Bring clean solar power to East Africa, help avoid 2,944 tonnes of CO2 and create 140 new jobs in the region!

Mit dem Laden des Videos akzeptieren Sie die Datenschutzerklärung von YouTube.

Mehr erfahren

Video from October 2022.

The acquisition of this investment is associated with considerable risks and may lead to the complete loss of the invested assets.

UN Sustainable Development Goals

The investment at a glance

This is the second tranche of Ariya’s project “Green Solar and Battery Systems for Businesses in East Africa”. The first tranche was completed in April 2023 and EUR 604,200 of a total of EUR 3,275,700 has already been raised via the bettervest crowd. This tranche will be used to finance the remaining amount.The project is carried out as co-funding with the crowdfunding platform ROCKETS. This means that the project will be offered on the bettervest and ROCKETS platform in parallel.

Project intent

Kenyan company Ariya Finery Limited intends to use the loan to finance several solar photovoltaic plants with an expected total capacity of 4 MWp, as well as battery systems in East Africa. Construction has already started on some of the projects and the remaining projects have been identified, with many of them in the final stages of contracting. All of the end clients are established East African small and medium-sized enterprises in the agriculture, food, manufacturing, tourism and logistics sectors. In addition, Ariya intends to use the loan to finance its operations and growth in East Africa.

Social & Economic Impact

Ariya Finergy Limited not only provides businesses with cheaper and cleaner electricity, but also ensures a reliable, stable power supply, which significantly strengthens the economic performance of businesses and creates jobs. Ariya itself will be able to create more than 140 additional jobs in the region through the project, including 8 in its own company. This support for local small and medium-sized enterprises has one of the greatest positive impacts on the economic development of the entire region and ultimately on the prosperity of the population.

Climate protection

The implementation of the project and the installation of the solar panels are expected to save 2,944 tonnes of CO2 annually.

Established, sustainable company

The Ariya Group has been active in the solar industry in Kenya since 2015 and has already made a name for itself as a service provider for commercial customers with 41 systems installed. In the process, Ariya's customer payback rate is 100%. Recent awards recognising Ariya's growth and achievements include being named EPC Company of the Year in March 2022, and Solar Quarter's co-founders Troy Barrie and Jenny Fletcher were awarded for Outstanding Achievement in Project Technology and Female Executive of the Year respectively in June 2022. Ariya's innovative floating solar project, which was funded in the last crowdfunding round, was named Best Project of the Year in June 2022. In addition, the Managing Director of Ariya Finergy 2021 was awarded Woman in Solar of the Year by the African Solar Industry Associations (AFSIA).

Risk reduction measures

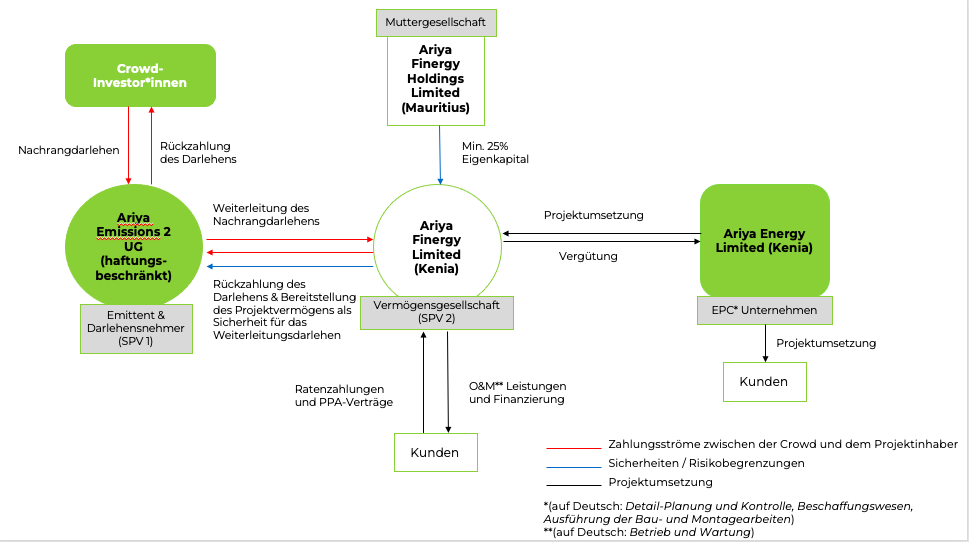

In order to be able to incorporate risk-mitigating measures despite subordinated loans, two special purpose vehicles are used: The German Ariya Emissions 2 UG (haftungsbeschränkt) (which is independent of the local project owner) takes the collected capital from the crowd and forwards it as a secured loan to the Kenyan Ariya Finergy Limited. In return, all assets, such as the photovoltaic systems to be financed, are pledged to the German Ariya Emissions 2 UG until the loan is repaid in full. Ariya Finergy Limited only installs the plants at established medium-sized companies that go through a qualification process.

During the term of this loan, Ariya Finergy Limited may not take out any further loans or engage in any business activities other than those in which it is already engaged without the consent of Ariya Emissions 2 UG. In addition, Ariya Emissions 2 UG will be provided with a liquidity buffer of 25,000 euros (which will also be collected via crowdfunding) in order to be able to intervene or even take legal action in the event of any repayment problems on the part of the local Ariya Finergy Limited.

Another risk-mitigating measure is that currency risks are greatly reduced, as customer receivables from Ariya Finergy Limited are predominantly paid in euros or USD.

Further information can be found in the text section under "Risk reduction measures".

Early bird bonus

All investors who invest up to and including 26.05.2023 will receive an early bird bonus of 1%. This means that the interest rate increases to a total of 7%.

Project description

Sustainable economic growth is one of the most important factors for improving the quality of life on the African continent. In this regard, Kenya is one of the fastest developing countries and a trading hub in East Africa. In 2021, the Kenyan economy grew by 6.7 % after contracting by 0.3% in 2020. Small and medium enterprises are at the heart of Kenya’s economy and growth in this regard. According to a 2019 report by the International Trade Center, they account for about 98% of all businesses in Kenya and create 80% of new jobs annually.

However, excessively high electricity costs, as well as unreliable power supply leading to production stoppages, pose major problems for businesses, forcing them to look for alternatives to the national electricity supplier. Many companies are therefore opting for a clean and reliable power supply from renewable energy sources and against the use of diesel generators.

The Ariya Group of Companies has addressed this issue by developing, financing and implementing customised green energy systems in Kenya. These include photovoltaic (PV) solar systems, smart integrated batteries and power stabilisation technologies. Ariya Group focuses on established commercial and industrial (C&I in English) clients operating in various sectors in Kenya.

With this crowdfunding, Ariya Finergy Limited aims to finance 4 MW of solar PV systems and battery systems at established businesses in East Africa. The average size of the systems to be installed is expected to be 300 kWp, resulting in about 13 systems being installed at various businesses so that they can benefit from clean solar power and cost savings. In addition, Ariya intends to use the loan to finance its operations and growth in East Africa.

With its business model, Ariya actively contributes to four of the UN’s sustainable development goals (“SDGs“):

By installing solar panels, Ariya’s customers receive clean, renewable electricity, which is a cost-effective alternative compared to the Kenyan electricity grid or diesel generators (Goal 7.2).

Many of Ariya’s customers are involved in agriculture (~ 57 % of Kenya’s workforce), more specifically in tea, horticulture and floriculture (~ 33 % of Kenya’s exports). Furthermore, a single tea factory employs on average 3000 people, each of whom generates the income for a family of four. Expensive electricity, frequent power outages and poor power quality are recurring problems. An intelligently designed solar system can thus have an indirect impact on economic sustainable growth (Goal 8.1).

Ariya’s holistic approach combines various innovative technologies such as solar thermal collectors and cost-effective battery energy storage systems to help its customers meet the energy needs of their industrial processes. The intelligently designed systems also address the shortcomings of the electricity infrastructure, which mainly lead to expensive electricity, frequent power outages and poor power quality (Goal 9.4). By providing financing to its customers, Ariya also contributes to Goal 9.3.

Ariya’s business model addresses climate change (Goal 13), as its solar panels and other energy efficiency solutions replace diesel generators and grid electricity (80% of which is generated by thermal power plants) and significantly reduce CO2. Similarly, Ariya also contributes directly to this goal by replacing unsustainable firewood-fuelled heating with solar thermal.

By switching to solar energy, the companies can increase their environmental sustainability by reducing their CO2 emissions. It is expected that with this financing, a total of 4 MW of solar systems will be installed, generating 5,900 MWh of solar electricity annually, saving 2,944.1 tonnes of CO2 per year.

The average CO2 emissions per kWh of electricity from the general energy supply mix of the Kenya Power and Lighting Company, the public grid operator in Kenya, were used as the basis for the calculation. This rate is currently 499 g/kWh. Over the lifetime of the project, this results in a CO2 saving of 14,720 tonnes, and over the lifetime of a solar system of about 25 years, 73,600 tonnes of CO2 can be avoided.

The investment risks associated with the subordinated loan are described in detail in the VIB under item 5 and in the risk notes. The measures taken to mitigate the risks are explained in this section:

(a) Dual company structure:

Two special purpose vehicles (SPVs) are used for the crowdfunding campaign:

1. The first, named Ariya Emissions 2 UG (haftungsbeschränkt), acts as borrower and issuer and is based in Germany. It forwards the collected capital as a secured project loan to the local asset company Ariya Finergy Limited (AFL). In return, collateral is pledged to it (see further down in this text section). Furthermore, Ariya Emissions 2 UG does not engage in any other business activities during the entire term of the loan in order not to mix the risk with other projects. The shareholders and managing directors of Ariya Emissions 2 UG (haftungsbeschränkt) are independent of the Ariya Group. In addition, Ariya Emissions 2 UG (haftungsbeschränkt) has a liquidity buffer of 25,000 euros of the funds collected in the crowdfunding. The liquidity buffer serves as a financial cushion for any necessary measures by the issuer in the event that the project owner fails to meet its payment obligations.

2. The second special purpose vehicle, the Kenyan Ariya Finergy Limited (AFL), is the local asset company used by Ariya for the purpose of financing as a pure asset company. It acts as borrower vis-à-vis Ariya Emissions 2 UG (haftungsbeschränkt) and remains the owner of the project assets financed and generated with the project loan, which are pledged to the German UG, for the entire term of the loan. AFL may not take out any further loans during the term of this loan without the consent of Ariya Emissions 2 UG (haftungsbeschränkt). AFL may not engage in any business activity other than that in which it is already engaged during the term of the Loan.

(b) Project Assets:

The assets financed by the Kenyan project company AFL in the context of this campaign are available to the German issuer Ariya Emissions 2 UG (haftungsbeschränkt) as collateral for the on-lending loan. The assets are in particular the solar plants financed with the crowdfunding and leased to customers or the customer receivables of AFL from power purchase agreements (PPAs) with customers. projects planned under this financing will generate customer receivables of EUR 4,214,000 over the entire term.

c) Payments in USD or Euro:

All contracts, with a few exceptions, provide for customers to pay in USD or Euro. Since the majority of Ariya’s customers operate internationally and generate sales in hard currency, this decisively reduces currency risks in the local currency KES.

d) Equity financing:

AFL had a gearing ratio of 2.62 at the end of 2021, representing an equity ratio of 28%. The disbursement of the crowd loan is linked to the condition that AFL demonstrates an equity ratio of at least 25%.

The same threshold applies for the entire term of the loan. With the consent of the issuer Ariya Emissions UG 2 (haftungsbeschränkt), AFL may fall below this value for a limited time and up to a lower limit of 20%. From the perspective of the issuer in Germany, the own funds represent a buffer against losses, for example from currency risks between customer payments in USD and payment obligations from the project loan to the issuer in EUR.

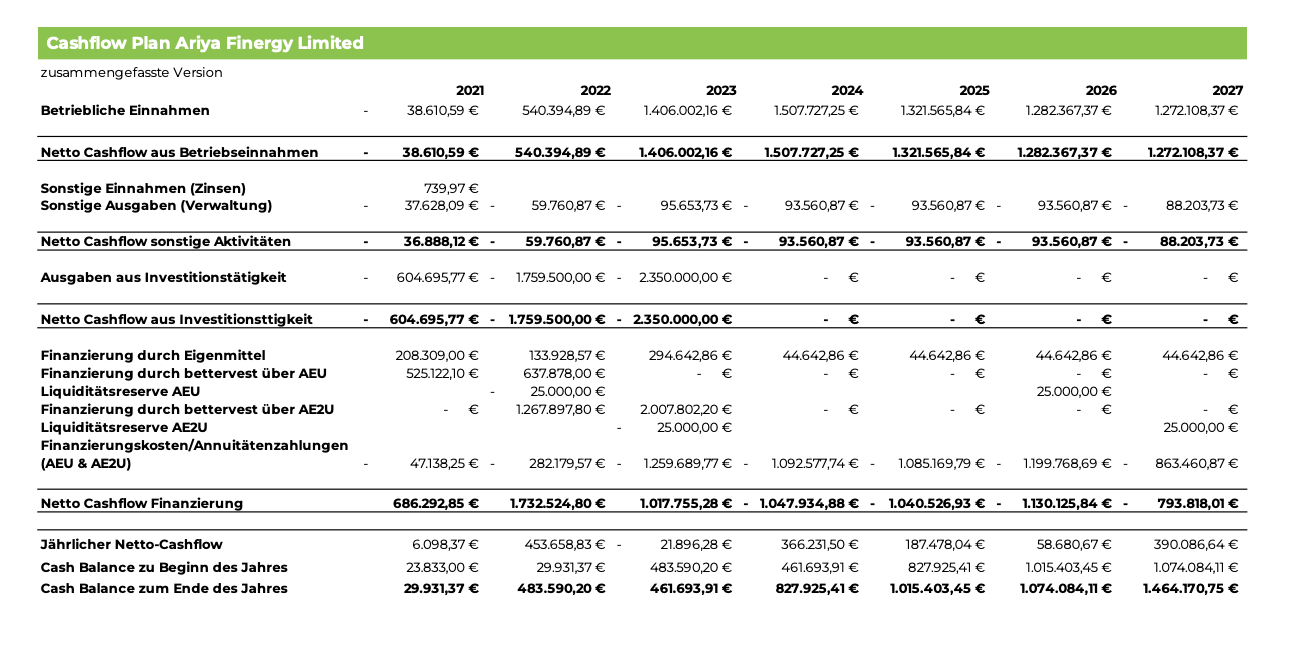

Investment needs

A total of 4.2 million euros is needed for the entire project, which will be used on the one hand to finance PV solar plants and battery systems for Ariya’s customers in East Africa. On the other hand, it will be used to finance the company’s business operations and growth. The loan will thus cover the costs of staff, sales and management support functions, as well as the acquisition and operation of the solar PV and battery systems and related services. The crowdfunding is expected to finance €3,275,700.00 (including fees). The project is carried out as co-funding with the crowdfunding platform ROCKETS. This means that the project will be offered on the bettervest and ROCKETS platform in parallel.

The term of the loan is 5 years and has an annual interest rate of 6% p.a. for the crowdinvestors. Investors who invest in the project witjing the first 4 weeks will also receive an early bird bonus of 1% (i.e. a total of 7% p.a.). Repayment takes place once a year and includes repayment and interest (annuity repayment). The funding threshold in this project is €50,000. If only this amount is reached, the project owner will still use the investor funds to finance his business activities and invest to a lesser extent in the above-mentioned projects.

Repayment

The liquid funds for the repayments to the investors consist of the sales proceeds of the solar plants and the sale of the clean solar electricity, which is regulated by a Power Purchase Agreement (PPA).

The third webinar on the Ariya project was held on 5/26/2023 at 6pm. Jenny Fletcher and Troy Barrie reported on the project progress and answered the questions of the participants. You can view the recording here.

The second webinar on Ariya Finergy’s project was held on 2/21/2023 at 6pm via Zoom. Jenny Fletcher (CEO) and Troy Barrie (CTO) presented the current status of the project and answered the audience’s questions. You can watch the recording here.

Ariya Finergy Limited’s webinar took place on 11/15/2022 at 6pm. The two founders Jenny Fletcher (CEO) and Troy Barrie (CTO) presented the project and their company and answered the questions of the listeners. You can watch the recording of the webinar span style=”text-decoration: underline;”> here .

To create an additional social impact, Ariya will donate 2% to the IMANI orphanage in Kenya for every investment received from 15/11/2022 up to and including 24/12/2022.

Imani Rehabilitation Agency is a non-profit organisation dedicated to the care and protection, rehabilitation, education, primary health care and reintegration of orphans and vulnerable children. It was established in 1992 and has grown from one home for 20 children to an average of 300 children being cared for in the 6 Imani homes.

Ariya had already successfully implemented a similar action in the last crowdfunding project 2021 through the support of bettervestors – you can find a few impressions below.

Ariya Finergy is your partner for electricity from renewable energy! With your help, we fight climate change by offsetting fossil fuel consumption and reducing the devastating impact on local forests by communities and industries that use forests as fuel. Ariya Finergy works primarily with established industries, helping to improve their sustainability by solving their main problems: Expensive electricity, poor power quality and frequent power outages. All our projects generate strong financial returns for our clients.

The Borrower and Country Profile

Ariya Emissions 2 UG (haftungsbeschränkt)

Falkstraße 5

60487 Frankfurt am Main

Germany

Ariya Finergy Limited

3rd Floor, Kalamu House

Grevillea Grove

PO Box 530 Sarit Centre

Nairobi, Kenya

Ariya Emissions 2 UG (haftungsbeschränkt): Issuer and Borrower

The special purpose vehicle Ariya Emissions 2 UG (haftungsbeschränkt) is based in Germany and acts as issuer and borrower in this project. The task of this special purpose vehicle is to pass on the money collected from the crowdinvestors as a project loan to the asset company and project owner on site Ariya Finergy Limited. Ariya Emissions 2 UG (haftungsbeschränkt) does not carry out any other business activities during the entire term of the loan. The shareholders and directors of Ariya Emissions 2 UG (haftungsbeschränkt) are independent of Ariya.

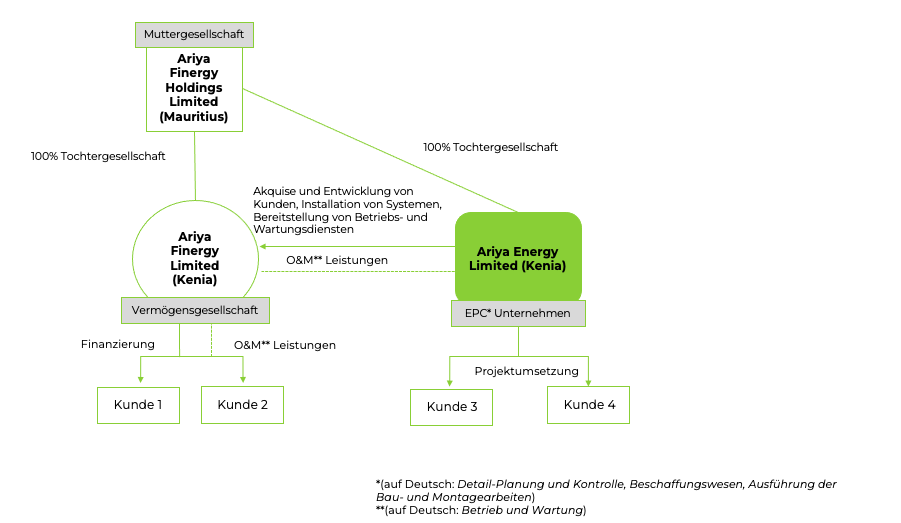

The Ariya Group

Ariya Finergy Limited (AFL): Project owner

Ariya Finergy Limited (AFL) is a special purpose vehicle in Kenya established specifically for the financing of solar projects. AFL acts as an asset company on the ground in Kenya and takes the crowdfunding investors’ loan in the form of a project loan from Ariya Emissions 2 UG (haftungsbeschränkt). Throughout the life of the loan, AFL retains ownership of the project assets financed and generated by the crowdfunding loan.

Ariya Energy Limited, Kenya (AEL): EPC company.

Ariya Energy Limited (AEL) acts as the procurement and construction company for the Group. AEL designs, installs and operates renewable energy systems based on customer needs. These include photovoltaic (PV) solar systems, smart integrated batteries and power stabilisation mechanisms. Installing on-grid and off-grid solutions, AEL’s holistic approach ensures that its customers receive the most appropriate technology or combination of technologies to ensure optimal economic returns and environmental benefits. The company aims to unlock the potential for clean energy and power stabilisation in East Africa’s commercial and industrial sectors, which remains largely untapped due to a lack of sufficient technical knowledge and financing.

AEL employs 27 people and has so far installed 41 photovoltaic and battery systems in Kenya, generating a total of over 10 GWh of solar energy. The company’s revenue has doubled year on year, including in 2021 when it reached its target of €3.4 million. With a strong and reliable customer base and the ability to raise debt capital from reliable sources, AEL continues to grow.

AEL’s founders were brought together by a desire to improve the lives of the Kenyan people and promote business growth and sustainability through the provision of clean, renewable and reliable energy.

CEO and co-founder Jenny Fletcher was born in Kenya. Although she has worked and travelled extensively in other countries, she was always drawn back to Kenya. She has 28 years of experience building a variety of successful businesses in the for-profit and not-for-profit sectors in Africa, Europe, the Americas and Asia, and has local knowledge and strong personal connections across a wide range of industries and the private and public sectors in East Africa.

Troy Barrie, CTO and co-founder of the company, has extensive expertise in solar PV, energy storage, smart control and distributed generation as a means of ensuring power quality. A registered Professional Engineer, Troy has global experience in manufacturing, commercial product deployment and customer relations, and has implemented complex systems in multiple countries in North America, Africa and Asia.

The 27-member team currently consists of 15 engineers as well as financial and legal experts. Together, they have more than 100 years of experience in the solar industry and more than 30 years of experience in the development of batteries and power stabilisation solutions.

Awards

In 2016, Ariya Group’s business model was selected for funding under the Powering Agriculture Energy Grand Challenge by BMZ, United States Agency for International Development, Embassy of Sweden, Duke Energy and OPIC. In the competitive process with over 900 applicants, Ariya Group was one of 13 companies to prevail.

In 2020, Ariya’s solar PV energy management controller project was selected for financial support from Innovate UK. This is a proprietary technology that ensures cost-effective, reliable integration of the grid, generator, batteries and solar energy.

In 2021, Ariya’s CEO and co-founder was awarded Woman in Solar of the Year by the African Solar Industry Associations (AFSIA).

In 2022, Ariya received a number of awards from Solar Quarter, it was named EPC Company of the Year, while its co-founders Troy Barrie and Jenny Fletcher were awarded for Outstanding Achievement in Project Technology and Female Executive of the Year respectively. Ariya’s innovative floating solar project, funded in the latest round of financing, was named Best Project of the Year.

EWhen making investment decisions, it is advisable to find out in advance about the project location, especially the country in which the project will be implemented. To get an overview, the following indicators are a helpful starting point for independent research. The information was retrieved from the relevant data sources in April 2023 and is published without guarantee.

| INDICATOR | RATING KENIA |

|---|---|

| Euler Hermes Ranking | Euler Hermes hat das Risiko der Nicht-Zahlung von kenianischen Unternehmen mit “sensitive risk” bewertet und auf einer Skala von AA bis D mit C gerated (Quellen: Euler Hermes Country Risk Map) |

| OECD Klassifizierung | Die OECD klassifiziert das allgemeine Länderrisiko Kenias auf einer Skala von 0 (geringes Risiko) bis 7 (hohes Risiko) mit 7 (Quellen: OECD Country Risk Classification und OECD Ranking 2023). |

| Korruptionsindex (Transparency International) | Der Korruptionsindex, der von Transparency International veröffentlicht wird und auf einer Basis von 0 (hohes Maß an Korruption) – 100 (keine wahrgenommene Korruption) bemessen wird, liegt in Kenia bei 32 (Quelle: Transparency International 2022). |

| Commercial Bank Prime Lending Rate | Die Commercial Bank Prime Lending Rate zeigt auf, welchen Durchschnitt an annualisierten Zinsraten lokale Geschäftsbanken ihren kreditwürdigsten Kunden für neue Kredite in der Landeswährung berechnen. Bei Kenia lag die Commercial Bank Prime Lending Rate im Februar 2023 bei 13,06% (Quelle: Trading Economics 2023). |

| Kreditwürdigkeit (Moody’s) | Moody’s hat die Kreditwürdigkeit von kenianischen Staatsanleihen auf einer Skala von AAA bis D mit B2 bewertet und somit als spekulativ eingestuft (Quelle: Trading Economics 2023) |

| Devisenmarkt (Bundesbank) | In den letzten fünf Jahren ist der Devisenpreis für den Euro in Kenia gestiegen, vor fünf Jahren lag der Preis bei 124,74 Kenia-Shilling, vor einem Jahr bei 127,80 und heute liegt der Preis bei 144,37 Kenia-Shilling (Quelle: Bundesbank 2023). |

The solar projects in detail

The more than 40 systems that Ariya has already built are a mix of roof and ground-mounted systems. It is anticipated that approximately 85% of the systems in this financing round will be installed on rooftops and the remainder on ground-mounted systems. The main components of these PV solar systems include solar modules, structures, inverters and a control unit for communication. Ariya only uses first-class suppliers that are carefully vetted.

Selection of components

To ensure that high quality components are used for the power systems, Ariya conducts extensive reviews of potential suppliers and selects them based on the quality of their products and services.

Reviewing and updating the supplier list is an ongoing process as new suppliers are identified and existing suppliers are continuously monitored.

Verification of the load-bearing capacity of the roofs

For all projects, a structural integrity report was prepared by an independent structural engineer to confirm that the proposed roofs have the required load-bearing capacity for solar construction.

Key figures

| Borrower | Ariya Emissions 2 UG (haftungsbeschränkt) |

| Type of investment | Subordinated loan |

| Loan Amount | EUR 2,671,500.00 |

| Term | 5 years |

| Interest | 6,0 % p.a. (7,0% p.a. for an investment within the first 4 weeks) |

| Repayment of loan and interest | annuity |