks (fire protection, theft, etc.) also covers claims for damages and loss of income in the event of machinery damage. Further information can be found in the text section under "Risk reduction measures".

Established, sustainable company

Hydrobox NV was founded in 2018 in Brussels, Belgium. The company develops innovative, standardized containerized hydropower plants and is dedicated to providing reliable, sustainable and affordable access to energy, especially in rural areas of Kenya. Through its local subsidiaries, Hydrobox currently operates 3 hydropower plants with a total capacity of 600 kW in Murang'a County, Kenya, providing access to electricity for over 4,000 end-users (800 households). In addition to this current project, Hydrobox has 4 other projects in development that will add an additional 1.6 megawatts to its existing operations over the next 24 months. The company is a partnership between a Belgian and Kenyan entrepreneur and is deeply embedded in the local community, where it works with other organizations to bring about positive change. The company maintains good relationships with government stakeholders and since 2018 has had a strategic partnership with NETFUND (National Environment Trust Fund), an agency of the Ministry of Environment and Forestry, to pilot innovative energy projects in the country, mainly to promote productive uptake of electricity by female and youth led businesses. Hydrobox received the 2019 EDF Pulse Africa Award for the most innovative off-grid power generation model. In addition, Hydrobox was awarded the 2019 Most Innovative Company Award by Jungle Bells (Euronext) for its innovation in providing scalable sustainable energy solutions. In 2020, the company was included in the list of 100 Top Startups (SET100) in the Start Up Energy Transition Awards and was awarded the “Efficient Solution” label by the Solar Impulse Foundation and in 2022 it won together with NETFUND the P4G’s 2022 State-of-the-Art Partnership of the Year award.

Project description

Access to energy is the key prerequisite for sustainable development and growth of nations. Sustainable economic growth in turn leads to an improvement in the quality of life of the population. On the African continent, Kenya is one of the fastest developing countries and a major hub in East Africa. Kenya recorded economic growth of 7.5 % in 2021, according to the Corona Year 2020, and growth of 5.5 % was projected for 2022.

Nevertheless, there is a major energy problem in Kenya that is hampering the country’s further development: nearly 40 % of the rural population still lacks access to energy, and those who are connected to the grid complain of poor power reliability and high electricity prices. This is also felt by businesses, which have to contend with production losses due to power outages and with enormous costs. Small and medium-sized enterprises in particular are at the heart of the Kenyan economy and provide 80% of the new jobs created each year, thus ensuring stability and growth in the country. In order to remain competitive, many companies are therefore looking for alternatives to the national electricity supplier and opting for a clean and reliable power supply through renewable energies.

This is where Belgian-Kenyan company Hydrobox NV (Hydrobox) comes in, with a mission to provide reliable, sustainable and affordable access to energy. Hydrobox relies on environmentally friendly run-of-river hydroelectric systems, which is more efficient than many other renewable energy sources because it is based on a resource that is available 24/7 (running water).

The company has developed a standardized and smart hydropower plant that is deployed in a decentralized manner on rivers and can be operated and monitored remotely. In addition, the power plants rely on the “run-of-river” principle to generate electricity, which does not require a dam and minimizes the impact on nature.

Through its business model, Hydrobox actively contributes to four of the UN’s SDGs („sustainable development goals“):

By installing the hydropower facilities and implementing an innovative business model, Hydrobox’s customers receive clean, affordable and reliable electricity, which is a cost-effective alternative compared to the Kenyan electricity grid or diesel generators (Goal 7.2). The combination of Anchor, Business and Household customers allows Hydrobox to comfortable repay commercial loans and charge an affordable tariff to its customers.

Hydrobox’s customers are small and medium enterprises operating in various sectors such as agriculture, more specifically tea, coffee and maize processing, or IT. Expensive electricity, frequent power outages and poor power quality are recurring problems. Thus, a constant and reliable source of electricity that is available 24/7 can have an indirect impact on the economic, sustainable growth of businesses (Objective 8.1).

Hydrobox’s hydropower stations can be deployed in a decentralized manner, making them particularly beneficial in rural areas where infrastructure is weak. The innovative stations, which are equipped with smart sensors, can also be operated and monitored remotely. The smart system also enables “predictive maintenance”, which reduces costs and increases the lifespan of the stations (Objective 9.4).

Hydrobox’s business model addresses climate change (Goal 13), as the hydropower stations replace diesel generators and grid electricity, and provide a significant reduction in CO2 emissions.

By switching to green hydroelectric power, Hydrobox’s customers increase their environmental sustainability by reducing their CO2 emissions. The hydropower stations generate approximately 1,746,000 kWh of electricity annually, resulting in CO2 savings of approximately 1,000 tons per year at a rate of 0,59 tCO2/MWh.

Over the life of the loan, this results in CO2 savings of 8,000 metric tons, and over the life of the hydropower station of approximately 25 years, 25,000 metric tons of CO2 can be avoided.

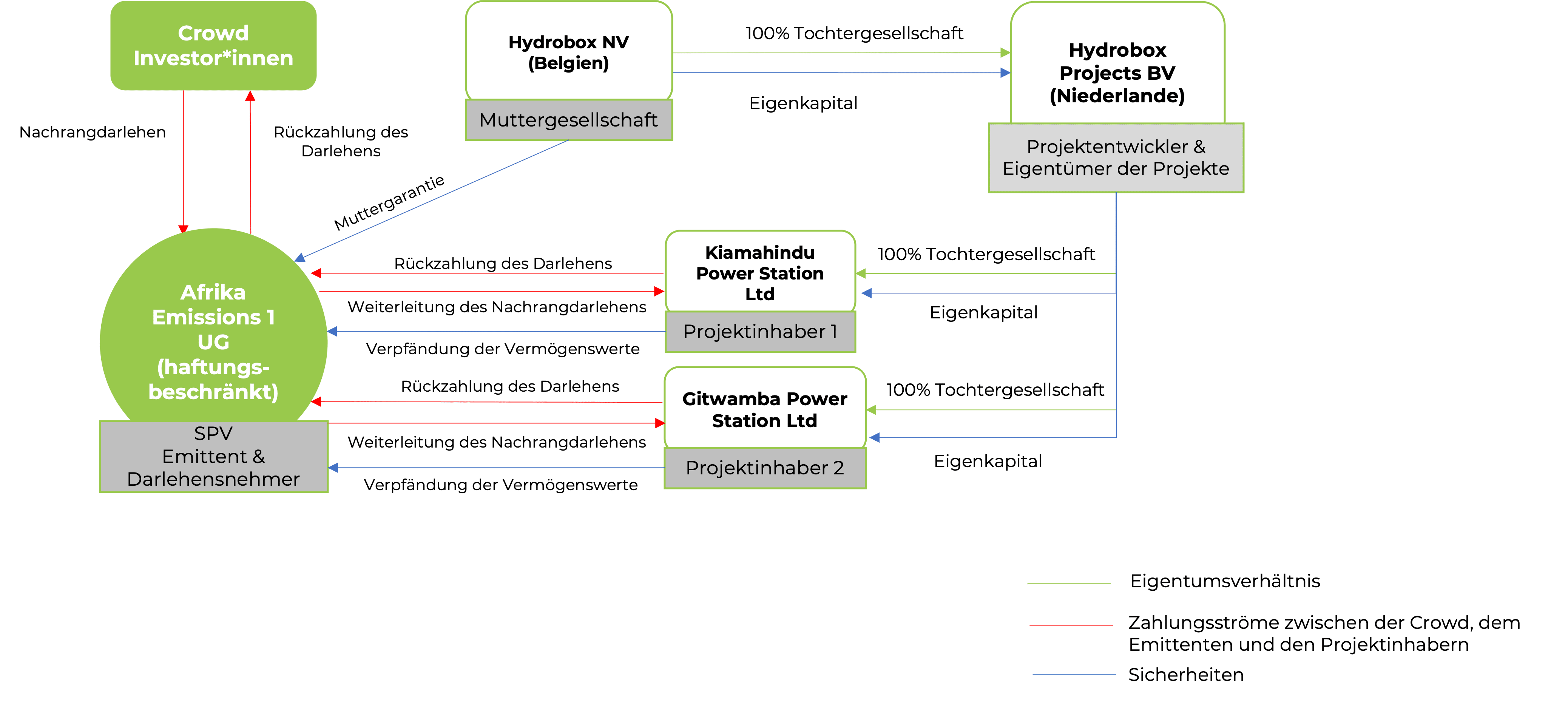

The investment risks associated with the subordinated loan are described in detail in the VIB under item 5 and in the risk notes. The measures taken to mitigate the risks are explained in this section:

1) Dual corporate structure

Three special purpose vehicles (SPVs) are used for the crowdfunding campaign:

(a) The German SPV Afrika Emissions 1 UG (haftungsbeschränkt) acts as borrower and issuer and is based in Germany. It forwards the capital collected from the crowd as a secured project loan to two Kenyan project companies, Gitwamba Power Station Limited and Kiamahindu Power Station Limited. In return, all assets (see point 5 below) are pledged to the German special purpose vehicle until the loan is repaid in full. The shareholders and managing directors of Afrika Emissions 1 UG (haftungsbeschränkt) are independent of the project companies and Hydrobox. In addition, the special purpose vehicle will be provided with a liquidity buffer (see further below under item 4).

b) The two Kenyan project companies, Gitwamba Power Station Limited and Kiamahindu Power Station Limited, jointly act as borrowers vis-à-vis the German special purpose vehicle Afrika Emissions 1 UG (haftungsbeschränkt). During the entire term of the loan, they remain the collective owners of the project assets financed and generated with the project loan. These assets are pledged to the special purpose vehicle Afrika Emissions 1 UG (haftungsbeschränkt).

2) Guarantee of the financially strong parent company in Belgium

The parent company Hydrobox NV in Belgium (HBNV) has confirmed its firm intention to support both Gitwamba Power Station Limited and Kiamahindu Power Station Limited (the project companies) up to the total amount of the crowdfunded loan. This is done by means of a guarantee for 100% of the loan amount in favour of the special purpose vehicle Afrika Emissions 1 UG (haftungsbeschränkt).

In addition, the past shows that the shareholders of the parent company Hydrobox NV have repeatedly provided the company with equity, which further confirms the interest of the shareholders in the long-term success of the business. HBNV had a gearing ratio of 1.17 at the end of 2021, which corresponds to an equity ratio of 46%. Additional capital in the high six figures was injected by shareholders at the end of July 2022.

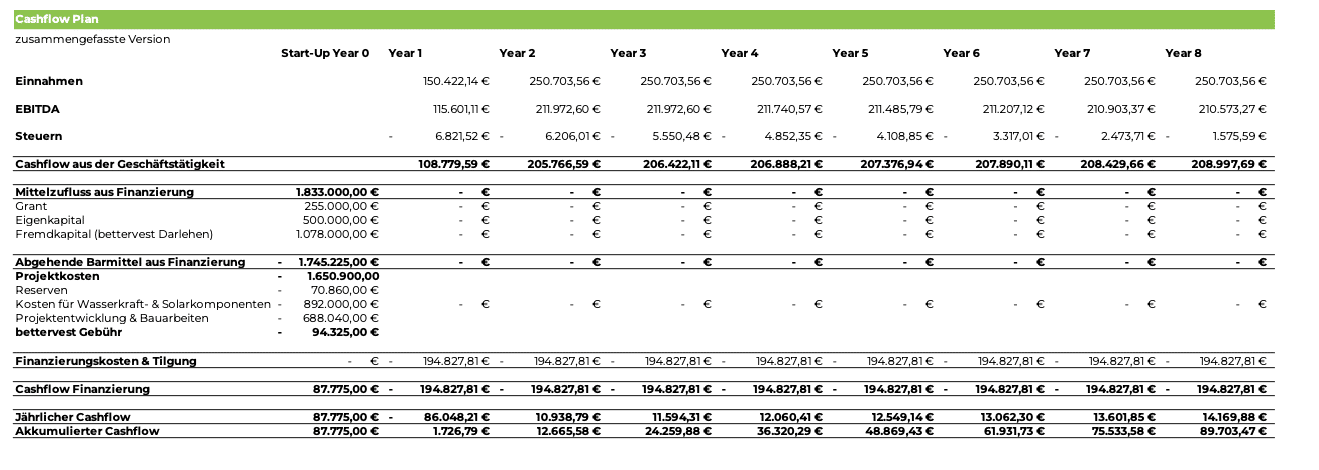

3) Relatively low share of debt financing

The project companies Gitwamba Power Station Limited and Kiamahindu Power Station Limited receive equity financing from the Belgian parent company Hydrobox NV amounting to almost EUR 500,000 or 46% of the funding amount. Thanks to proceeds from subsidies of approximately EUR 255,000, the debt financing portion of the entire project amounts to a sustainable sum of EUR 983,675 or 54%.

4) Liquidity Provision/Provisions

a) Liquidity reserve

In order to strengthen the project liquidity, a liquidity reserve amounting to 5% of the net proceeds (i.e. a maximum of 49,184 EUR) will be collected in the course of the crowdfunding, to which the German special purpose vehicle Afrika Emissions 1 UG (haftungsbeschränkt) is entitled. EUR 25,000 of this serves as a liquidity buffer for the special purpose vehicle in order to be able to intervene or even take legal action in the event of any repayment problems on the part of the two project companies. The remaining liquidity reserve is reserved for short-term declines in performance. After two years, this reserve will go to the project companies.

b) Cross-liquidity clause

In addition, the investors benefit from a so-called “cross-liquidity clause”. This mechanism is created between the two project companies and allows for cash to be shared between the two legally separate entities to counteract potential liquidity shortages.

5) Pledge of project assets

In addition, the power purchase agreements, all receivables and the corresponding assets (turbines, associated distribution networks, etc.) are pledged to the German special purpose entity Afrika Emissions 1 UG (haftungsbeschränkt) to secure the repayment claim. The value of the assets including reserves amounts to EUR 920,000 and covers 85% of the funding amount.

6) Insurance cover

The two Kenyan project companies, Gitwamba Power Station Limited and Kiamahindu Power Station Limited, take out comprehensive insurance cover for the hydropower stations which, in addition to the usual risks (fire protection, theft, etc.), also covers claims for damages and loss of earnings in the event of damage to machinery.

Financing need

The total project cost is €1.68 million and includes the construction of the hydropower stations, project development costs, civil works and grid costs for electricity distribution. The project is partly financed by a grant and own funds from the two Kenyan project companies (subsidiaries of Hydrobox).

By means of this crowdfunding campaign, the remaining 1,078,000 euros (including fees) will be financed. The loan will cover the costs of turbine design and manufacture, project management, required licenses, civil works (surveying, excavation, construction of intake, forebay and penstock) and electrical works (step-up transformer, distribution boxes, power lines) and transportation costs.

The term of the loan is 8 years and has an annual interest rate of 6.5% p.a. for the crowd-investors. Repayment takes place once a year and includes repayment and interest (annuity repayment). Investors who invest in the project within the first four weeks receive an additional early bird bonus of 1% p.a. (i.e. a total of 7,5% p.a.). The funding threshold for this project is €50,000. If only this amount is reached, the local project companies will cover the difference with additional required debt capital from their parent company Hydrobox BV and carry out the project.

Repayment

The repayments to the investors are to be serviced from funds generated from the sale of the generated electricity through installment payments and concluded power purchase agreements (PPAs) with customers.

The hydropower stations will supply electricity to 300 households (1500 end users), sixteen schools, four hospitals and twelve businesses through two mini-grids. The largest consumers are presented below:

Kiriti Tea Factory is a tea factory developed by and for local tea farmers. It is a group of passionate tea farmers in the foothills of the Aberdare Mountains in central Kenya who have extensive experience in the tea sector. With hundreds of affiliated tea farmers and over 600 hectares of mature highland tea, the factory is very successful and on its way to revolutionizing the Kenyan tea industry.

Emashu LTD is a maize miller in Baricho town. The company requires a load of 80 kW (day and night) which is an ideal anchor customer for Hydrobox. Emashu wants to double its production capacity and is now constructing a second miller next to it’s current one. Emashu has signed an LOI and we Hydrobox is now the process of developing a PPA.

Jay Shree – a farm in Baricho, Kirinyaga County. The farm grows subsistence crops as well as coffee and has signed a power purchasing agreement with a dedicated load of 20kW.

BRCK and Gridless are the creation of serial social entrepreneur Erik Hersman. BRCK provides wi-fi internet in rural areas for the bottom of the pyramid by having customers pay with their time (e.g. through participation in surveys) instead of their money. From running their internet hubs in rural areas, Erik identified the existence of excess energy in rural minigrids. He then developed Gridless which operates as a buyer of last resort for renewable minigrids. They have a flexible demand used for data & blockchain. Hydrobox has a USD PPA with Gridless with a floor price plus a variable upside based on the revenue generated by Gridless.

Safaricom is Kenya’s leading mobile telecommunications company. Safaricom provides 4G Internet, which is now available in over 30 counties in Kenya. Safaricom has already deployed 635 sites, approaching 1,000 4G stations. Safaricom needs reliable power for its transmission towers in the region where Hydrobox operates. The company has also set a goal of sourcing electricity from 100% renewable sources by 2030.

The sixteen schools and four hospitals in the rural area have smaller needs (5-20 kW) but a very large impact: access to Hydrobox’s energy allows them to provide services without interruptions, reduce operating costs, and make the switch to renewable energy.

The 300 households (1500 end users) are customers for whom the national grid is not accessible, not reliable enough or not affordable due to high connection fees.

Reliability and climate adaptability

The two hydropower plants can produce stable electricity all year round (round the clock).

Kiamahindu:

The Kiamahindu power plant builds on existing infrastructure to reduce project development costs.

The Kiamahindu power plant uses three environmentally friendly, series-connected turbines from the manufacturer Turbulent, each with an output of 37 kW (total output 110 kW). These can generate electricity from a river with a low head (the difference in height between the point of water intake and the turbine), which is common in these areas in Kenya. The project was designed based on river flow, which is available 90% of the time, ensuring stable power generation throughout the year.

Gitwamba:

The Gitwamba power plant was designed as a hybrid hydro and solar power plant. This is because the flow rate of the river is very different in the dry and rainy seasons. The solar system provides additional power in the dry season, while the hydro power plant provides additional capacity in the rainy season, giving customers a stable base load day and night. This combines the best of both worlds and mitigates the effects of climate change, which makes the seasons more unpredictable.

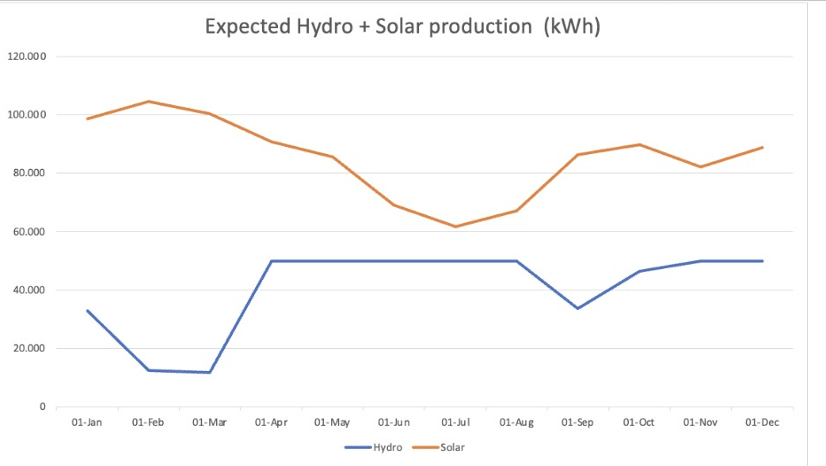

Figure 2: Projected output of the Gitwamba power plant from solar and hydro power over the year.

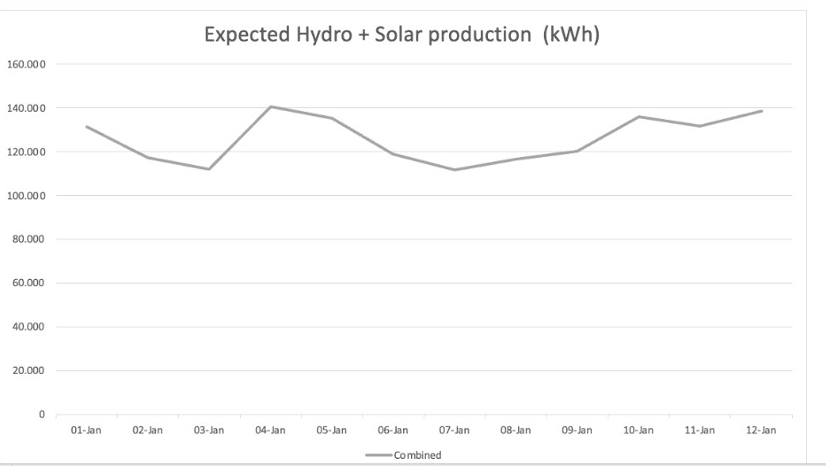

Figure 3: Projected combined electricity generation of the Gitwamba power plant throughout the year.

The Gitwamba hydropower plant has a capacity of 140 kW. The hydropower component has an installed capacity of 90 kW at a design flow of 0.65 m3/s. The solar component has an installed capacity of 85 kWp and a capacity of 60 KVA (50 kW).

This combination provides stable electrical output throughout the year, regardless of the dry or rainy season.

How does a hydropower plant work?

A hydroelectric power plant harnesses the flow of running water. The Federal Office of Economics and Climate Protection explains the principle as follows: “The kinetic and potential energy of a water flow is converted by a turbine wheel into mechanical rotational energy that can be used to drive machines or generators.” Two main parameters determine the amount of electricity generated: the water column (head), which is the difference in elevation between the point of water extraction and the turbine, and the flow rate, which is the amount of water flowing through the river, measured in m3/s.

What are the different types of hydropower plants?

One can classify hydropower plants according to different criteria. A basic division can be made by configuration: a plant with a dam and reservoir or without. Hydropower plants with a dam and a reservoir can store water for short or long periods to meet peak demand. Hydropower plants without dams and reservoirs (“run-of-river”) provide smaller amounts of electricity and are usually designed to operate in a river without interfering with its flow. For this reason, small-scale hydropower is considered a more environmentally friendly option because it minimizes interference with the natural environment.

Advantages of hydropower over others

In areas where there is a suitable river, small-scale hydropower is a very interesting alternative to solar and wind power because it is available 24/7. This allows hydropower plants to supply electricity continuously without the need to store electricity in batteries, which is costly and often technically impossible for industrial users such as factories or power-intensive IT applications. The continuous production of hydropower also stabilizes national power grids with baseload production that balances intermittent energy sources such as solar and wind, ensuring a stable national grid.

Hydrobox’s hydropower plant – decentralized energy with minimal impact on the environment

Hydrobox’s innovative hydropower plant is characterized by a high degree of standardization: the plant is fully equipped and the turbines are prefabricated in Belgium, simplifying on-site installation.

The Gitwamba Power Station uses a cross-flow turbine and one three-phase synchronous generator for single and parallel operation. In addition it is equipped with solar panels to provide additional capacity during dry season.

The Kiamahindu power station is equipped with three Turbulent Turbines that are placed in sequence.

Both powerplants are equipped with smart sensors and remote management features that provide the following benefits:

– Remote monitoring: water levels, temperatures, turbine speed, turbine valve position, electrical output parameters.

– Automatic water level control: hydraulic control of turbine valves and hydraulic power units depending on the current water level

– Automatic control system with touch screen for on-site control of the power plant, voltage regulation and synchronization with the grid

– Remote control possibility: start & stop of the plant, opening & closing of the turbine valves, switching of the operating mode (manual/automatic)

– Daily reports and alarm functions

Furthermore, Hydrobox attaches great importance to having the lowest possible impact on the environment. The plant is therefore designed according to the principle of the run-of-river power plant, which ensures that the natural course of the river is not affected by the construction of a dam. Only a part of the river is cut off for power generation (which ensures sufficient ecological flow) and flows back into the river a few hundred meters later (no water extraction). A fine-mesh trash rack prevents fish from entering the intake and becoming entangled in the crossflow turbine (link to turbine manufacturer). The Turbulent turbine uses an eco-friendly turbine as it allows fish and other river life to pass through its turbine unharmed. Please follow this link and this link for more detailed explanation on the turbine. A detailed environmental and social impact assessment is conducted at the start of each project, the company has a system in place to monitor environmental and social impacts, and the project is audited annually by the Ministry of Environment. This ensures a minimal environmental footprint.

The hydropower plants combines many advantages over other, traditional hydropower plants: Standardization and smart design can reduce time and costs. The run-of-river principle without dams keeps the ecological impact low. The plants are easier to scale than single household systems and easier to implement than large and complex infrastructure projects. In addition, the hydropower plants have long lifetimes (up to 30 years).

Hydrobox has developed a podcast series with Raf Stevens and Tito Monako:

“We developed this initiative because our community of investors and supporters keeps growing and because our existing investors keep telling us that who we are and what we stand for is the main reason why they invest in us.

Many stories have been told about the African continent – some positive, but also many not so positive.

With this podcast, we want to share our passion and optimism about Africa, social entrepreneurship and renewable energy as levers to improve the world.

We hope that these stories can change some people’s views and inspire others. Together we are stronger – Tuko Pamoja.”

Spotify link: https://open.spotify.com/show/1uZNlGoyNqxIdcllYxusbF?si=CnT3b6XZQoWFYG3hbxQ_5w

Also accessible via: https://rss.com/podcasts/tuko-pamoja-hydrobox-podcast/

Our mission is to create positive impact by empowering people and transforming communities through sustainable electricity. We do this by electrifying all facets of a community through an innovative business model and technology, ensuring that our customers benefit from reliable, affordable and green electricity. This in turn helps them grow their business and improve their standard of living.

Supporting our campaign with bettervest helps us empower businesses and households in Kenya, transition the country to green power and achieve a positive financial return. This is an investment in people, the planet and profit.

The Borrower and Country Profile

Hydrobox NV

Ulensstraat 86, Box 6 Makani

1080 Sint-Jans-Molenbeek

Belgium

Contact:

+32 498 610833 info@hydrobox.africa

www.hydrobox.africa

Afrika Emissions 1 UG (haftungsbeschränkt)

Falkstraße 5

60487 Frankfurt

Kiamahindu Power Station Ltd

Building: Karen Office Park Hemingways Building

Langata Road

Nairobi, Kenya

Thomas Poelmans, founder and CEO of Hydrobox, was formerly head of Deloitte’s Africa consulting practice in Belgium, where he was responsible for a service line that provided financial audits, due diligence, fraud investigations and project management support across Africa. After his time at Deloitte, he began working as an entrepreneur in Africa.

In 2012, he was one of the initiators of WorldLoop, where he supported the creation of 15 e-waste recycling companies across Africa. In 2015, he co-founded NAMé Recycling, a plastic recycling company operating in Cameroon and Gabon. In 2018, he founded Hydrobox.

John Magiro, Hydrobox’s technical director, grew up in a small village in Murang’a Kenya, about a 3-hour drive from the capital, Nairobi. During his childhood, no one in his community had electricity. The nearest power pole was 15 km away. After seeing his mother struggle, he decided to build his first micro hydroelectric power plant using everyday objects. His talent was quickly noticed, so he was able to expand and professionalize the technology by building a weir to channel water to a turbine and generate electricity.

John is the winner of the 2016 Switch Africa Green – Seed Award, the 2017 East Africa Hub Grant, the 2017 WWF Africa Youth Award, the EDF Pulse Africa Award (2019), and the Business Daily Top 40 under 40 Award (2020).

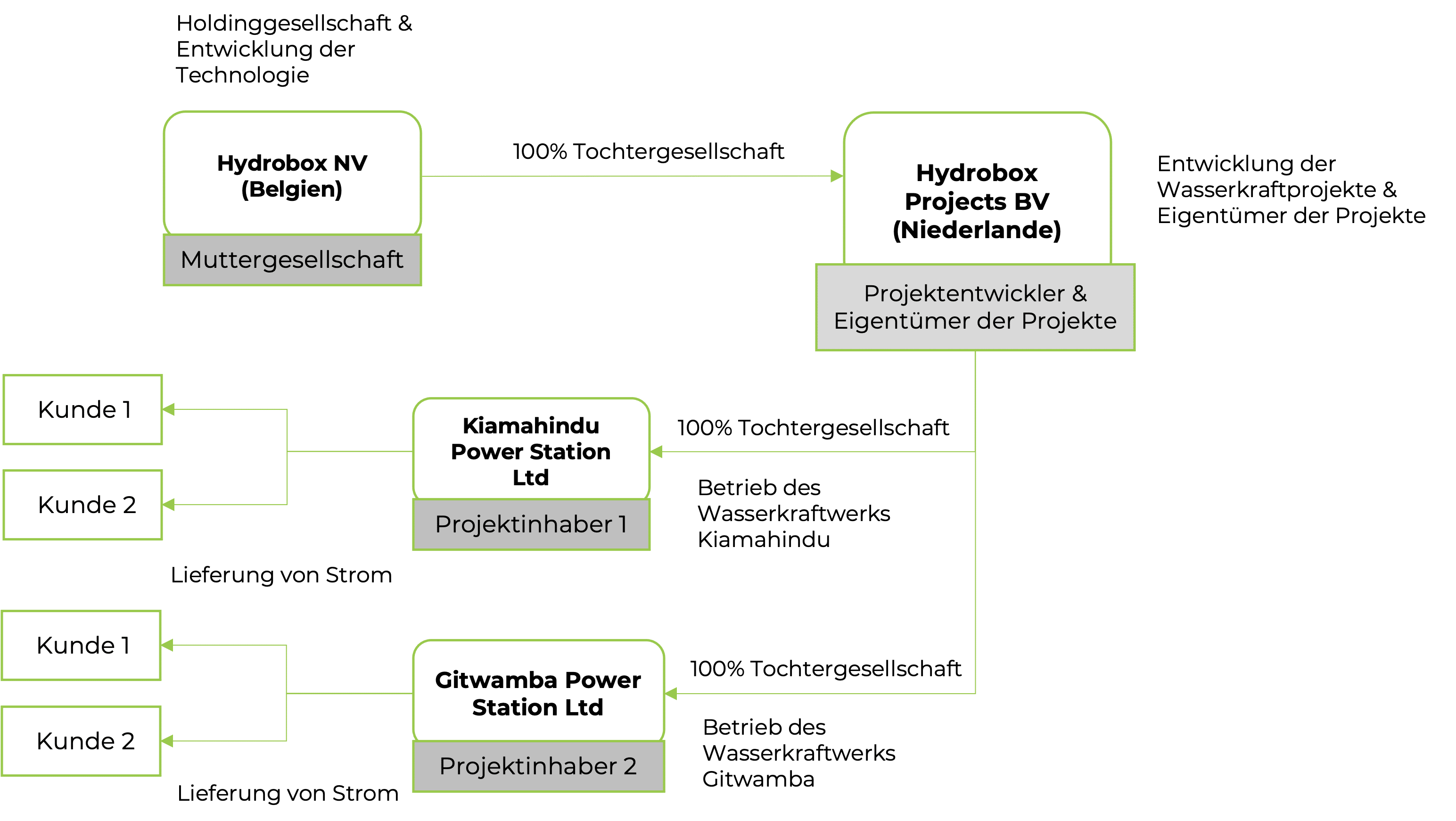

Afrika Emissions 1 UG (limited liability): Issuer and borrower

The special purpose entity Afrika Emissions 1 UG (haftungsbeschränkt) is based in Germany and acts as issuer and borrower in this project. The task of this special purpose company is to forward the collected money of the crowdinvestors as project loans to the two local project owners Kiamahindu Power Station Ltd and Gitwamba Power Station Ltd. Afrika Emissions 1 UG (haftungsbeschränkt) does not carry out any other business activities during the entire term of the loan. Shareholders and directors of Afrika Emissions 1 UG (haftungsbeschränkt) are independent from the project owners and Hydrobox.

Kiamahindu Power Station Ltd and Gitwamba Power Station Ltd: Project companies in Kenya

The two project companies Kiamahindu Power Station Ltd and Gitwamba Power Station Ltd are two 100% subsidiaries of Hydrobox Projects BV. The two companies are based in Kenya and act as project companies to build and operate the hydropower plants.

Hydrobox Projects BV: project developer and shareholder of Kiamahindu Power Station Ltd and Gitwamba Power Station Ltd.

Hydrobox Projects BV was founded in 2019 and is based in the Netherlands. It is a shareholder in the local project companies such as Kiamahindu Power Station Ltd and Gitwamba Power Station Ltd (100% parent company) and is responsible for the project development and construction of the plants.

Hydrobox NV: holding company and developer of the hydropower plants

Hydrobox NV is a holding company established in Belgium in 2018. It is the parent company of Hydrobox Projects BV (100% shareholder).

When making investment decisions, it is advisable to find out in advance about the project location, especially the country in which the project will be implemented. To get an overview, the following indicators are a helpful starting point for independent research. The information was retrieved from the relevant data sources in March 2023 and is published without guarantee.

| INDIKATOR | BEWERTUNG KENYA |

|---|---|

| Euler Hermes Ranking | Euler Hermes has rated the risk of non-payment by Kenyan companies as “sensitive risk” and rated it C on a scale of AA to D. (Source: Euler Hermes Country Risk Map) |

| OECD Classification | The OECD classifies Kenya’s general country risk on a scale from 0 (low risk) to 7 (high risk) with 7 (Source: OECD Country Risk Classification and OECD Ranking 2023). |

| Corruption index (Transparency International) | The Corruption Index, published by Transparency International and measured on a basis of 0 (high level of corruption) – 100 (no perceived corruption), in Kenya is 32 (Source: Transparency International 2022). |

| Commercial Bank Prime Lending Rate | The Commercial Bank Prime Lending Rate shows the average annualised interest rate charged by local commercial banks to their most creditworthy customers for new loans in local currency. For Kenya, the Commercial Bank Prime Lending Rate was 12.77% in January 2022. (Source: Trading Economics 2023). |

| Credit Worthiness (Moody’s) | Moody’s has rated the creditworthiness of Kenyan government bonds at B2 on a scale of AAA to D, classifying them as speculative (Source: Trading Economics 2023) |

| Foreign exchange market (Bundesbank) | In the last five years, the foreign exchange price for the euro in Kenya has increased, five years ago the price was 125.02 Kenya shillings, one year ago it was 127.65 and today the price is 133.93 Kenya shillings (Source: Bundesbank 2023). |

Key figures

| Borrower | Afrika Emissions 1 UG (haftungsbeschränkt) |

| Type of investment | Nachrangdarlehen |

| Funding target | EUR 1.078.000 |

| Term | 8 years |

| Interest | 6.5% p.a. (7.5% p.a. for investments within the first 4 weeks) |

| Repayment of loan and interest | annuity |