bettervest Funding Part 2 - Subordinated Loan

The acquisition of this investment is associated with considerable risks and can lead to the complete loss of the invested assets.

About bettervest and our successes so far

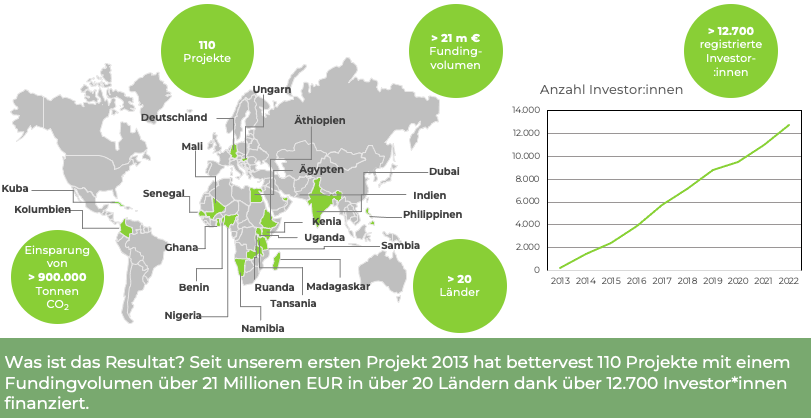

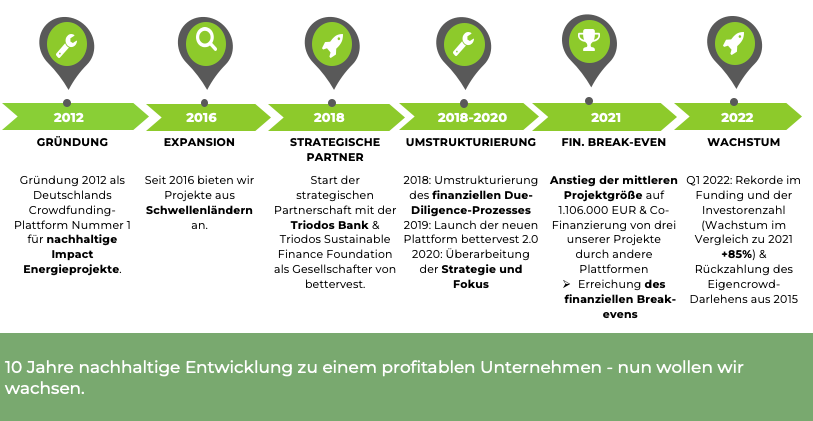

bettervest was founded in October 2012 and has become the number one German impact crowdfunding platform. Since its foundation, bettervest has expanded its portfolio to include different technologies and markets. This has enabled us to finance numerous small and medium-sized enterprises and CO2-saving technologies with a total financing volume of more than 21 million euros. The financed projects contributed to 14 of the 17 Sustainable Development Goals (SDGs) of the United Nations and led to a reduction of more than 900,000 tonnes of CO2. To optimise our business model, several strategic changes were also implemented from 2018 to 2020, which have paid off and made bettervest an emerging crowdfunding platform. In 2021, bettervest achieved its best annual result since its inception and reached profitability. In 2022, bettervest additionally achieved the three best funding months in its history, resulting in a full 85% increase in funding compared to the previous year. Despite our modest marketing budget, bettervest also recently experienced record growth in new investor registrations. With targeted and sensible marketing measures, we were able to increase the number of crowdinvestors by 17% to over 12,700 in the last 12 months. Combating climate change is always a key objective when selecting projects. However, we pay just as much attention to the impact that project owners achieve in improving the income, health and living conditions of the poorest sections of the population in particular. bettervest has thus been able to establish a clear positioning as Germany's impact crowdfunding platform for energy projects, which is also one of the reasons why we have recently been very much in the public eye. What stood out in particular was that we were featured as part of a report on "Sustainable Investing" on ARTE and ZDF. Since June 2021, bettervest has been offering other platforms to co-fund its projects, which has become an additional attractive source of income. bettervest has now successfully demonstrated the success of its business concept in all areas and is now looking for growth capital to further expand the business and our impact.

Stay a part of bettervest & profit

Those of you who had bet on the growth of the company still have the opportunity to benefit financially. Because our growth has just taken off. Due to restructuring in 2018 (reorganisation of project validation), 2019 (development of the new platform) and 2020 (strategic focus on core markets as well as impact investment), our growth could only really start in 2021. 2022 also already shows great numbers (more on this in the attached documents). We would therefore like to give you the chance to benefit from the growth that is just starting now.

Our intention through your investment

As you can see, bettervest is on a promising path to growth and profitability - and thus a worthwhile investment. With your investment we will on the one hand (52% of the loan) refinance a previous loan, the remaining 48% will go into the growth of the company, with priority given to personnel in the area of project acquisition and project assessment, but also in investor marketing and platform development. With this financing, bettervest will receive the capital it needs to initiate initial growth and enable impactful projects that benefit people and planet on a larger scale than before. In 2023, bettervest will raise additional equity to make further investments in the company. Details on the investments can be found in the attached documents.

Your options

You have the following options to participate in bettervest's success: Option 1: qualified subordinated loan. The subordinated loan will have a fixed, limited term and a fixed interest rate. The repayment will be due at the end of the term. On this project page you can start the investment process for the subordinated loan option. Option 2: Profit participation rights: Here you become a kind of virtual shareholder of bettervest and thus profit from our economic successes. Click here to go to the project page for the profit participation rights option. Explanations of the differences between the options can be found in the FAQs and in the contracts. This text is only an introduction. All detailed information about our company, figures and goals can be found in the PDF documents listed below.

Supporting not only climate-protecting, but also comprehensively effective and additionally sustainable projects is a matter close to our hearts.

In addition, impact investing is becoming the most important alternative to traditional investments. We are more motivated than ever to accelerate this process in a sustainable way.

Our history