Support Munyax Eco’s mission to provide Great Lake people with access to clean, affordable energy from Solar power, while reducing CO2 emissions by 3071 tons per year.

Mit dem Laden des Videos akzeptieren Sie die Datenschutzerklärung von YouTube.

Mehr erfahren

video from August 2023. German Subtitles can be selected in the lower right corner of the screen.

The acquisition of this investment is associated with considerable risks and may lead to the complete loss of the invested assets.

UN Sustainable Development Goals

The investment at a glance

This is the first tranche of Munyax Eco’s “Solar Products for Clean Power in Rwanda” project. More tranches will come online in the future.

Project intent

Munyax Eco Limited, a company based in Kigali, Rwanda, aims to expand access and use of clean energy in Africa. For this purpose, Munyax has built up a large product portfolio consisting of energy solutions such as solar water heaters, Solar home systems, solar water pumps or photovoltaic solar systems. Munyax is active in Rwanda and provides solar solutions to households, especially in rural areas, but also to companies, hospitality sector, health facilities, NGOs or political institutions. In the coming years, Munyax Eco would like to continue to grow and expand its product range, launch operations in Burundi and the Democratic Republic of Congo, and create new jobs. Therefore, the company plans to use the loan to buy new solar products, hire new employees, finance a bank security and liquidity buffer.

Sustainable & social impact

Through the solar products, Munyax's customers will have access to clean solar power and they will be able to move away from fossil fuels, and eliminate kerosene lamps, candles, and diesel generators as well as other non clean energy solutions. This reduces carbon emissions and respiratory illnesses caused by indoor wood or kerosene consumption. In the long run it reduces energy cost for end users. In the course of Munyax Eco's growth plans, the company wants to create 30 new jobs. An important aspect of Munyax's mission is the advancement of women: for example, the company boasts a high percentage of female employees and encourages young women through training. Munyax Eco's customers are also predominantly women, who gain more time and a better quality of life by using its solar products.

Climate protection

The solar products produce clean solar electricity and generate CO2 savings of up to 3,071 tons of CO2 per year. So in total, the implementation of the project will save at least 21,497 tons of CO2 over the term of seven years.

Early bird bonus

All investors who invest up to and including 20.10.2023 will receive an early bird bonus of 1%. The interest rate thus increases to 7.5% in total.

Risk reduction measures

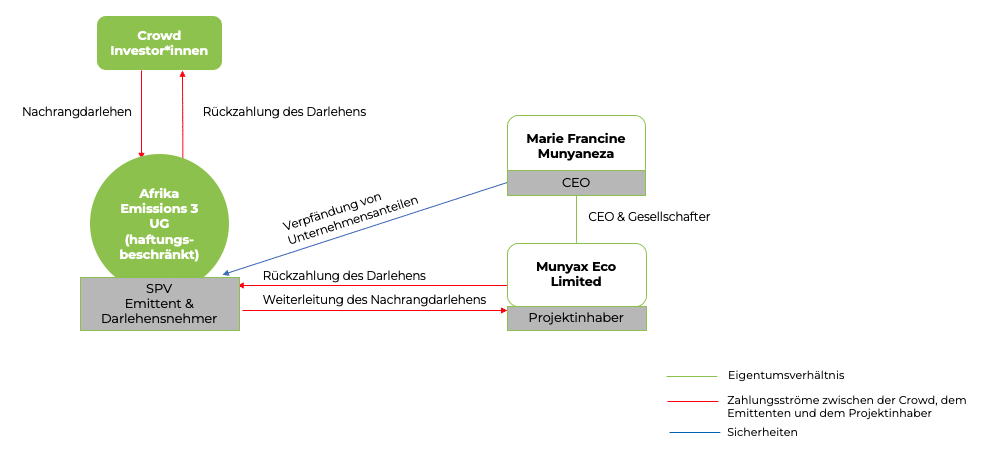

For the crowdfunding campaign on bettervest, a special purpose company called Afrika Emissions 3 UG (haftungsbeschränkt), based in Germany, was established to act as the borrower in this project. It forwards the collected capital as a secured loan to the project owner in Rwanda, Munyax Eco Limited (Munyax Eco). Shareholders and managing directors of Afrika Emissions 3 UG (haftungsbeschränkt) are independent of Munyax Eco. In addition, Afrika Emissions 3 UG (haftungsbeschränkt) has a liquidity buffer of up to 25,000 euros of the money collected in the crowdfunding, which serves as a financial cushion for any necessary measures if Munyax fails to meet its payment obligations.

The on-lending loan from Afrika Emissions 3 UG (haftungsbeschränkt) to Munyax includes the following risk mitigation measures:

(i) pledge of company shares of Munyax Eco Limited in favor of the special purpose vehicle Afrika Emissions 3 UG (haftungsbeschränkt).

(ii) ancillary loan agreements (“financial covenants”) between Munyax Eco Limited and Afrika Emissions 3 UG (haftungsbeschränkt) to maintain the financial stability of Munyax at a high level.

For further information, please refer to “Risk Reduction Measures” in the text section.

Established, sustainable company

Munyax Eco Limited was founded in 2013 in Kigali, Rwanda. The company’s vision is to play a key role in accelerating access to and adoption of clean energy solutions in Africa, while promoting women’s leadership and participation. To do so, the company with its 30 employees focuses on solar solutions and on a diverse product portfolio that provides customers with clean and affordable energy. With more than 5,000 solar equipment installed, Munyax has been able to reach over 760,000 people.

Since 2019, Munyax has been able to increase its revenue by 2.2 times and has generated $2.38 million in revenue since 2019. Now, the experienced company is looking to grow further, introduce new products, expand operations into Burundi and the Democratic Republic of Congo, and hire new talents.

Munyax Eco has a large network of partners such as SolarisKit, ENERSOL, Get Invest and SIMA Foundation, which support the company strategically, operationally or financially. After five years of existence, MUNYAX Eco was recognized by the London Stock Exchange Group as one of “Africa’s fastest growing and arguably most dynamic companies” in its latest “Companies to Inspire Africa” report published in January 2019. In 2020, Munyax Eco received the Africa Solar Industry Association (AFSIA) Solar Award for exceptional performance in the solar water heater sector, with more than 1,000 units across Rwanda. Francine Munyaneza, Founder and CEO of Munyax Eco, was one of 10 finalists out of 21,000 applicants for Africa’s Business Heroes Awards 2022. Francine has been also nominated recently as one the 2023 Power List featuring the 50 most influential female executives in the Pan-African energy industry today.

Project description

Rwanda is a landlocked East African country, also known as the “Land of a Thousand Hills” because of its mountainous terrain. Until the onset of the Covid pandemic in 2020, Rwanda’s economy was one of the fastest growing in all of Africa and in 2021 this trend continues. Despite strong economic development, 50% of the population does not have access to electricity, so many households rely on fossil fuels such as diesel and kerosene or candles for light. The simplest tasks prove tedious without electricity, daylight must be used for work and study, and entertainment is also scarce. In addition, harmful emissions cause respiratory diseases and affect the quality of life of many people.

This challenge has been addressed by the Rwandan Belgian company Munyax Eco Limited . Munyax Eco offers a diverse range of solar products through which customers can access energy and benefit from clean solar power. With 10 years of experience in the market, Munyax has a broad customer base that includes household customers, businesses, NGOs, healthcare facilities, and political institutions.

Munyax Eco’s goal now is to scale and grow its proven business model. In addition to Rwanda, Munyax Eco would like to expand its business to Burundi and the Democratic Republic of Congo. Through this crowdfunding campaign, Munyax Eco therefore aims to finance various solar products such as solar home systems, solar water heaters or solar coolers, employees, office space and a bank collateral.

With its business model, Munyax Eco actively contributes to 5 of the UN’s sustainable development goals („SDGs“):

The solar products Munyax sells to its customers are powered by sustainable solar electricity, so their distribution and use actively contributes to Goal 7.

The use of solar products also reduces health hazards such as indoor air pollution that can cause respiratory illnesses (Goal 3.9). It also emits less CO2 (Goal 13), which helps combat climate change.

Many of Munyax’s customers are businesses or other organizations and institutions. Solar products provide them with clean, reliable, and affordable electricity, which indirectly has a positive impact on the customers’ economic, sustainable growth (goal 8.1). In addition, the company’s growth plans include hiring 30 new employees by 2030.

Munyax is committed to the advancement of women and gender equality (Goal 5) and currently employs 30 employees, 60% of whom are women. In addition, Munyax offers special training programs for young people, in which 60% are women.

By using the products powered by solar energy, fuel is saved, generating a large CO2 saving potential.

With the total loan, + 3000 solar products will be purchased, generating CO2 savings of approximately 3071 tons of CO2 per year. Over the life of the project, it is 21,494.71 tons of CO2.

The investment risks associated with the subordinated loan are described in detail in the VIB under item 5 and in the risk notes. With a view to assessing and limiting the risks for investors, the issuer draws attention to the following special features in the design of the project:

1) Use of a special purpose vehicle:

For the crowdfunding campaign on bettervest, a special purpose entity called Afrika Emissions 3 UG (haftungsbeschränkt) based in Germany was established to act as the borrower in this project. It forwards the collected capital as a secured loan to the project owner in Rwanda, Munyax Eco Limited (Munyax Eco). Shareholders and managing directors of Afrika Emissions 3 UG (haftungsbeschränkt) are independent of Munyax Eco. In addition, Afrika Emissions 3 UG (haftungsbeschränkt) has a liquidity buffer of up to 25,000 euros of the money collected in the crowdfunding, which serves as a financial cushion for any necessary measures if Munyax does not meet its payment obligations.

2) Collateralization of the on-lending loan:

The on-lending loan from Afrika Emissions 3 UG (haftungsbeschränkt) to Munyax Eco includes the following risk mitigation measures:

(i) pledge of shares of Munyax Eco Limited in favor of the special purpose vehicle Afrika Emissions 3 UG (haftungsbeschränkt)

(ii) ancillary loan agreements (“financial covenants”) between Munyax Eco Limited and Afrika Emissions 3 UG (haftungsbeschränkt) to maintain the financial stability of Munyax at a high level

The project’s risk will be mitigated by an additional equity injection of an estimated EUR 1 million in the first year. The first round is expected to be completed by the end of 2023.

Investment requirements

The cost of the overall Munyax Eco project is expected to be EUR 2,000,000. This will finance materials, salaries for employees, office space, a bank guarantee of EUR 300,000, as well as the liquidity buffer and fees.

Material includes costs for:

– 10 containers of 62 new solar water heaters,

– 4 containers of 134 new solar panels each, 6 energy storage systems (RESS), 15 LED solar street lights & accessories,

– 4 containers each of 5 new sandwich panels, 8 solar coolers, 9 thermostats, 1 box, 4 solar charge controllers, 3 battery fuses, 6 batteries, 1 air heat exchanger, 1 control system, 1 LED lighting unit, 1 water pump & accessories,

– 1 container each with 431 new solar reading lights, 161 solar lantern with cell phone charger, 319 solar lantern with additional bulb and cell phone charger, 267 solar light with cell phone charger, 194 solar home systems, 113 solar home systems, 137 solar home systems, and

– 1 vehicle.

Therefore, 2,000,000 euros (incl. fees) are to be collected via crowdfunding. The term of the loan is 7 years and has an annual interest rate of 6.5% p.a. for the crowd investors. Investors who invest in the project within the first week receive an additional early bird bonus of 1% p.a. (i.e. a total of 7.5% p.a.). The funding threshold for this project is 50,000 euros. If only this amount is reached, the project owner will still use the investor funds for the purchase of material and invest to a lesser extent in the investment objects mentioned above.

Repayment

The repayment of the loan will be made from liquid funds generated by Munyax Eco in the course of its business activities as income from the sale of solar products.

Type of products:

Solar water heaters

Solar-home-systems

Mini-Grids

Solar Outdoor & Street Lights

Solar Pumping

Solar Cold Room

Solar Fridge

PV-System

Sales & Distribution

MUNYAX ECO get customers in different ways

– (physical contact or e-communication),

– door to door marketing;

– television/radio adverts;

– social media, website

– billboards, and vehicles branding;

– participation in business exhibitions/exposition

Once the company is in touch with the customer, the sales and technical team do the preliminaries to ensure the technical feasibility of the project, payment and contract signing.

The products are then taken from the warehouse to the customer’s premise for direct installation which can take in average from 4 hours to 2 weeks depending on the size of the installation

MUNYAX ECO is currently developing more partnerships in order to get more “agents”, access points and visibility in the region.

Business Model

MUNYAX ECO generates revenue through the sale of solar products, offering customers the option to make purchases on credit with payment spread over 3, 6, up to 12 monthly installments.

In addition, Munyax Eco already signed an MoU with the Rwandan Electricity Group (REG) under the Solar Water Heater subsidy program where Solar Water Heater customers get a 2 years loan to finance SWH at zero interest rate, project implementation to start this October 2023.

MUNYAX ECO is also currently negotiating with other institutions in order to let them put in place an efficient system to finance all end users. That is the reason of the guarantee fund to be financed in the second call.

MUNYAX ECO aims to provide affordable and clean energy to everyone, while also promoting the participation of women and youth at all levels of the company. To make solar equipment more affordable, MUNYAX ECO has adopted a customer-oriented business model that offers payment facilities. Investing in MUNYAX ECO through this campaign with Bettervest will not only benefit the investor and Munyax Eco, but it will also promote gender and youth participation and help to protect our planet from climate change.

The Borrower and Country Profile

Afrika Emissions 3 UG (haftungsbeschränkt)

Falkstraße 5

60487 Frankfurt

Germany

Munyax Eco Ltd.

KN3 Road

Kigali

Rwanda

Contact:

+250 784 969 785

info@munyaxeco.com

www.munyaxeco.com

Afrika Emissions 3 UG (haftungsbeschränkt): Issuer and borrower

The special purpose entity Afrika Emissions 3 UG (haftungsbeschränkt) is based in Germany and acts as borrower in this project. The task of this special purpose company is to forward the collected money of the crowd investors as a project loan to the local project owner, Munyax Eco Limited (Munyax). Shareholders and managing directors of Afrika Emissions 3 UG (haftungsbeschränkt) are independent of the project owner Munyax.

Munyax Eco Limited: Project owner

Munyax Eco Limited was founded in 2013 in Kigali, Rwanda. The Rwandan-Belgian company’s vision is to play a key role in accelerating access to and adoption of clean energy solutions in Africa, while promoting women’s leadership and participation. To do so, the company with its 30 employees focuses on solar solutions and on a diverse product portfolio that provides customers with clean and affordable energy. With more than 5,000 products installed, Munyax has reached over 760,000 people.

In 2014, Munyax was selected by Rwanda Energy Group (REG) as a certified supplier/installer of solar water heaters through a Solar Rwanda Program tender.

Since 2019, Munyax has been able to increase its revenue by 2.2 times and has generated accumulated turnover USD 2.38 million since 2019 within 3 years. In 2022, the revenue was 870,919 USD. Now, the experienced company is looking to grow further, introduce new products, expand operations into Burundi and the Democratic Republic of Congo, and hire new talent. It also plans to set up its own production facility in Rwanda in the future and invest in digitalization with a digital platform.

Management:

Founder and CEO Francine Munyaneza is a Rwandan citizen and a graduate of the Université Catholique de Louvain in Belgium, where she studied finance and economic management. Beyond her academic qualifications, and before starting her company she had over 15 years of experience in the Middle East, Europe, Africa, Asia and the Americas, where she has held senior positions with leading North American companies as well as humanitarian organizations (Placer Dome, International Committee of the Red Cross, Doctors Without Borders). This has enabled her to identify and manage situations where government, the private sector and civil society need to work seamlessly together, with joint outcomes and approaches that are tangible and economically sustainable.

Partners & Awards:

Munyax has a large network of partners including technical partners such as SolarisKit, ENERSOL and Get Invest.

Recently, Munyax Eco has signed an important contract with the National Electricity Company – Rwandan Electricity Group (REG) under the Solar Water Heater subsidy program where Solar Water Heater customers get a 2 years loan at zero interest rate, starting this October 2023.

After five years of existence, Munyax was recognized by the London Stock Exchange Group as one of “Africa’s fastest growing and arguably most dynamic companies” in its latest “Companies to Inspire Africa” report published in January 2019. In 2020, Munyax received the Africa Solar Industry Association (AFSIA) Solar Award for exceptional performance in the solar water heater sector. Francine Munyaneza, Founder and CEO of Munyax Eco, was one of the 10 finalists out of 21,000 applicants in the 2022 Africa’s Business Heroes Competition (from the Jack Ma Foundation) This year, in 2023, Francine has been nominated as one of the 2023 Power List featuring the 50 most influential female executives in the Pan-African energy industry today.

MUNYAX ECO is one of the companies selected to follow the Stanford Seed Transformation Program from January 2023

When making investment decisions, it is advisable to find out in advance about the project location, especially the country in which the project will be implemented. To get an overview, the following indicators are a helpful starting point for independent research. The information was retrieved from the relevant data sources in October 2023 and is published without guarantee.

| INDICATOR | RATING RWANDA |

|---|---|

| Euler Hermes Ranking | Euler Hermes has rated the risk of non-payment by Rwandan companies as “Medium Risk” and C rated on a scale of AA to D. (Source: Euler Hermes Country Risk Map) |

| OECD Classification | The OECD classifies Rwanda’s overall country risk on a scale of 0 (low risk) to 7 (high risk) as 6 (Source: OECD Country Risk Classification and OECD Ranking 2023). |

| Corruption Index (Transparency International) | The Corruption Index, published by Transparency International and measured on a basis of 0 (high level of corruption) – 100 (no perceived corruption), in Rwanda is 51 (Source: Transparency International 2022). |

| Commercial Bank Prime Lending Rate | The Commercial Bank Prime Lending Rate shows the average annualised interest rate charged by local commercial banks to their most creditworthy customers for new loans in local currency. For Rwanda, the bank lending rate was 15.86% in August 2023. (Source: Trading Economics 2023). |

| Credit Worthiness (Moody’s) | Moody’s has rated the creditworthiness of Rwandan government bonds as B2 (stable) on a scale of AAA to D, and thus classified them as speculative (Source: Trading Economics 2023) |

| Foreign Exchange Market (Bundesbank) | In the last five years, the foreign exchange price for the euro in Rwanda has increased, five years ago the price was 1,011.37 Rwanda francs, one year ago it was 1,021.61 and today the price is 1,285.74 Rwanda francs (Source: Bundesbank 2023). |

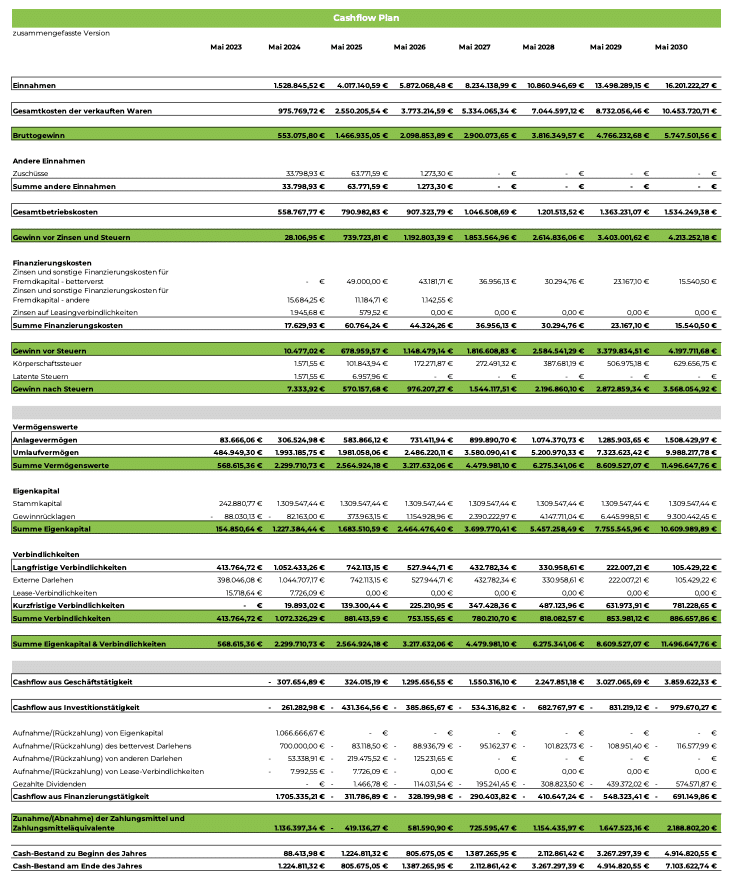

Key figures

| Borrower | Afrika Emissions 3 UG (haftungsbeschränkt) |

| Type of investment | Subordinated Loan |

| Loan Amount | EUR 250,000 |

| Term | 7 years |

| Interest | 6.5% p.a. (7.5% p.a. for investments within the first week) |

| Repayment of loan and interest | annuity |