What is crowdfunding?

In general, the term crowdfunding refers to any online-based, collective investment by multiple people (i.e. the crowd) in one specific project. Such projects can pursue a wide variety of goals: from the production of a music album, to the establishment of a company, or even the modernisation of outdated, inefficient heating systems. Project owners present their projects on an online platform using detailed descriptions, images and videos in order to solicit financial support from the general public. Individuals may allocate money to any project they wish to finance. Thus, only those ideas that were convincing and inspiring will be realised. Investors need neither know one another nor possess large amounts of capital. What connects individuals is the shared desire to achieve a specific goal.

In Germany, the concept of crowdfunding has become increasingly popular over the past years and its future is very promising. The German Crowdfunding Information Portal and the Federal Crowdfunding Association publish regular reports and articles on the development of this market.

How does crowdfunding work?

Crowdfunding always starts with an idea – be it for a product, a service or any other project. Naturally, implementing any project requires money. When initiators do not want to, or are unable to turn to traditional financial institutions, such as aid projects launched by non-profit organisations, they opt for alternative funding mechanisms. This is where crowdfunding comes in. Individuals financially support the presented projects or ideas by investing a sum of their choosing. Depending on the platform and the type of project, investments from as little as €5 are possible.

Projects are only successful once a certain funding threshold is reached. If not, the invested money is returned to the investor. Yet, certain projects, especially in reward-based crowd funding, do not have a funding limit. This is often the case with product innovations.

Using the platform is free of charge for the investors. Platforms usually charge at 5-12% of the funding sum as a fee, which is payable by the project owners.

What makes crowdfunding so attractive?

Crowdfunding combines financing with positive publicity. On the one hand, it is an alternative or additional method of financing (when combined with bank loans, business angels, government subsidies and so on). By facing fewer bureaucratic obstacles, the project funding and development phase is significantly decreased in length. On the other hand, the crowd is a great multiplying factor in terms of public communication. The advertised project gains quick, widespread and sometimes even viral awareness, especially through the use of social media. Moreover, the feedback provided by the crowd has a different quality to that of a bank, because each investor has a stake in the success of the project. Furthermore, through crowdfunding the project owner builds up a customer base or can engage existing customers.

What are the different types of crowdfunding?

Within the crowdfunding market there are several different types of crowdfunding. The models can be distinguished as follows:

- Equity based crowdfunding: the investor acquires shares in the project and benefits from its future revenues. (This type is often referred to as a crowd-investing). The actual financial transaction occurs via participation right (equity) or a subordinated loan (debt capital), resulting in a contractual relationship between investor and project owner.

- Lending-based crowdfunding: investors offer the project initiator a loan, either with or without interest. Depending on the loan, this type can overlap with equity based crowd funding.

- Reward-based crowdfunding: investors are not reimbursed for their investment. The investor receives token of appreciation in the form of a certificate or detailed description of the project’s development. For film and music projects, possible rewards include a small role or even a private concert for investors.

- Donation-based crowdfunding: investors make donations towards a specific project. As a counterpart to traditional charity organisations, this model bypasses high administration costs and represents are more transparent and direct channel through which to donate money.

Investors, donors and lenders should always be aware of the risks and disadvantages associated with crowdfunding. With regards to the first two models listed above, there is always a risk of a total loss of the investment. Especially with innovative ideas there exists a high risk of failure and not every project owner is a competent entrepreneur. The huge organisational effort accompanying a crowdfunding campaign should not be underestimated. There is no guarantee for success.

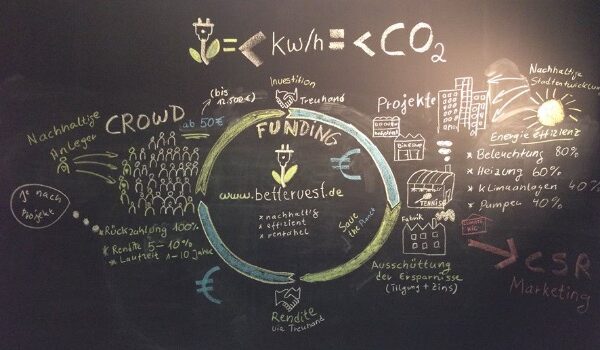

bettervest’s business model is based on a combination of equity and lending-based crowdfunding. Unlike other platforms which focus solely on start-ups, investors on our platform finance projects independent of a company’s increasing revenue or profits. Instead, investors finance the replacement or retrofitting of existing technologies, rendering them more efficient and cost-effective. The investors receive reimbursement through the savings that the measure achieves. In addition to the financial returns, project owners can offer rewards or make partial payments in kind.

Nevertheless, even on our platform a risk of total loss of investment remains, for example, in the event that a project owner declares bankruptcy. For this reason, the average risk of insolvency, as well as the risk of the project owner defaulting, is indicated in the documents provided by credit rating agencies. For further information, please refer to the complete risk declaration document.