Bring clean solar power to East Africa, help avoid 2,944 tonnes of CO2 and create 140 new jobs in the region!

Mit dem Laden des Videos akzeptieren Sie die Datenschutzerklärung von YouTube.

Mehr erfahren

Video from October 2022. For subtitles, please press the CC button at the bottom right of the screen.

The acquisition of this investment entails considerable risks and may result in the complete loss of the assets invested.

UN Development Goals (SDGs)

The investment at a glance

This is the fifth and final tranche of Ariya’s ‘Green Solar and Battery Systems for Businesses in East Africa’ project at bettervest. The first and second tranches were completed in April and October 2023. In 2024, the third tranche was financed in February and the fourth tranche in June. Of the maximum financing amount approved by the supervisory authority via bettervest without co-funding participation (EUR 1,999,500), EUR 1,606,350 has already been collected via the bettervest crowd. The remaining available financing amount of EUR 393,150 is to be financed with this final tranche. The project will not be extended after the end of this tranche.

Project intent

The Kenyan company Ariya Finergy Limited intends to use the loan to finance several photovoltaic solar plants with an expected total capacity of 4 MWp as well as battery systems in East Africa. Construction of some projects has already started and the remaining projects have been identified, many of which are in the final stages of procurement. All end customers are established East African small and medium-sized enterprises in the agriculture, food, manufacturing, tourism and logistics sectors. In addition, Ariya intends to utilise the loan to fund its operations and growth in East Africa.

Social & economic impact

Ariya Finergy Limited not only supplies the companies with cheaper and cleaner electricity, but also ensures a reliable, stable power supply, which significantly strengthens the economic performance of the companies and creates jobs. Ariya itself will be able to create more than 140 additional jobs in the region through the overall project, 8 of which will be within its own company. This support for local small and medium-sized enterprises has one of the greatest positive effects on the economic development of the entire region and ultimately on the prosperity of the population.

Climate protection

The implementation of the overall project and the installation of the solar systems is expected to save 2,944 tonnes of CO2 per year.

Established, sustainable company

The Ariya Group has been active in the solar industry in Kenya since 2015 and has already made a name for itself as a service provider for commercial customers with 41 installed systems. The repayment rate of Ariya customers is 100%. In 2023, the Ariya Group achieved an annual turnover of USD 5.94 million. Recent awards recognising Ariya's growth and achievements include being named EPC Company of the Year in March 2022, and co-founders Troy Barrie and Jenny Fletcher being recognised for Outstanding Achievement in Project Technology and Female Executive of the Year respectively by Solar Quarter in June 2022. Ariya's innovative floating solar project, which was financed in the last crowdfunding round, was voted the best project of the year in June 2022. In addition, the Managing Director of Ariya Finergy was honoured as ‘Woman in Solar of the Year’ by the African Solar Industry Associations (AFSIA) in 2021.

Risk reduction measures

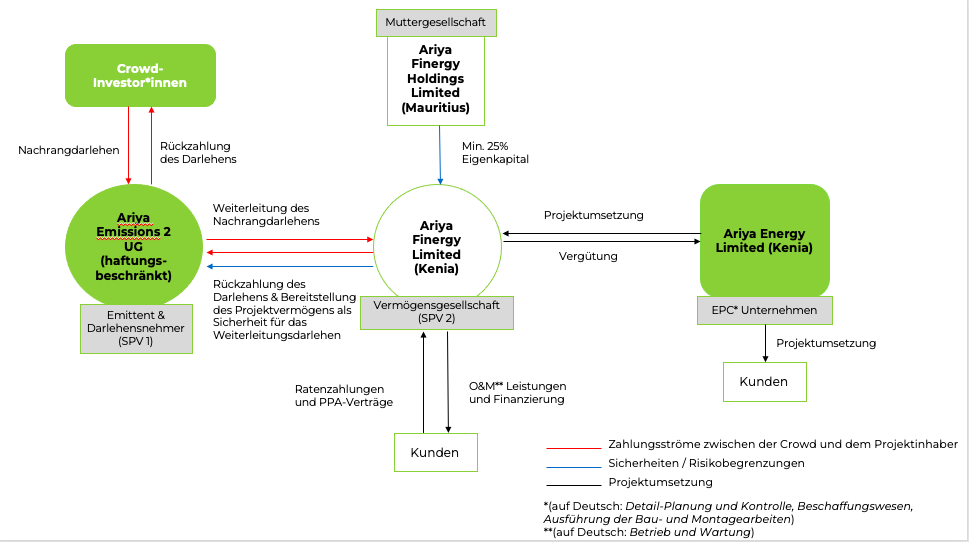

In order to be able to incorporate risk-mitigating measures despite subordinated loans, two special purpose vehicles are used: The German Ariya Emissions 2 UG (haftungsbeschränkt) (which is independent of the local project owner) raises the capital collected from the crowd and forwards it to the Kenyan Ariya Finergy Limited as a secured loan. In return, all assets, such as the photovoltaic systems to be financed, are pledged to the German Ariya Emissions 2 UG until the loan has been repaid in full. Ariya Finergy Limited only installs the systems at established medium-sized companies that undergo a qualification process. During the term of this loan, Ariya Finergy Limited may not take out any further loans or engage in business activities other than those in which it is already active without the consent of Ariya Emissions 2 UG. In addition, Ariya Emissions 2 UG will be provided with a liquidity buffer of EUR 25,000 (which will also be collected via crowdfunding) in order to be able to intervene or even take legal action in the event of any repayment problems on the part of the local Ariya Finergy Limited. Another risk-mitigating measure is that currency risks are greatly reduced, as Ariya Finergy Limited's customer receivables are predominantly paid in euros or USD. Further information can be found in the text section under ‘Risk minimisation measures’.

Early-bird bonus

All investors who invest up to and including 3 October 2024 will receive an early bird bonus of 1% p.a. The interest rate therefore increases to a total of up to 7% p.a.

Subsidy for your investment

As this is the last tranche, the project owner Ariya is offering an investment voucher. This reduces the amount to be transferred by 3.13%, which is economically comparable to an additional interest of up to 1.5% on your investment, which means that your investment with the use of the voucher is economically equivalent to the interest rate of up to 8.5% p.a. in the early bird phase and up to 7.5% p.a. thereafter. You will receive the voucher if you enter the following code at the end of the investment process: ARIYA-5. The voucher is valid immediately and for the entire duration of the project.

Project description

Sustainable economic growth is one of the most important factors for improving the quality of life on the African continent. In this regard, Kenya is one of the fastest developing countries and a trading centre in East Africa. In 2021, the Kenyan economy grew by 6.7% after contracting by 0.3% in 2020. Small and medium-sized enterprises are at the heart of Kenya’s economy and growth in this regard. According to a 2019 report by the International Trade Centre, they account for around 98% of all businesses in Kenya and create 80% of new jobs every year.

However, excessively high electricity costs and an unreliable power supply, which leads to production losses, pose major problems for companies and force them to look for alternatives to the national power supplier. Many companies are therefore opting for a clean and reliable power supply from renewable energy sources rather than using diesel generators.

The Ariya Group of Companies has addressed this issue by developing, financing and implementing customised green energy systems in Kenya. These include photovoltaic (PV) solar systems, smart integrated batteries and power stabilisation technologies. Ariya Group focuses on established commercial and industrial (C&I) clients operating in various sectors in Kenya.

With this crowdfunding, Ariya Finergy Limited aims to finance 4 MW of solar PV systems and battery systems at established companies in East Africa. The average size of the systems to be installed is expected to be 300 kWp, so that about 13 systems will be installed at different businesses to enable them to benefit from clean solar power and cost savings. In addition, Ariya intends to utilise the loan to finance its operations and growth in East Africa.

Ariya’s business model actively contributes to four of the UN’s sustainable development goals:

By installing solar panels, Ariya’s customers receive clean, renewable electricity, which is a cost-effective alternative to the Kenyan power grid or diesel generators (Goal 7.2).

Many of Ariya’s customers are engaged in agriculture (~57% of Kenya’s workforce), more specifically in tea, horticulture and floriculture (~33% of Kenya’s exports). In addition, a single tea factory employs an average of 3000 people, each of whom generates the income for a family of four. Expensive electricity, frequent power cuts and poor power quality are recurring problems. An intelligently designed solar system can therefore have an indirect impact on sustainable economic growth (Goal 8.1).

Ariya’s holistic approach combines various innovative technologies such as solar thermal collectors and cost-effective battery energy storage systems to help its customers meet the energy needs of their industrial processes. The intelligently designed systems also address the shortcomings of the electricity infrastructure, which primarily lead to expensive electricity, frequent power outages and poor power quality (Goal 9.4). By providing financing for its customers, Ariya also contributes to Goal 9.3.

Ariya’s business model contributes to climate change mitigation (Goal 13), as the solar panels and other energy efficiency solutions replace diesel generators and grid electricity (80% of which is generated by thermal power plants) and significantly reduce CO2 emissions. Ariya also contributes directly to this goal by replacing unsustainable, firewood-fuelled heating systems with solar thermal energy.

By switching to solar energy, the companies can increase their environmental sustainability by reducing their CO2 emissions. The overall project is expected to install a total of 4 MW of solar panels that will generate 5,900 MWh of solar power annually, saving 2,944.1 tonnes of CO2 per year.

The calculation was based on the average CO2 emissions per kWh of electricity from the general energy supply mix of the Kenya Power and Lighting Company, the public grid operator in Kenya. This rate is currently 499 g/kWh. Over the lifetime of the project, this results in CO2 savings of 14,720 tonnes, and over the lifetime of a solar system of around 25 years, 73,600 tonnes of CO2 can be avoided.

The investment risks associated with the subordinated loan are described in detail in section 5 of the VIB and in the risk information. The measures taken to minimise risk are explained in this section:

a) Dual corporate structure:

Two special purpose vehicles (SPVs) are used for the crowdfunding campaign:

1. the first, named Ariya Emissions 2 UG (haftungsbeschränkt), acts as borrower and issuer and is based in Germany. It forwards the collected capital as a secured project loan to the local asset company Ariya Finergy Limited (AFL). In return, collateral is pledged to it (see further below in this section). In addition, Ariya Emissions 2 UG does not engage in any other business activities during the entire term of the loan so as not to mix the risk with other projects. The shareholders and managing directors of Ariya Emissions 2 UG (haftungsbeschränkt) are independent of the Ariya Group. In addition, Ariya Emissions 2 UG (haftungsbeschränkt) has a liquidity buffer of EUR 25,000 of the funds raised in the crowdfunding. The liquidity buffer serves as a financial cushion for any necessary measures by the issuer if the project owner does not fulfil its payment obligations.

2. the second special purpose vehicle, the Kenyan Ariya Finergy Limited (AFL), is the local asset company used by Ariya for the purpose of financing as a pure asset company. It acts as the borrower vis-à-vis Ariya Emissions 2 UG (haftungsbeschränkt) and remains the owner of the project assets financed and generated with the project loan, which are pledged to the German UG, for the entire term of the loan. AFL may not take out any further loans during the term of this loan without the consent of Ariya Emissions 2 UG (haftungsbeschränkt). AFL may not, during the term of the loan, engage in any business activity other than that in which it is already engaged.

b) Project assets:

The assets financed by the Kenyan project company AFL as part of this campaign are available to the German issuer Ariya Emissions 2 UG (haftungsbeschränkt) as collateral for the on-lending loan. The assets are in particular the solar plants financed with the crowdfunding and leased to customers or the customer receivables of AFL from power purchase agreements (PPAs) with the customers. The projects planned as part of this financing will generate customer receivables totalling EUR 4,214,000 over the entire term.

c) Payments in USD or Euro:

With a few exceptions, all contracts stipulate that customers pay in USD or euros. As the majority of Ariya’s customers operate internationally and generate sales in hard currency, this significantly reduces currency risks in the local currency KES.

d) Equity financing:

AFL had a gearing ratio of 2.62 at the end of 2021, which corresponds to an equity ratio of 28%. The disbursement of the crowd loan is linked to the condition that AFL demonstrates an equity ratio of at least 25%.

The same threshold applies for the entire term of the loan. With the consent of the issuer Ariya Emissions UG 2 (haftungsbeschränkt), AFL may fall below this value for a limited period of time and up to a lower limit of 20%. From the perspective of the issuer in Germany, the own funds represent a buffer against losses, for example from currency risks between customer payments in USD and payment obligations from the project loan to the issuer in EUR.

This financing plan contains the total projected cash flows for Ariya Finergy Limited covering the receipt, initial utilisation and repayment of the loans.

Investment requirements

A total of 4.2 million euros is required for the overall project, which will be used to finance solar PV systems and battery systems for Ariya’s customers in East Africa. It will also be used to finance the company’s business activities and growth. The loan will cover the costs of personnel, sales and management support functions as well as the acquisition and operation of the solar PV and battery systems and related services.

This is the fifth and final instalment of Ariya’s ‘Green Solar and Battery Systems for Businesses in East Africa’ project at bettervest. The first and second tranches were completed in April and October 2023. In 2024, the third tranche was financed in February and the fourth tranche in June. Of the maximum financing amount approved by the supervisory authority via bettervest without co-funding participation (EUR 1,999,500), EUR 1,606,350 has already been collected via the bettervest crowd. The remaining available financing amount of EUR 393,150 is to be financed with this final tranche. The project will not be extended after the end of this tranche.

The term of the loan is 3 years and has an annual interest rate of up to 6% p.a. for the crowd investors. Investors who invest in the project within the first four weeks also receive an early bird bonus of 1% (i.e. up to 7% p.a. in total). As this is the last instalment, the project owner Ariya is offering an investment voucher. This reduces the amount to be transferred by 3.13%, which is comparable to an additional interest of up to 1.5% on the investment. Investors who redeem the voucher with the code ARIYA-5 during the early bird period will receive a perceived interest rate of up to 8.5% p.a. and investors who redeem the voucher after the end of the early bird period will receive a perceived interest rate of up to 7.5% p.a..

Repayment is made once a year and includes amortisation and interest (annuity repayment). The funding threshold for this project is €50,000; if only this amount is reached, the project owner will still use the investor funds to finance his business activities and invest to a lesser extent in the above-mentioned projects.

Repayment

The liquid funds for the repayments to the investors are made up of the proceeds from the sale of the solar installations and the sale of the clean solar power, which is governed by a power purchase agreement (PPA).

The fourth webinar for the Ariya Finergy project took place on 14th May 2024 at 6 PM via Zoom. Troy Barrie (CTO), Roselida Parker (Business Analyst), and Duncan Mbogo (Head of Finance) presented the current status of the project and answered the audience’s questions. You can watch the recording here.

On 26th May 2023 at 6 PM, the third webinar for the Ariya project was held. Jenny Fletcher and Troy Barrie reported on the progress of the project and answered participants’ questions. You can view the recording here.

The second webinar for the Ariya Finergy project was held on 21st February 2023 at 6 PM via Zoom. Jenny Fletcher (CEO) and Troy Barrie (CTO) presented the current project status and answered the audience’s questions. You can watch the recording here.

The Ariya Finergy Limited webinar took place on 15th November 2022 at 6 PM. The two founders, Jenny Fletcher (CEO) and Troy Barrie (CTO), introduced the project and their company and answered the audience’s questions. You can view the webinar recording here.

Ariya Finergy is your partner for renewable energy! With your support, we are tackling climate change by offsetting the consumption of fossil fuels and reducing the devastating impact on local forests caused by communities and industries relying on them for fuel. Ariya Finergy primarily works with established industries, helping to improve their sustainability by addressing their key challenges: high electricity costs, poor power quality, and frequent outages. All our projects generate strong financial returns for our clients.

The Borrower and Country Profile

Ariya Emissions 2 UG (haftungsbeschränkt)

Falkstraße 5

60487 Frankfurt am Main

Deutschland

Ariya Finergy Limited

3rd Floor, Kalamu House

Grevillea Grove

PO Box 530 Sarit Centre

Nairobi, Kenia

Kontakt

+254 700 784330

info@ariyafinergy.com

https://ariyafinergy.com/

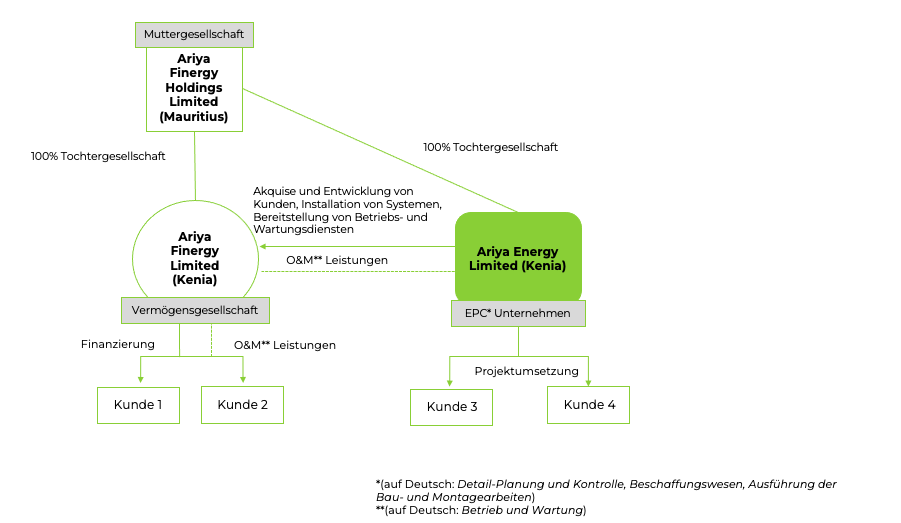

Ariya Emissions 2 UG (limited liability): Issuer and Borrower

The special purpose vehicle Ariya Emissions 2 UG (haftungsbeschränkt) is based in Germany and acts as the issuer and borrower for this project. Its role is to transfer the funds raised from crowd investors as a project loan to the asset company and local project owner, Ariya Finergy Limited. During the entire loan term, Ariya Emissions 2 UG (haftungsbeschränkt) carries out no further business activities. The shareholders and directors of Ariya Emissions 2 UG (haftungsbeschränkt) are independent from Ariya.

The Ariya Group

Ariya Finergy Limited (AFL): Project Owner

Ariya Finergy Limited (AFL) is a special purpose vehicle established specifically for financing solar projects in Kenya. AFL acts as the local asset company in Kenya and receives the crowd investors’ project loan from Ariya Emissions 2 UG (haftungsbeschränkt). Throughout the loan term, AFL remains the owner of the project installations funded and generated by the crowdfunding loan.

Ariya Energy Limited, Kenya (AEL): EPC Company

Ariya Energy Limited (AEL) serves as the procurement and construction company for the group. AEL designs, installs, and operates renewable energy systems tailored to customers’ needs, including photovoltaic (PV) solar systems, smart integrated batteries, and power stabilisation mechanisms. By installing both grid-tied and off-grid solutions, AEL ensures through its holistic approach that customers receive the most suitable technology or combination of technologies to maximise economic returns and environmental benefits. The company’s goal is to unlock the potential for clean energy and power stabilisation in the East African commercial and industrial sectors, which have remained largely untapped due to a lack of technical expertise and financing.

AEL employs 35 staff members and has installed 41 photovoltaic and battery systems across Kenya, generating over 10 GWh of solar energy in total. The company’s revenues have doubled year-on-year, including in 2021, when it reached the target of €3.4 million. With a strong and reliable customer base and the ability to secure debt financing from trusted sources, AEL continues to grow.

The founders of AEL were brought together by a shared desire to improve the lives of Kenyans and support the growth and sustainability of businesses through the provision of clean, renewable, and reliable energy.

CEO and co-founder Jenny Fletcher was born in Kenya. Although she has worked and travelled extensively in other countries, she has always been drawn back to Kenya. With 28 years of experience building a wide range of successful enterprises in both the for-profit and non-profit sectors in Africa, Europe, America, and Asia, she possesses local knowledge and strong personal connections across a variety of industries and the public and private sectors in East Africa.

Troy Barrie, CTO and co-founder, has extensive expertise in photovoltaics, energy storage, smart controls, and decentralised power generation as a means of ensuring power quality. As a registered “Professional Engineer,” Troy Barrie has global experience in manufacturing, commercial product delivery, and client relationships and has implemented complex systems in several countries across North America, Africa, and Asia.

The 35-member team currently includes 17 engineers, as well as finance and legal experts. Collectively, they possess over 100 years of experience in the solar industry and more than 30 years of experience in battery and power stabilisation solution development.

Awards

In 2016, the Ariya Group’s business model was selected for a grant under the Powering Agriculture Energy Grand Challenge by BMZ, the United States Agency for International Development, the Embassy of Sweden, Duke Energy, and OPIC. Out of over 900 applicants, the Ariya Group was one of 13 companies to succeed in this competitive process.

In 2020, Ariya’s Solar PV energy management controller project was chosen for financial support by Innovate UK. This proprietary technology ensures cost-effective and reliable integration of grid, generator, battery, and solar power.

In 2021, Ariya’s CEO and co-founder was recognised as the “Woman in Solar of the Year” by the African Solar Industry Associations (AFSIA).

In 2022, Ariya received several accolades from Solar Quarter, being named EPC Company of the Year, while its co-founders, Troy Barrie and Jenny Fletcher, were recognised for outstanding achievements in project technology and as female leader of the year, respectively. Ariya’s innovative floating solar project, funded in the last round, was named Project of the Year.

It is advisable to gather information about the project location, particularly the country in which the project is being implemented, before making investment decisions. The following indicators provide a helpful starting point for independent research. The information was retrieved from the relevant data sources in May 2024 and is published without warranty.

| INDICATOR | Assessment of Kenya |

|---|---|

| Euler Hermes Ranking | Euler Hermes has assessed the risk of non-payment by Kenyan companies as “sensitive risk” and rated it with a C3 on a scale from AA to D (Sources: Euler Hermes Country Risk Map). |

| OECD Classification | The OECD classifies the overall country risk of Kenya on a scale from 0 (low risk) to 7 (high risk) as 7 (Sources: OECD Ranking 2024). |

| Corruption Index (Transparency International) | The corruption index published by Transparency International, measured on a scale of 0 (high level of corruption) to 100 (no perceived corruption), stands at 31 for Kenya (Source: Transparency International 2022). |

| Commercial Bank Prime Lending Rate | The Commercial Bank Prime Lending Rate indicates the average annualized interest rates that local commercial banks charge their most creditworthy customers for new loans in the local currency. In Kenya, the Commercial Bank Prime Lending Rate was 15.20% in January 2024 (Source: Trading Economics 2023). |

| Creditworthiness (Moody’s) | Moody’s has rated the creditworthiness of Kenyan government bonds at B3 on a scale from AAA to D, classifying them as speculative (Source: Trading Economics 2023). |

| Foreign Exchange Market (Bundesbank) | In the last five years, the exchange rate for the euro in Kenya has overall increased; five years ago, the price was 112.81 Kenyan Shillings, one year ago it was 148.54, and today the price is 142.58 Kenyan Shillings (April 2024), thus decreasing compared to one year ago (Source: Bundesbank 2023). |

The Solar Projects in Detail

Among the over 40 systems that Ariya has already built, there is a mix of rooftop and ground-mounted installations. It is expected that about 85% of the systems in this financing round will be installed on rooftops, with the remainder on open land. The main components of these PV solar systems include solar modules, structures, inverters, and a control unit for communication. Ariya uses only top-tier suppliers who are carefully vetted.

Selection of Components

To ensure that high-quality components are used for the power supply systems, Ariya conducts extensive reviews of potential suppliers and selects them based on the quality of their products and services.

The review and updating of the supplier list is an ongoing process, as new suppliers are identified and existing suppliers are continuously monitored.

Verification of Roof Load-Bearing Capacity

For all projects, an independent structural engineer has prepared a report on the structural integrity of the roofs to confirm that the proposed roofs have the necessary load-bearing capacity for the solar installation.

Key Data

| Borrower | Ariya Emissions 2 UG (limited liability) |

| Investment Type | Subordinated Loan |

| Loan Volume | EUR 393.150 |

| Term | 3 Years |

| Return | Up to 6% p.a. (up to 7% p.a. for investments made within the first 4 weeks) |

| Repayment and Interest Payment | Annuity |